5 Key Investor Insights for the Second Half of 2025

- Market Insights

- 8 mins

Get investing insights for US-connected global citizens.

Book a free consultation with our cross-border advisors.

On the surface, the first half of 2025 has been challenging for investors. From a trade war and market correction to an escalating Middle East conflict and concerns over the growing national debt, investors may feel as if financial markets are stumbling from one problem to the next. Daily news headlines often present an endless stream of negativity, making the situation feel worse than it may be.

However, as the old saying goes, it's important to never let a good crisis go to waste. While this phrase is often used in a political context, the principle applies equally well to long-term investing and financial planning. This is because diving beneath the headlines can often reveal important opportunities for investors. For instance, while the first half experienced market corrections for the S&P 500 and Dow, and a bear market for the Nasdaq, it also witnessed one of the fastest recoveries in history.

Taken together, this created an environment that rewarded those who focused on their asset allocations and maintained a broader perspective. While uncertainty is never pleasant, the reality is that risk and reward are opposite sides of the same coin. If it were easy to stay invested and see past the immediate headlines, everyone would do so, and future returns would potentially be less attractive.

It's important to keep these lessons in mind amid heightened uncertainty as we enter the second half of the year. Below, we explore five key insights that can help investors navigate these markets and position their portfolios for opportunities, regardless of the exact headlines in the coming months.

Markets are resilient as we begin the second half of the year

Past performance is not indicative of future results

Investors have become accustomed to market swings over the past several years. This year has been no exception, with many investors worrying that we were entering an escalating trade war that could last years, resulting in a global recession.

