Distributions from Employer-Sponsored Retirement Plans

- Global Wealth Management

- 10 mins

A withdrawal of money from an employer-sponsored retirement plan is generally referred to as a distribution. When you have money in a plan maintained by your current or former employer, you need to be aware of your distribution options for several reasons.

First, not every option may be available to you. Your distribution options may differ depending on the type of employer-sponsored plan, the specific provisions of the plan, the type of contributions (employer, employee, pre-tax, Roth, after-tax, etc.), and whether you are still working for the employer at the time of the distribution.

Second, your choices may result in different tax consequences for you — one choice may lead to immediate taxation or taxation at a higher rate, while another choice may allow continued tax-deferred growth of your retirement money.

Third, your payout choices may determine how long your retirement plan funds last. When dealing with retirement money, you need to be extra careful about the amount and timing of your distributions. One or more bad decisions now could have a significant impact later in your retirement.

Finally, different choices may result in different payouts and tax consequences for your beneficiaries. This can be an important concern if providing for your beneficiaries and minimizing their taxes is one of your main goals.

Caution: The tax laws governing distributions from employer-sponsored retirement plans are complex. Consult a tax professional for guidance.

Caution: Special rules apply to distributions to qualified individuals impacted by certain natural disasters and to qualified reservist distributions.

When can you take distributions from your retirement plan?

In general, you can take distributions from your retirement plan upon some specified events. For example, you may be entitled to take distributions when you retire or when you reach the plan’s normal retirement age. You may also be entitled to take a distribution upon job termination, disability, plan termination, or financial hardship.

Depending upon the type of retirement plan and the provisions of the plan, you may be eligible to receive certain distributions while you are still working for your employer as well as after your employment has ended. However, some plans may only allow distributions after your employment has ended.

Caution: Taxable distributions made prior to age 59½ may be subject to the federal 10% premature distribution tax unless an exception applies. One important exception is for distributions you receive as a result of termination of employment if your separation from service occurs during or after the calendar year in which you reach age 55 (age 50 for qualified public safety employees participating in certain state or federal governmental plans).

Caution: The premature distribution penalty is 25% from SIMPLE IRAs during the first two years of plan participation.

When you must start taking distributions — required minimum distributions

You cannot leave your money in an employer-sponsored retirement plan indefinitely. The federal government requires you to take annual distributions (required minimum distributions, or RMDs) over your life expectancy. Your required beginning date for taking your first distribution from a qualified retirement plan is usually April 1 of the calendar year following the calendar year in which you (the plan participant) reach age 72 (age 70½ if reached before January 1, 2020).

Note: Neither a charity, estate, nor some types of trusts can be designated beneficiaries.The Setting Every Community Up for Retirement Enhancement (SECURE) Act passed in late 2019 raised the RMD age from 70½ to 72, effective January 1, 2020. Anyone who turns 72 before July 1, 2021, (and therefore reached age 70½ before 2020), will need to take an RMD by December 31, 2021.

There is one situation where your required beginning date can be later than described above. If you work past age 72 (age 70½ if reached before January 1, 2020), your required beginning date as a plan participant under the plan of your current employer can be as late as April 1 of the calendar year following the calendar year in which you retire when both of the following apply:

- Your employer’s retirement plan allows you to delay your required beginning date in this manner

- You (the plan participant) own 5% or less of the employer’s company

Example: You own more than 5% of your employer’s company and you are still working at the company. Your 72nd birthday is December 2, 2021. You must take your first RMD from your retirement plan by April 1, 2022 — even if you are still working for the company at that time.

Example: You have money in two plans — one with your current employer and one with a former employer. You own less than 5% of each company. Your 72nd birthday is December 2, 2021, but you’ll keep working until you turn 73 on December 2, 2022. You can delay your first RMD from your current employer’s plan until April 1, 2023 — the April 1 following the calendar year in which you retire. However, as to your former employer’s plan, you must take your first distribution by the April 1 following the calendar year you reached age 72 — April 1, 2022.

