Charitable Giving: Advanced Strategies for Year End Planning

- Market Insights

- 6 mins

A quote often attributed to Winston Churchill is that "it is more agreeable to have the power to give than to receive." The holiday season is a natural time to reflect on charitable giving and the role it can play as part of a comprehensive financial plan. Thoughtful charitable planning can not only support philanthropic goals, but increase tax efficiency as well. The question isn't just whether to give, but how to give in ways that maximize both the impact on causes you care about and the benefits to your overall financial plan.

This year presents a unique opportunity for charitable planning. The recently passed One Big Beautiful Bill Act (OBBBA) includes provisions that impact these considerations. Additionally, donations for this tax year must be made by December 31, creating a window to review your giving strategy. Understanding how to structure charitable gifts can transform generosity into a core pillar of your planning strategy.

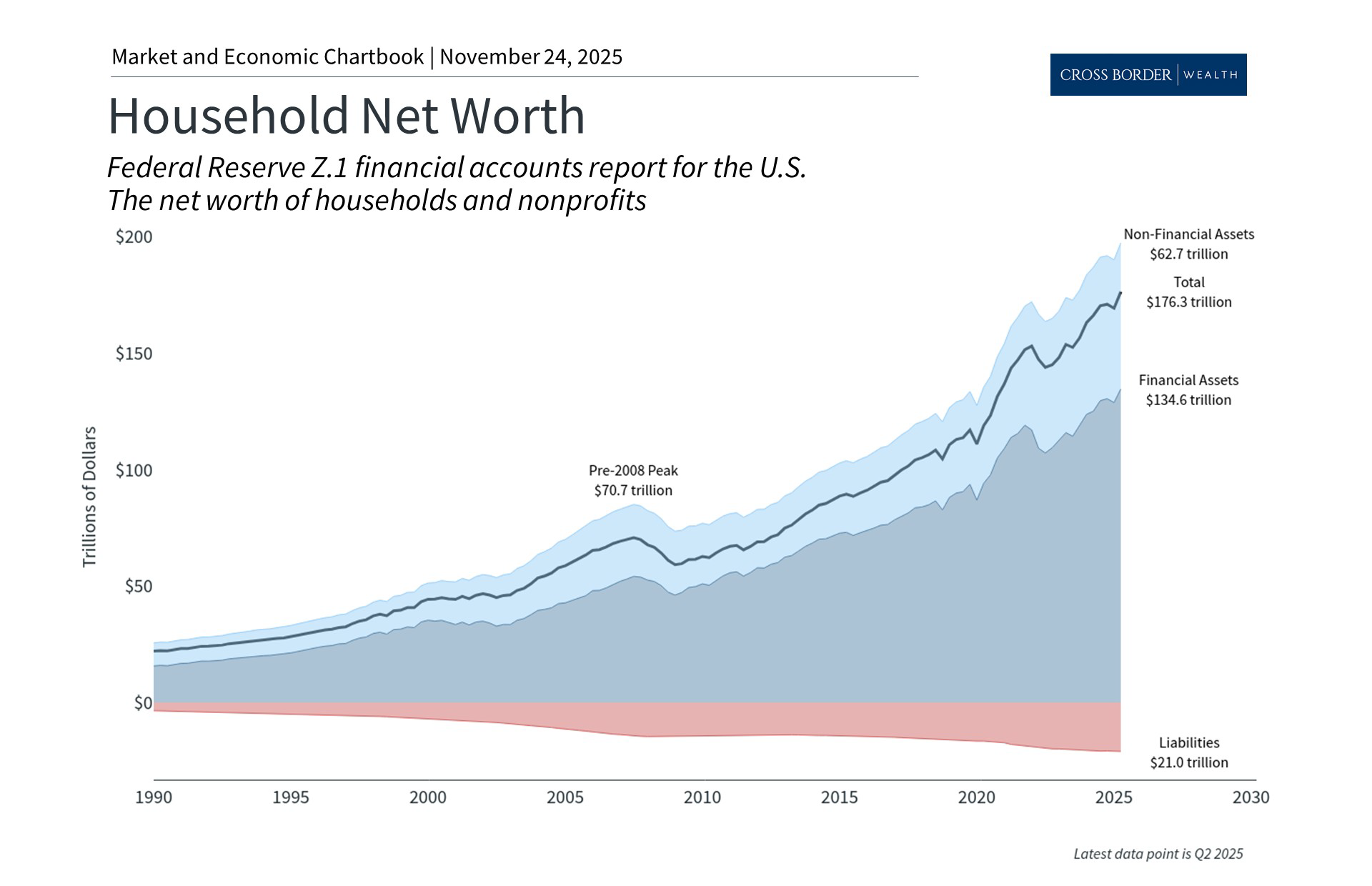

Household net worth has reached a new record level

Past performance is not indicative of future results

Americans gave $593 billion to charity in 2024, a 6.3% increase from 2023, according to the National Philanthropic Trust.1 This shows that charitable giving remains an important value for many households, even as the percentage of Americans who donate has declined in recent years. As the accompanying chart highlights, household net worth has increased steadily alongside economic growth and the stock market. Greater income and wealth, along with changes in the tax code, have created new incentives to give.