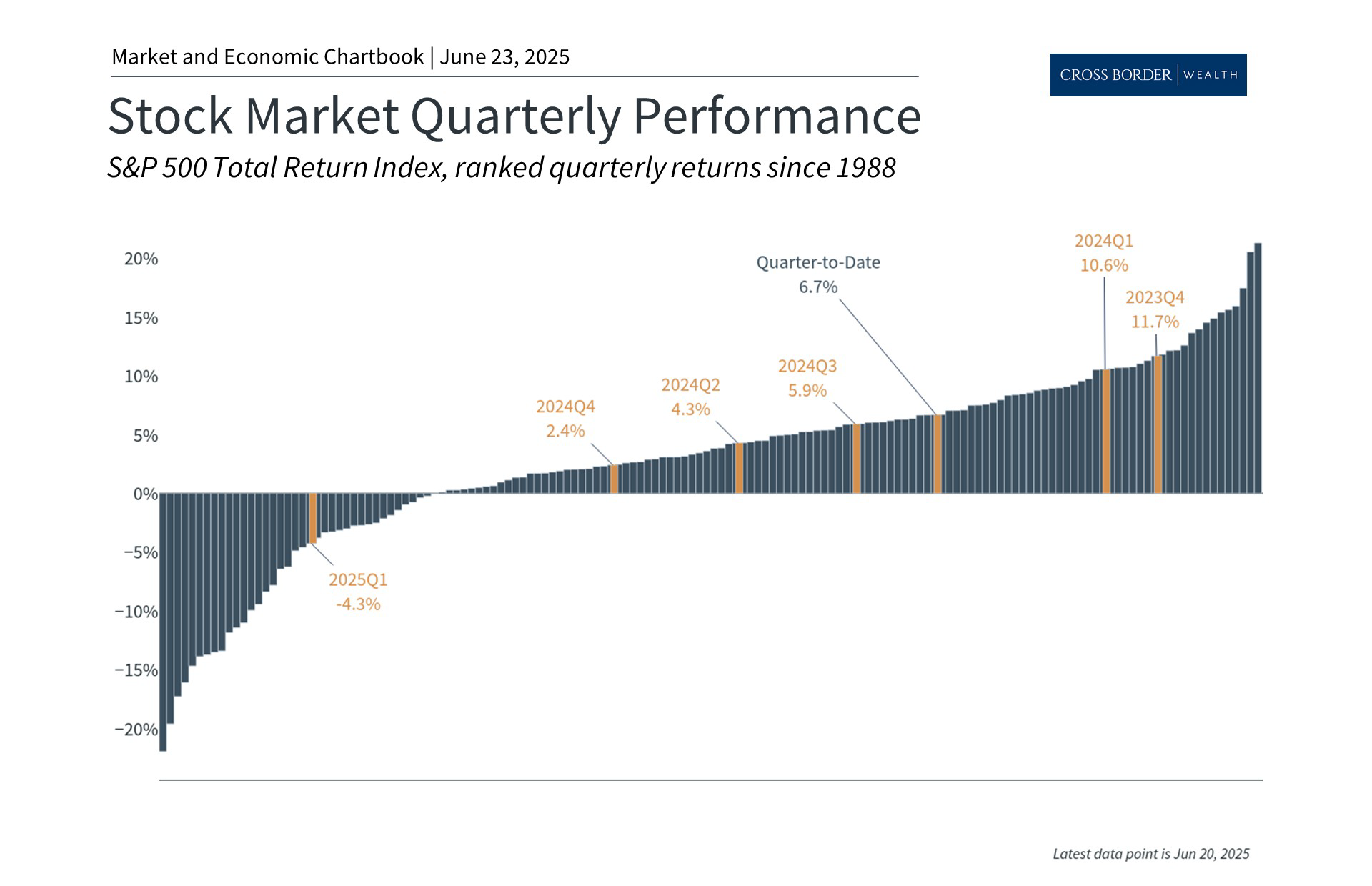

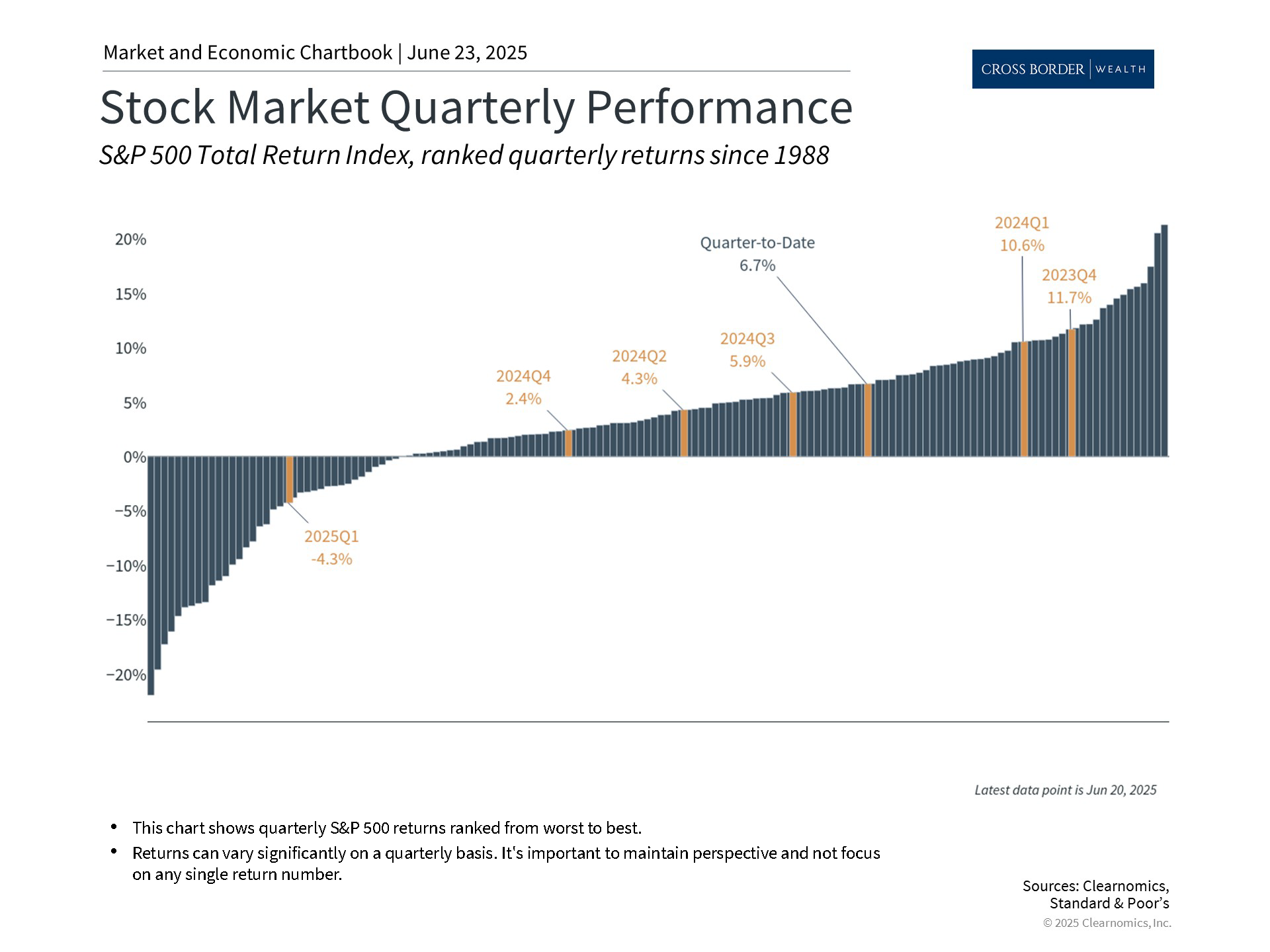

While tariffs are still a concern across the economy, recent trade deals have made the worst-case scenarios less likely. As the accompanying chart highlights, markets performed significantly better in the second quarter than in the first for this reason.

