Financial Planning Tips for American Expatriates

- Global Wealth Management

- 2 mins

Financial planning is very important no matter what situation you’re in. As an American expatriate, your financial planning decisions are going to have a big impact on your future. Take a look at the following financial planning tips for American expatriates. These tips should give you a lot to think about while also guiding you toward making healthy financial decisions.

Learn About Your Expat Status

One thing that you need to know right away is what expat status it is that you have. Some people make the mistake of thinking that they don’t have to pay taxes any longer once they are no longer living in America. This simply isn’t the case and you need to get specific information about your expat status. It’s always best to do everything by the book to avoid financial problems in the future.

Research the Cost of Living

If you’re planning on living abroad for a long period of time, then you definitely want to know about the cost of living. Research the cost of living at your preferred location so that you’ll know what to expect. Do the math to make sure that you can comfortably afford things. Sometimes people make the mistake of underestimating how much yearly expenses will be and this can cause them to burn through savings accounts fast.

Make Sure You Cancel American Utility Accounts

Some American expatriates make the mistake of forgetting to cancel their American utility accounts, too. Do your best to cancel your phone, cable, power, and water bills by the time you’re moving abroad. If you don’t do this, then your account could continue to be debited for no reason. You want to set yourself up for success and wasting money moves things in the opposite direction.

Set up an Investment Portfolio

It’s going to be more important than ever to make your money work for you. For this reason, it’s advisable to set up an investment portfolio that will help you to grow wealth. Work with a financial adviser that understands international markets and try to make investments that are sensible. This could help you to live comfortably while abroad if you’re able to make good investment moves.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

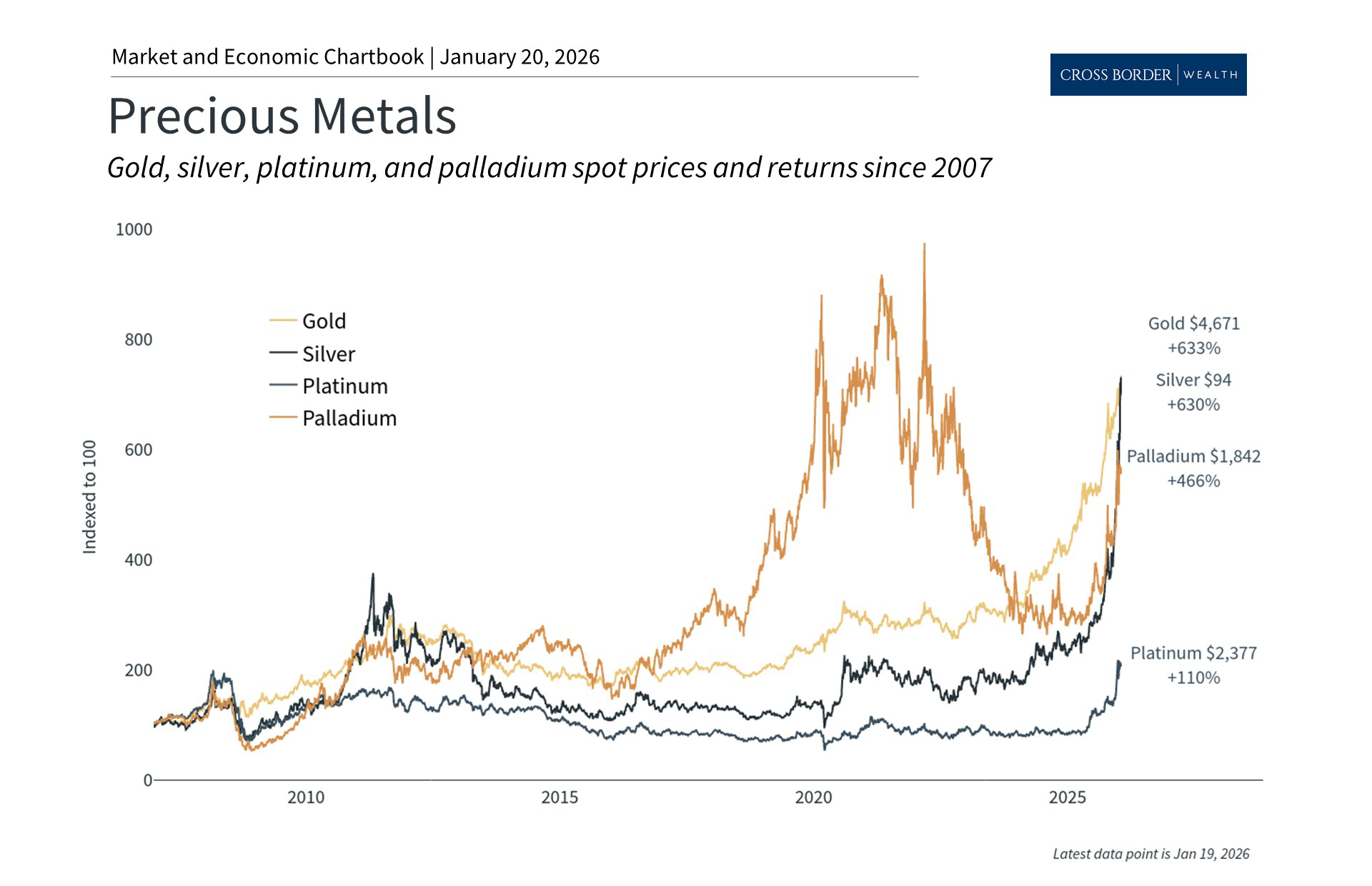

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.