Charitable giving also plays an important role in estate planning. Assets left to charity are not subject to estate tax, making charitable bequests an efficient way to reduce estate tax liability while supporting causes you care about. For those with estates large enough to be subject to estate tax, the combination of lifetime giving and charitable bequests can significantly reduce the tax burden on heirs.

Most importantly, charitable giving can help leave a durable legacy, reinforce family values across generations, and reduce lifetime taxes. For many families, philanthropy becomes a way to involve children and grandchildren in meaningful discussions about values and stewardship. The challenge for investors is that while the desire to give is straightforward, the optimal approach requires thoughtful planning.

Timing and structure matter more than ever

The OBBBA has created important changes for charitable giving. Most significantly, it increases the number of people who are able to itemize their tax returns due to the increase in the state and local tax (SALT) deduction cap from $10,000 to $40,000. Since charitable contributions are only tax deductible if you itemize, this increases their importance in tax planning today.

Additionally, there is a time-sensitive window from 2025 through 2029 to optimize the timing and structure of gifts. This is because, starting in 2026, the OBBBA introduces a floor for charitable deductions for itemizers of 0.5% adjusted gross income (AGI). This means that only the portion of charitable gifts exceeding 0.5% of your AGI will be deductible. For someone with $200,000 in AGI, for example, only donations above $1,000 (0.5% of $200,000) would be deductible.

One strategy that some investors use to overcome this challenge is known as "bunching,” or incorporating multiple years of giving into a single tax year to exceed the deduction threshold. This approach has become increasingly popular since the 2017 Tax Cuts and Jobs Act nearly doubled the standard deduction, which reduced the percentage of households that itemized.

Another key consideration is deciding which assets to donate. For example, gifting highly appreciated securities offers three key tax benefits: it avoids capital gains tax from an outright sale, removes further appreciation from the gross estate, and provides a deduction on ordinary income. For ordinary income deductions, consideration should be given to whether the recipient is a public or private charity and the investor’s estimated AGI. This "triple benefit" can be especially attractive during years with significant capital gains, such as when equity compensation vests or following a business sale, and when there are no losses to offset the gain.

Integrating charitable giving into portfolio rebalancing can also enhance efficiency. Some investors prioritize gifts of appreciated assets held in taxable accounts, then replenish those holdings through purchases in tax-deferred accounts. This approach can maintain the desired asset allocation while maximizing tax benefits.

Example vehicles for charitable giving

Different charitable giving vehicles serve different purposes, and selecting the right one depends on your specific circumstances and goals. The following are some common examples, although it is not an exhaustive list:

Donor-advised funds (DAFs) have grown in popularity, with assets exceeding $250 billion.1 DAFs function like charitable investment accounts: you make a contribution, receive an immediate tax deduction, and then recommend grants to charities over time. The funds can be invested and grow tax-free while you decide on the timing and recipients of your gifts. DAFs are especially valuable in years when maximizing deductions is important.

Under the new tax rules, donors can structure DAF contributions to ensure they exceed the 0.5% AGI floor threshold described earlier. DAFs are also simpler than other options, making them accessible to a wider range of donors.

Qualified charitable distributions (QCDs) are another option for those aged 70½ or older with traditional IRAs. QCDs allow you to transfer up to $108,000 for tax year 2025 directly from your IRA to charities. This can satisfy required minimum distribution (RMD) rules while excluding the amount from taxable income. QCDs provide tax benefits regardless of whether you itemize, so they can be valuable in years when itemized deductions are less favorable.

Charitable remainder trusts (CRTs) provide yet another option to support charitable causes as part of estate planning. With a CRT, you transfer assets into a trust that pays beneficiaries income for a specified period, with the remainder going to charity. This can be especially useful for highly appreciated assets, since the trust can sell them without you incurring immediate capital gains taxes.

As with any other trust vehicle, care should be taken in the structure. For example, certain retained powers could trigger inclusion of the asset in the grantor’s gross estate. Additionally, naming beneficiaries other than the grantor or spouse could trigger a gift tax.

For those fortunate enough to have substantial assets and long-term philanthropic goals, additional considerations may include:

- Private foundations, which offer maximum control and family governance structures but come with higher administrative requirements, minimum distribution rules, and excise taxes on investment income

- Charitable lead trusts, which provide income to charity for a period before assets pass to heirs

- Supporting organizations, which work closely with specific public charities

- Pooled income funds offered by certain charitable institutions

These examples represent some of the most common charitable giving vehicles, but there are additional options and variations that may be appropriate depending on your specific situation. Working with a trusted advisor can help determine which approach best aligns with your goals.

Charitable giving as part of comprehensive planning

The most effective charitable planning integrates giving into your broader financial strategy rather than treating it as separate from other financial decisions. This holistic approach considers how charitable giving intersects with investment management, tax planning, retirement income, and estate planning.

Perhaps most importantly, involving children and grandchildren in charitable decision-making creates opportunities to discuss what matters most to your family, why certain causes deserve support, and how to evaluate nonprofit effectiveness. These conversations can be among the most meaningful aspects of wealth planning, helping ensure that your family's values and sense of stewardship continue across generations.

- https://www.nptrust.org/philanthropic-resources/charitable-giving-statistics/

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.