Looking forward, markets will likely be sensitive to the next phase of trade agreements. The 90-day pauses for most countries will end in July, and the reported deal with China has not yet fully materialized. The administration has shown that its objective is to reach new deals, just as it did in 2018 and 2019. Regardless of the exact outcomes, the average level of tariffs on imported goods has risen significantly this year which could still impact consumer inflation and corporate profit margins.

Investors should keep all of this in mind in the second half of the year. While there is never a guarantee that markets will recover quickly, the key is to focus on the underlying trends. After all, markets are forward-looking and capable of adapting to changing conditions.

Geopolitical risks are dominating headlines today

Past performance is not indicative of future results

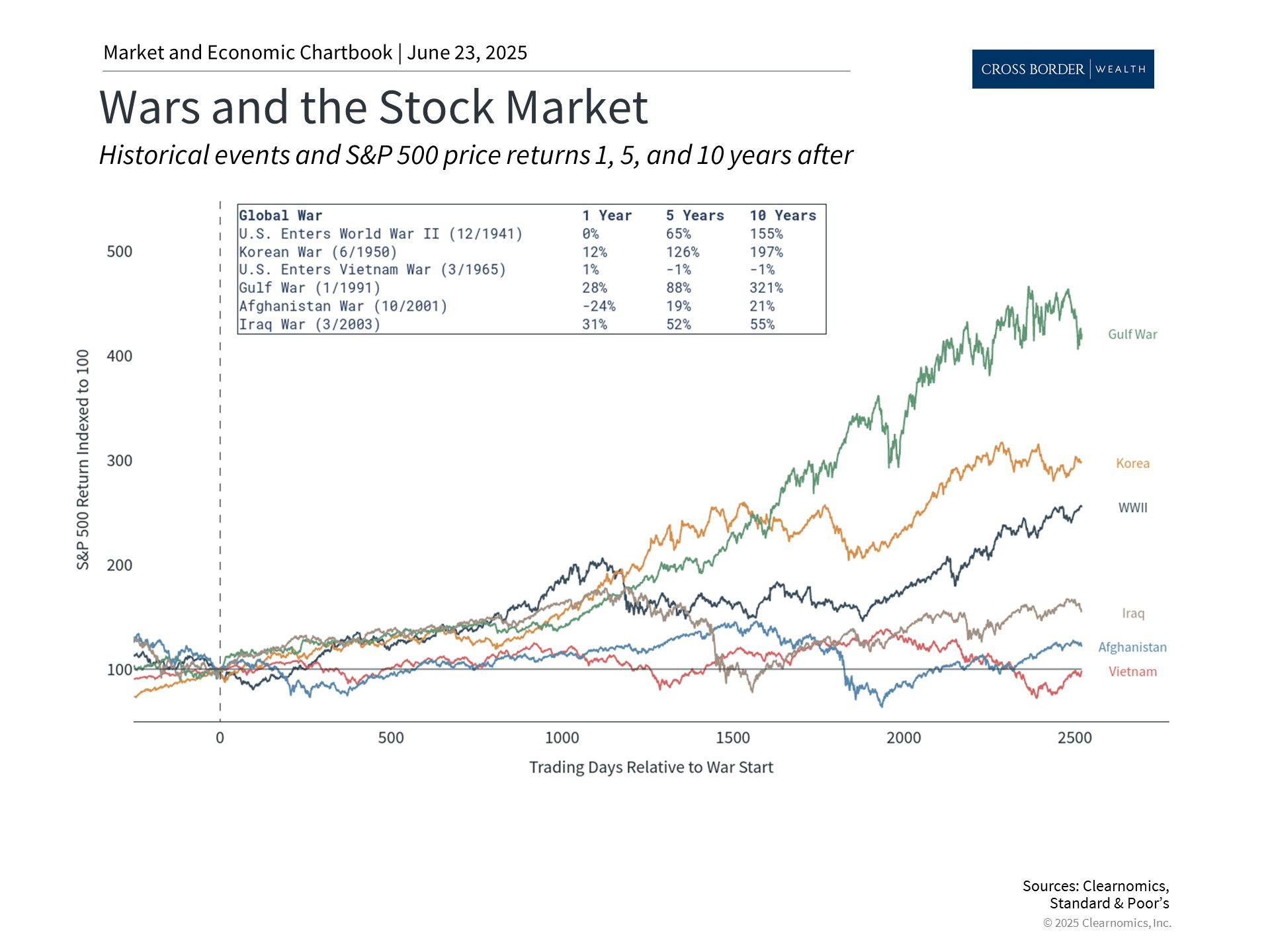

Geopolitical risks have intensified, particularly with the escalation of the Israel-Iran conflict which now involves the U.S. military. This naturally creates worries for some investors since these headlines are unlike the normal business and economic news flow. Fortunately, history provides important perspectives on how markets typically respond to geopolitical events.