Regardless of your required beginning date, subsequent distributions are due on or by December 31 of each calendar year.

Caution: This means that if you delay your first required distribution (as described above), you will have to take both your first and second required distributions from your former employer’s plan in 2022.

When your plan must make distributions available

Although you may decide to postpone distributions from your retirement plan until age 72 or later (in some cases), your plan has to make distributions available to you on a different schedule. A plan must allow you to receive distributions no later than 60 days after the latest of:

- The end of the plan year in which you no longer work for the employer’s company

- The end of the plan year in which you reach age 65 (or the plan’s normal retirement age, whichever is earlier)

- The end of the plan year in which the 10th anniversary of your participation in the plan occurs

Tip: A plan year is not necessarily the same as the calendar year. Check with your plan administrator to find out the plan year for your plan.

Normal retirement age is the earlier of:

- The age specified in your plan as the normal retirement age

- The later of the date you reach age 65 or the 5th anniversary of your participation in the plan

Generally, distributions are made to you once you reach age 65 or leave the employer’s company. It depends upon how the plan document is written. The plan may even provide for early retirement benefits.

Distribution options while still employed by the plan employer ("in-service" distributions)

Distribution options while still employed by the plan employer (“in-service” distributions). Depending upon the type of retirement plan and the provisions of the plan, one or more of the following distribution options may be available to you while you are still working for the employer maintaining the plan. However, plans differ in the distribution options allowed to employees. You may need to look at the plan’s summary plan description and/or consult the plan administrator to find out the details of your employer’s plan.

Plan loans

You may be able to borrow against your vested benefits in your employer’s retirement plan, if the plan allows participants to take loans. If the loan meets IRS guidelines, the loan will not be treated as a taxable distribution. In most cases, a plan loan must be repaid within five years from the date you borrowed the funds (the repayment period can be longer if the funds are used to purchase a primary residence). The interest rate on plan loans is generally very reasonable compared to other loans.

Hardship distribution

Some plans allow you to take hardship withdrawals while you are still working for your employer. If your plan permits this type of withdrawal, you need to demonstrate financial hardship to justify the withdrawal. Hardship withdrawals are generally subject to income tax, and perhaps a 10% premature distribution tax if you are under age 59½.

Caution: Hardship withdrawals generally may not be rolled over into an IRA or other employer retirement plan.

Profit-sharing plans

Some profit-sharing plans [including 401(k) plans] allow you to withdraw employer contributions (e.g., matching contributions or discretionary profit-sharing contributions) after a specified period of time.

Tip: 401(k) and 403(b) plans can also let you withdraw your own elective deferrals (pre-tax and Roth) when you reach age 59½.

Pension plans

In general, defined benefit and money purchase pension plans can’t allow distributions until you terminate your employment or reach the plan’s normal retirement age.

Tip: The Pension Protection Act of 2006 encourages “phased retirement” programs by permitting the distribution of pension benefits to employees who have attained age 62, but haven’t yet separated from service or reached the plan’s normal retirement age.

Pension plans — annuities as a standard form of benefit

Occasionally, you may be entitled to receive benefits based not only on your earnings record, but on someone else’s as well. This often happens when a married couple retires.A defined benefit pension plan and a money purchase pension plan are required to offer a certain type of annuity retirement benefit. In some cases, profit-sharing plans and stock bonus plans must also follow these rules.

A defined benefit plan normally pays benefits in some form of periodic payment for life. If you participate in a defined benefit plan, your options may be relatively limited. A defined benefit plan as a starting point must provide a qualified joint and survivor annuity (QJSA) to married participants. Keep in mind that you are not required to accept this annuity form of benefit — you and your spouse may elect to change this default form of payout. In this case, your plan will spell out alternate forms of payout that are available, such as a single-life annuity.

Married persons

Generally, if you have been married for at least a year on the annuity starting date, these pension plans must offer you and your spouse a QJSA. A QJSA provides an annuity payment during retirement as long as either you or your spouse is alive. The annuity is for your life with a survivor annuity for the life of your spouse. The annuity for your spouse’s life must not be less than 50% (or greater than 100%) of the annuity payable during the time you are both alive.