The accompanying chart shows that markets have generally recovered from geopolitical shocks over time, often within months of the initial disruption. Even significant events such as wars had limited long-term impact on well-diversified portfolios. This is not to minimize the human and societal costs of these conflicts, but to serve as a reminder that making dramatic portfolio changes based on geopolitics is rarely productive.

Instead, what mattered more during these historical periods were the market and economic trends. For example, the Gulf War took place during a long 1990s bull market driven by information technology. In contrast, the war in Afghanistan began after the dot-com bust, and continued across multiple economic cycles.

Going back further in history, the American economy was still struggling from the Great Depression at the onset of World War II. The war effort kickstarted industrial activity and propelled markets forward. The Vietnam War, on the other hand, coincided with a challenging period of stagflation.

The immediate market concern around the Iran conflict centers around oil supply disruptions. In this instance, the Strait of Hormuz to Iran’s south is a critical waterway through which over one-fifth of global oil is transported. Any disruption to oil production or critical supply paths could result in a jump in oil prices, fueling inflation.

Despite this, oil prices have stayed within a narrow range as the conflict has escalated. The price of Brent crude is only back to where it was as recently as January. So, while the situation is still evolving, it’s important to stay balanced when considering the impact of geopolitics.

The economy appears healthy

Past performance is not indicative of future results

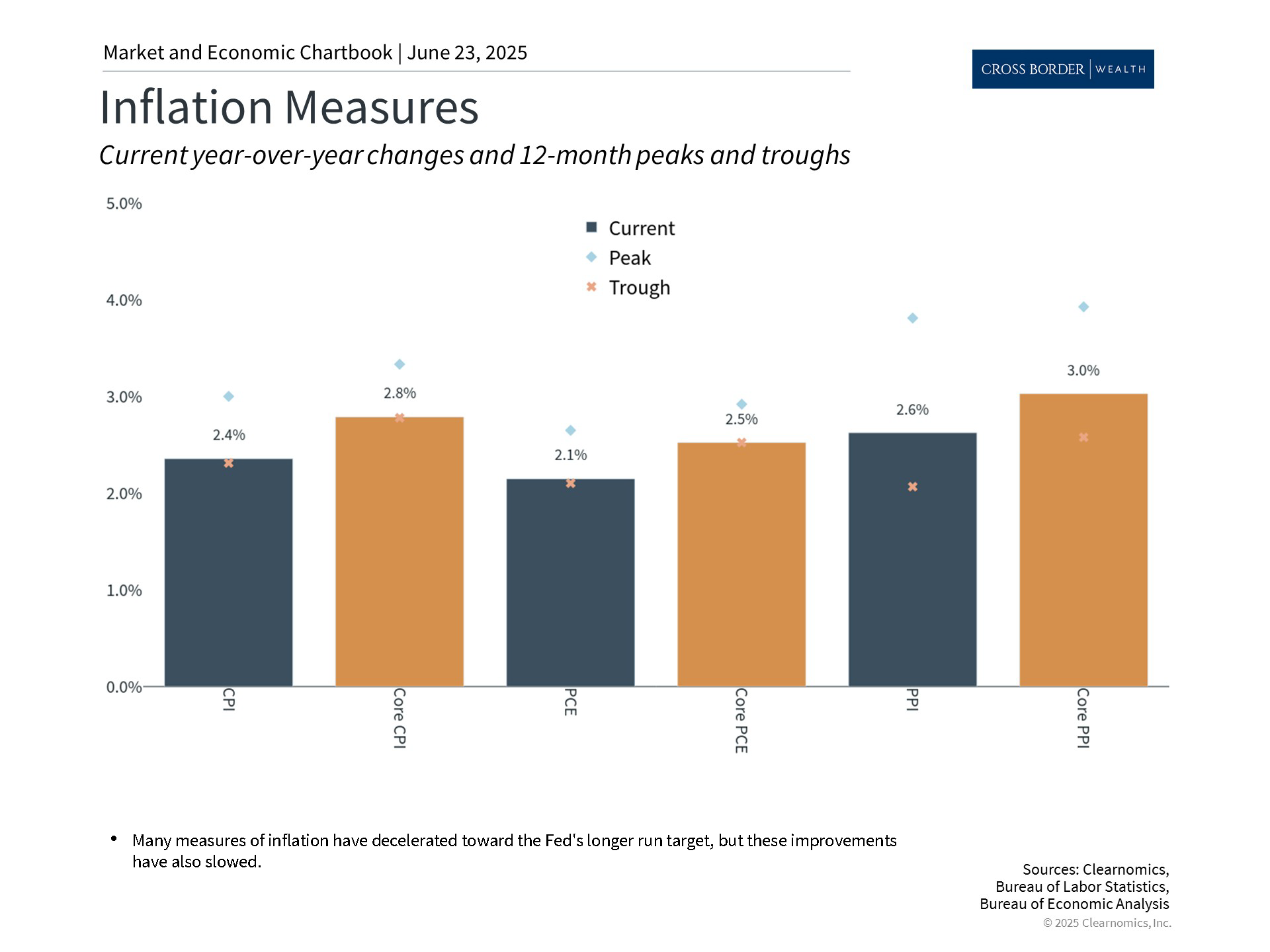

Perhaps the most important bright spot over the past several years has been the resilience of the U.S. economy. What has surprised investors the most is the strength of the labor market even as inflation has fallen back toward more historically normal levels. The accompanying chart shows that most inflation measures are at or below 3%.

The latest GDP report did show that the economy shrank by 0.2% during the first three months of the year. However, the details also show that this was largely due to trade as companies stockpiled imported goods ahead of potential tariffs. Consumer spending, which represents the largest component of economic growth, continued to grow steadily, supporting the overall economy. Without the trade disruptions, GDP growth would likely have been positive.

One area of concern that will likely resurface in the second half of the year is the growing national debt due to persistent government spending and deficits. This prompted Moody’s to downgrade the U.S. debt in May, following similar actions from other ratings agencies including Standard & Poor’s in 2011 and Fitch in 2023. This will be at the forefront once more as Congress debates the next budget bill, including provisions from the extension of the Tax Cuts and Jobs Act.

The national debt presents serious long-term challenges to the country and economy, especially because there do not appear to be long-term solutions. However, it’s once again important to not overreact with our portfolios. History shows that making portfolio decisions based on fiscal policy in Washington would have been counterproductive. Instead, these periods often present opportunities for investors across stocks and bonds.

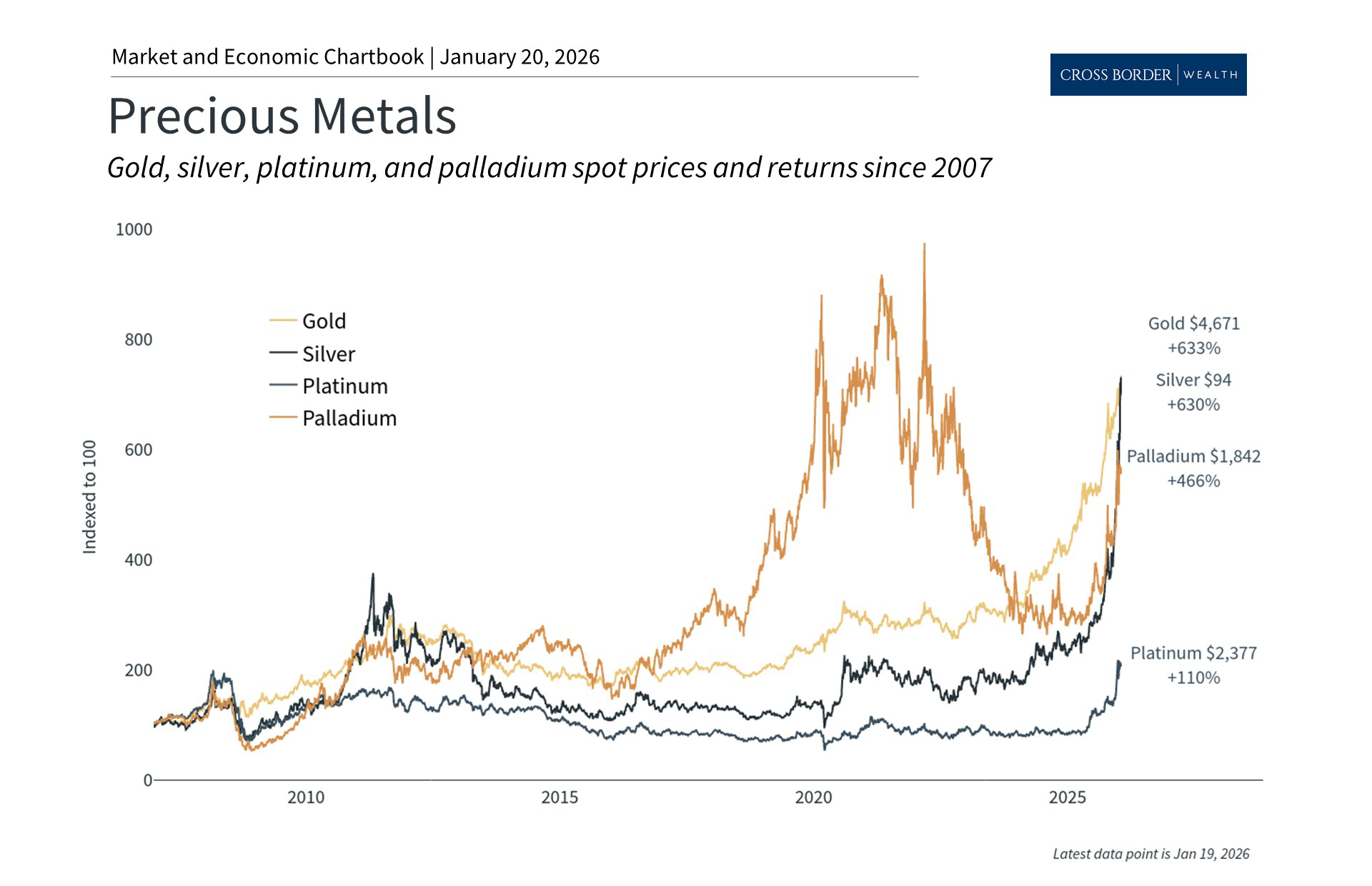

Asset classes beyond U.S. stocks have performed well

Past performance is not indicative of future results

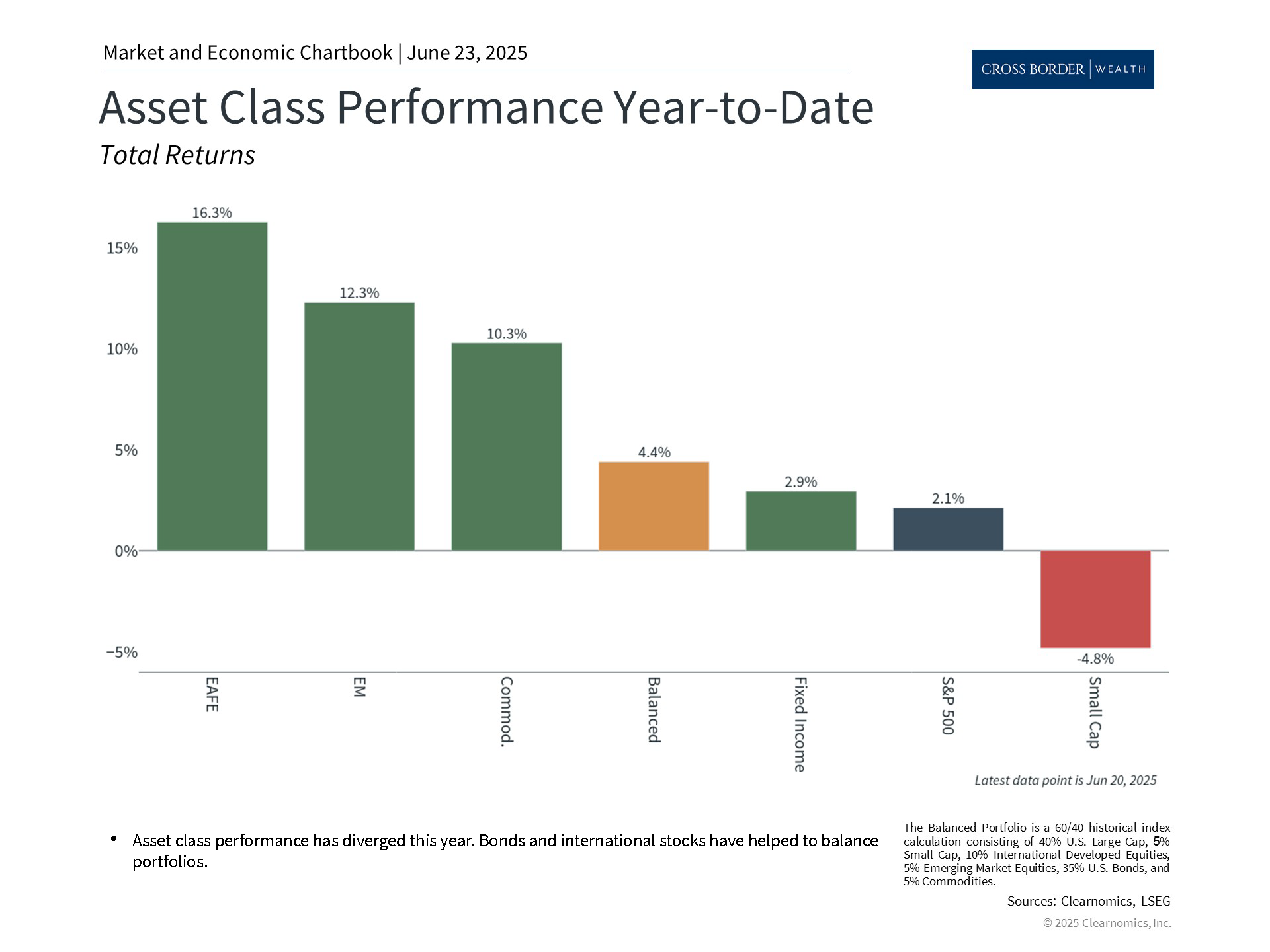

The biggest challenge with the market rebound is that U.S. stock market valuations are once again on the expensive side. That said, the elevated valuation environment has created opportunities in other areas of the market. International stocks, small-cap companies, and value-oriented sectors often trade at more attractive multiples, providing potential sources of opportunity for patient investors. Bond markets also offer compelling opportunities, with yields remaining above long-term averages across most fixed income sectors.