Tip: If you obtain the written consent of your spouse, you may elect against the QJSA. You can then choose another form of payout allowed under the plan. For example, you may be able to choose a single-life annuity based only on your lifetime. A single-life annuity provides a higher monthly benefit because the same amount of money is designed to last for one lifetime rather than two. The risk is that if your spouse outlives you, the annuity payments stop upon your death. If you die before your spouse, your spouse will stop receiving pension payments with a single-life annuity. To protect your spouse after your death, consider using a portion of the single-life annuity payments to purchase life insurance on your life (if you are insurable at an affordable cost). This option is often referred to as “maximizing your pension with life insurance.”

Single persons

If you are unmarried, these pension plans generally must offer you the option of a single-life annuity payout. However, you may generally elect against the single-life annuity and choose an alternate form of payout allowed under the plan. Consult your plan administrator regarding the distribution options available to you as a single individual.

In general: distribution options upon separation from service, retirement, or disability

After you leave your employer, whether due to a separation from service (voluntarily or involuntarily), retirement, or disability, you may be able to choose from up to four methods of taking a distribution from your retirement plan.

Tip: In general, a plan cannot force you to take a distribution from your account until you reach the plan’s normal retirement age.

Caution: However, a plan may “cash out” your benefit without your consent if the value is $5,000 or less. (In general, if the distribution exceeds $1,000, payment must be made to an IRA established on your behalf unless you elect to receive the payment in cash, or to roll it over into a different IRA or employer retirement plan.)

Rollover

A rollover is a direct (from one plan trustee to an IRA or second plan trustee) or indirect (from a plan trustee to you, and then to an IRA or second plan trustee) tax-free transfer of assets from a retirement plan to another plan (at a new employer) or to an IRA. If you cannot roll over your funds directly to another plan, you can generally roll over your funds first to an IRA and then later (if you choose) from the IRA to a new employer’s plan. Rollovers encourage retirement savings by allowing your money to continue growing tax deferred in the IRA or new plan. With an indirect rollover, your old plan administrator must withhold 20% of the distribution for federal income tax. (You can claim the amount withheld as a credit on your federal income tax return.)

Caution: Required minimum distributions, certain periodic payments, and hardship distributions generally cannot be rolled over into an IRA or employer-sponsored retirement plan. Consult a tax professional.

Lump-sum distribution

A lump-sum distribution is the withdrawal of your entire balance in an employer-sponsored retirement plan in one taxable year. The income tax consequences of a large lump-sum distribution are often considerable, and in some cases, you may have to pay the 10% premature distribution tax if you are under age 59½ (and perhaps a state penalty, too). In addition, after you take a lump-sum distribution, your plan funds are no longer in a tax-deferred retirement account. A lump-sum distribution is usually not a preferred option unless you urgently need money and have no other recourse. (Special tax-averaging and capital gains provisions that may make a lump-sum distribution a less taxing experience may be an option if you were born before 1936. Consult a qualified professional.).

Tip: An important exception from the 10% premature distribution tax applies to distributions from qualified retirement plans after you separate from service with the employer maintaining the plan, if your separation occurs during or after the calendar year in which you reach age 55 (age 50 for certain distributions to qualified public safety employees).

Periodic payments

You may be able to receive periodic payments from your employer-sponsored retirement plan in the form of an annuity, installment payments, or payments spread over your life expectancy. Some of these options are described above (see Defined benefit plans — annuities as a standard form of benefit). Consult your plan administrator to determine the specific types of annuities and periodic payments allowed under your plan.

Discretionary distributions

A discretionary distribution is any withdrawal from your retirement plan that is not a lump sum, loan, or annuity payout. It may be structured (you withdraw a set amount at set times) or unstructured (you withdraw what you need as you need it). Not all plans allow this option. The advantage is that you take only what you need, letting the balance of the funds continue to grow tax deferred. However, these distributions are generally subject to income tax, and the 10% premature distribution tax if you are under age 59½ (unless an exception applies).