One of the most significant developments of 2025 has been the strong performance of international stocks, with developed and emerging markets experiencing double-digit gains, based on the MSCI EAFE and MSCI EM indices. This has partly been driven by a weakening U.S. dollar. When the dollar falls, assets denominated in foreign currencies become more valuable.

This serves as a reminder for the second half of the year that market leadership rotates over time. Maintaining exposure to different regions can both enhance portfolio outcomes and potentially help to reduce risk through diversification. While past performance doesn't guarantee future results, the current environment highlights why investors often benefit from patient, long-term approaches that capture opportunities across global markets.

The benefits of maintaining a long-term perspective

Past performance is not indicative of future results

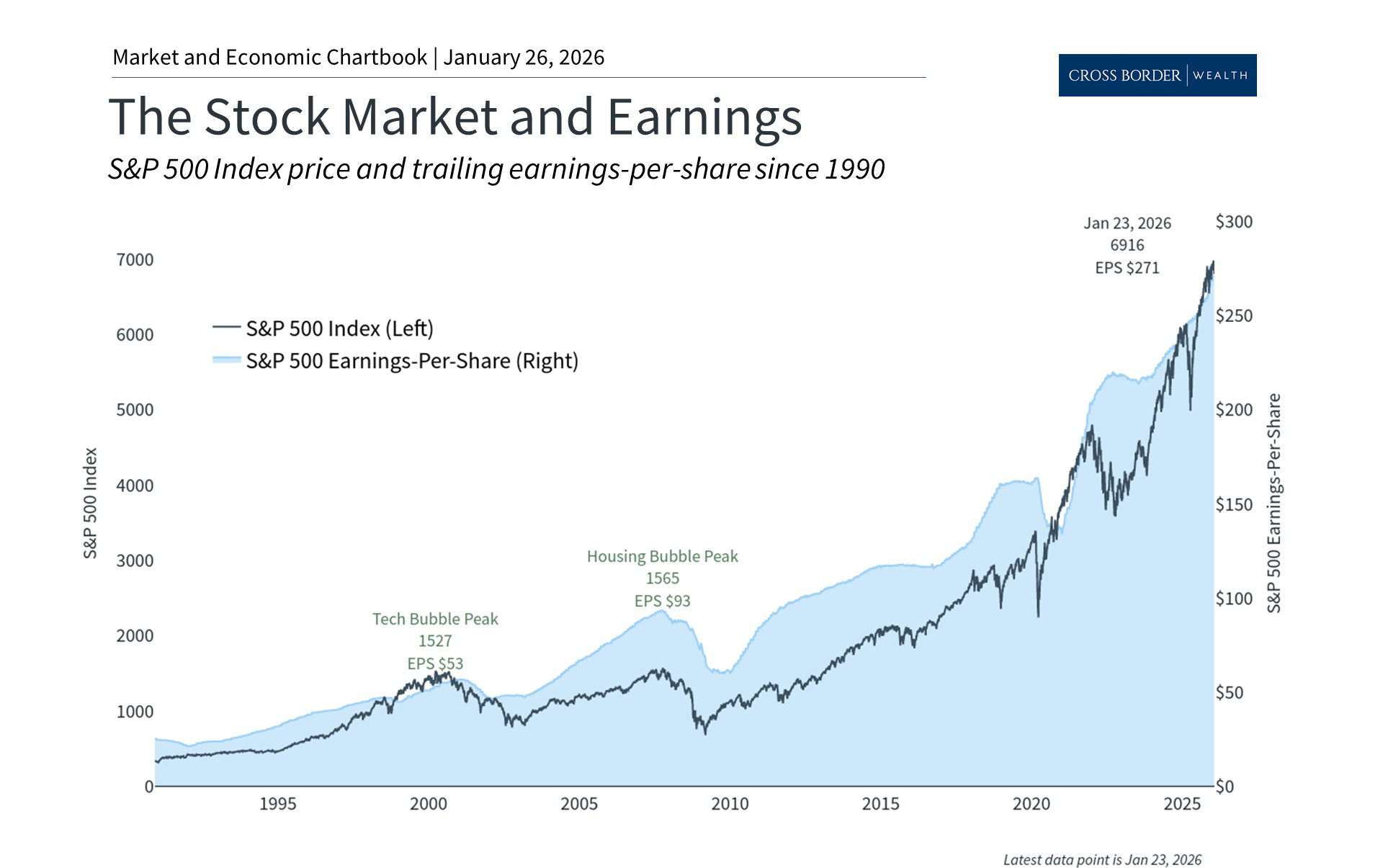