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

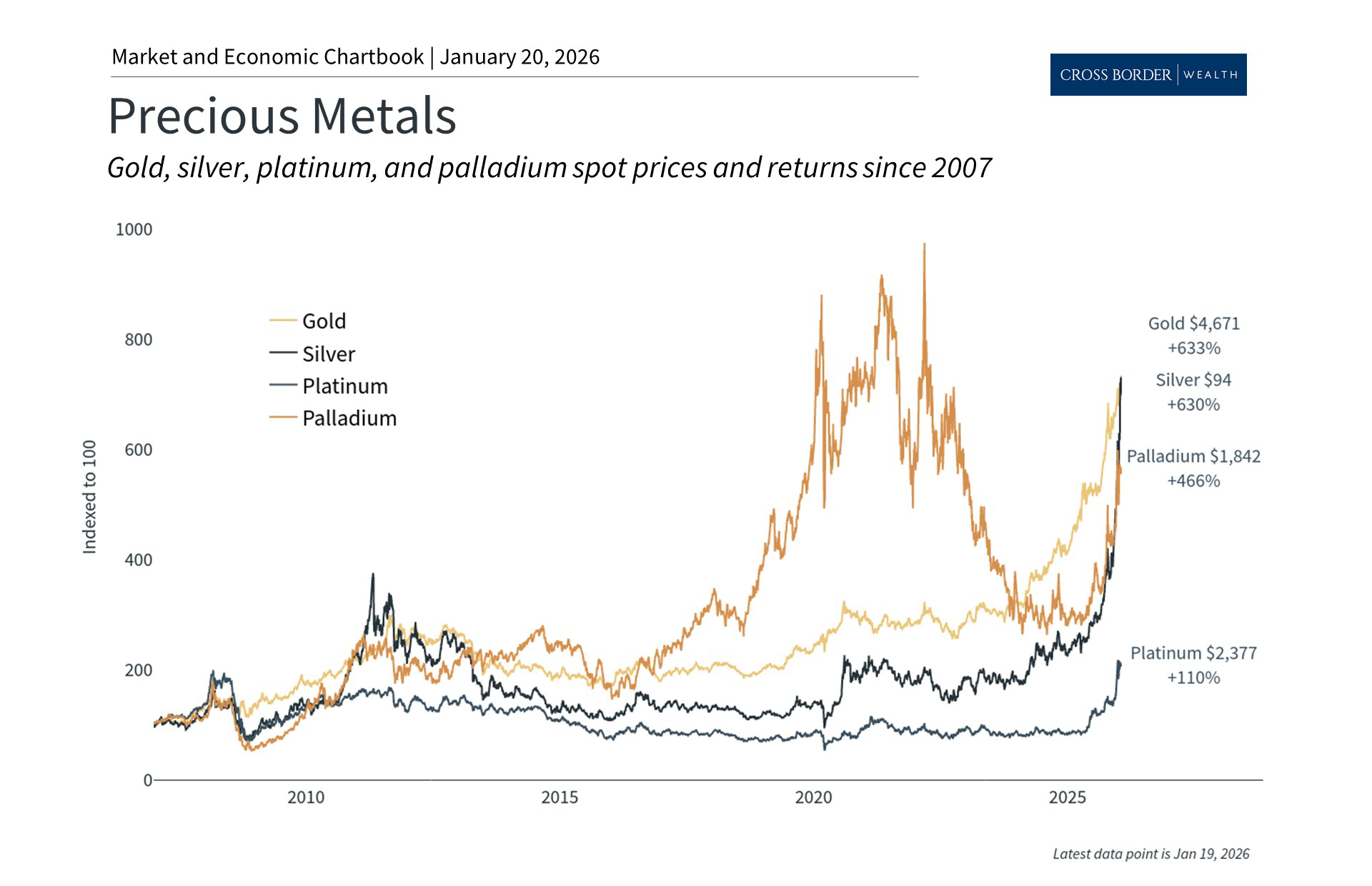

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.