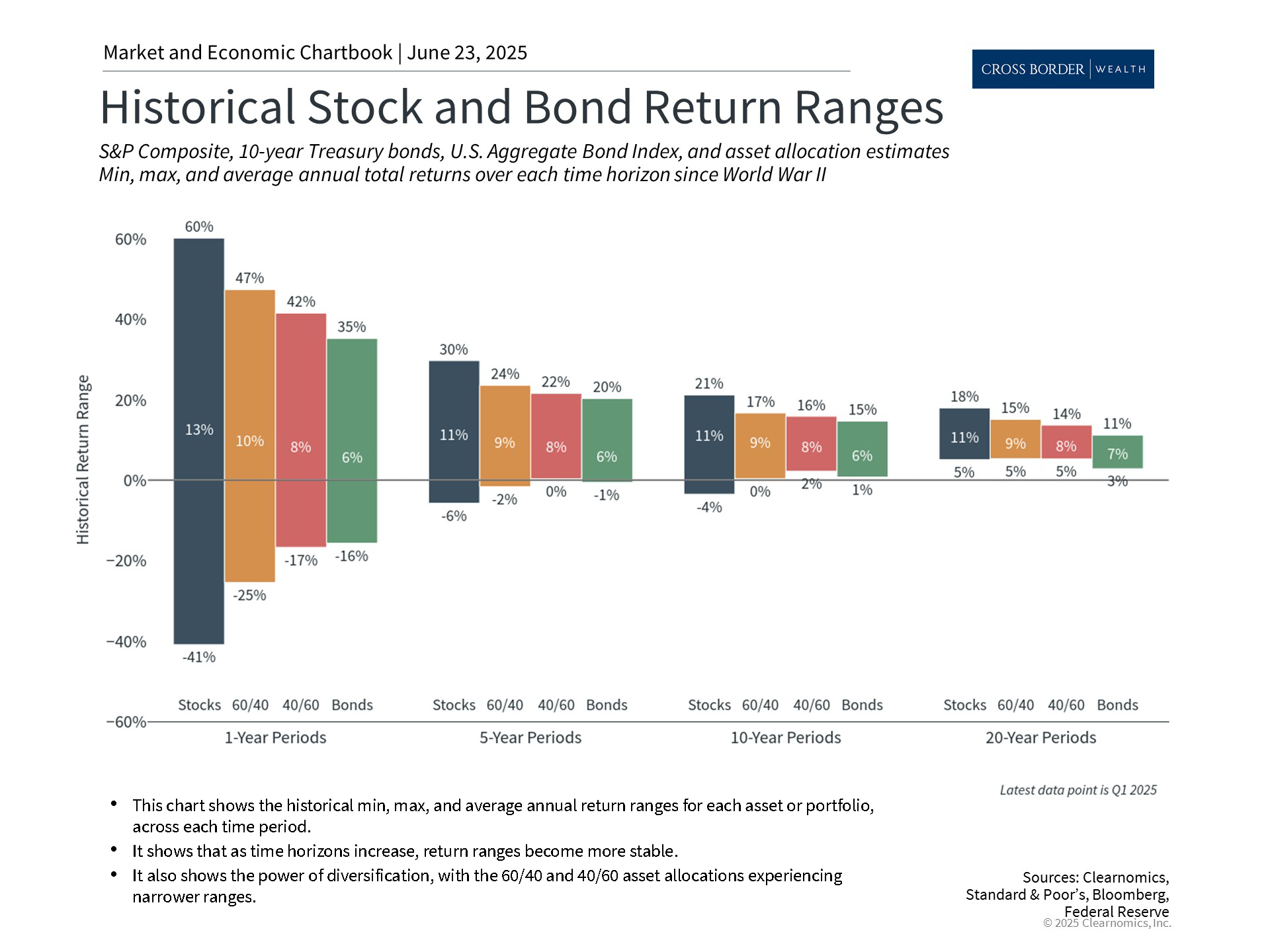

The patterns in the first half of the year are ones that investors have faced throughout history. They show that extending investment time horizons can improve portfolio outcomes, even when the market climate is the most challenging.

The accompanying chart shows that while annual returns can vary widely - with stocks ranging from significant losses to substantial gains in any given year - this volatility has historically smoothed out over longer periods. Over horizons of 10 years and more, the range of outcomes narrows substantially, which is why stocks and bonds have historically served as the foundations of long-term portfolios.

This historical perspective reinforces the importance of staying committed to well-constructed portfolios despite short-term concerns. This will only be more important as new developments test markets in the months to come.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.