Finding Perspective Amid Recession Fears

- Market Insights

- 7 mins

Get investing insights for US-connected global citizens.

Book a free consultation with our cross-border advisors.

The stock market has stumbled with the S&P 500 and Nasdaq declining year-to-date.1 While tariffs have garnered the most attention, investors are also concerned about mixed economic signals including weak consumer confidence, hotter inflation, government worker layoffs, and more. Some are now wondering if there will be a recession, and President Trump did not rule out the possibility in recent interviews. How can investors maintain perspective in this challenging market and economic environment?

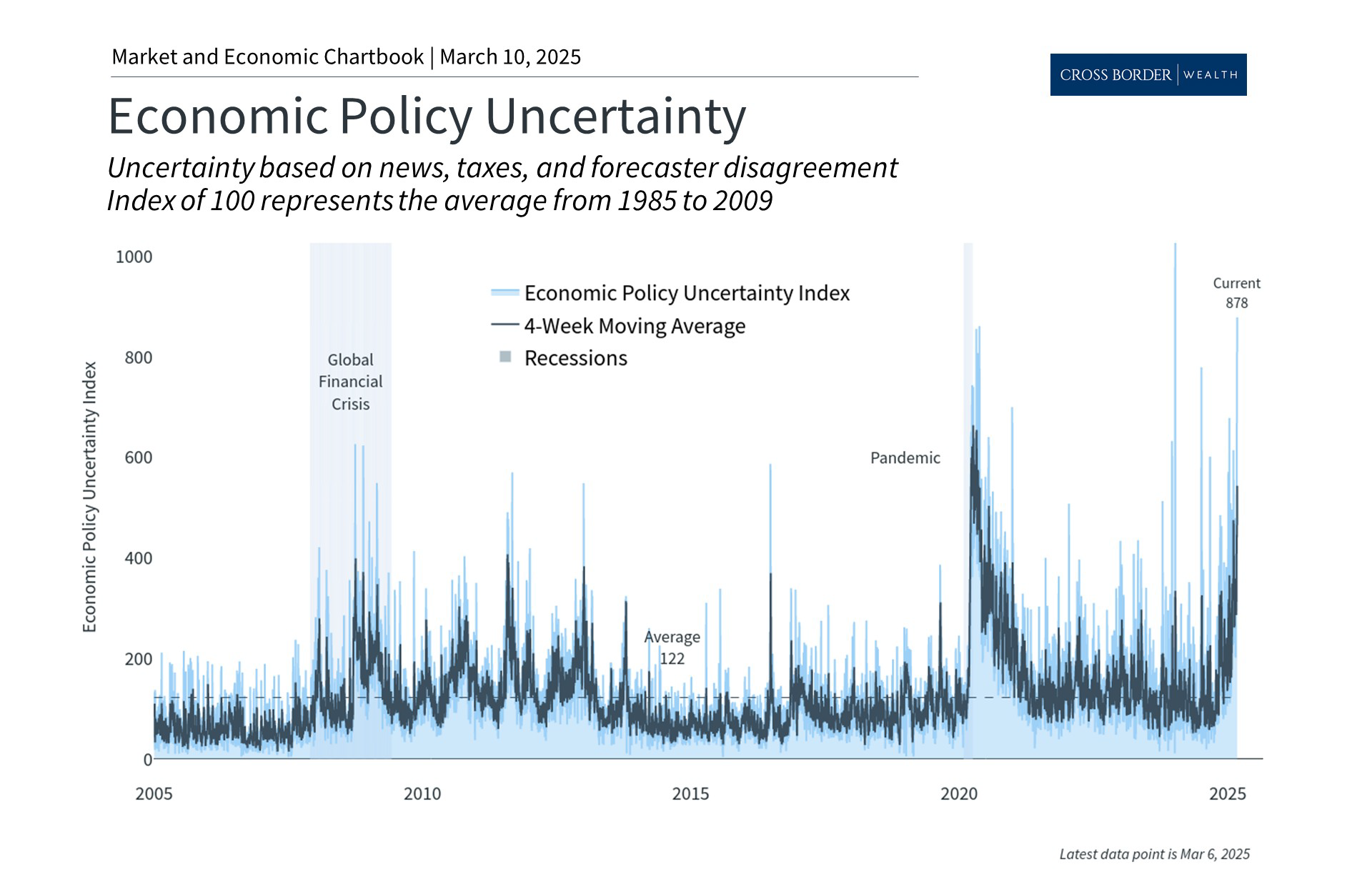

Chart: Uncertainty around economic policy has increased

Past performance is not indicative of future results

To start, it is important to understand the difference between how individuals and households feel about the economy versus what drives financial markets. For example, when the prices of everyday goods and services increase, this can present challenges for our personal budgets. However, it may create potential opportunities in investments that can benefit from price increases. So, it's important as investors to remain objective and distinguish between our personal experiences with the economy and the factors that influence long-term investment returns.

While the economy and stock market are not the same thing, they influence one another in important ways. When economic growth is strong, corporate earnings tend to grow which can boost share prices, and vice versa. Similarly, stock and bond markets can sometimes serve as a leading indicator for the broader economy since they reflect the forecasts of millions of investors.

This does not mean that the market is always correct. It’s important to remember that some investors and economists have been predicting a recession for nearly three years. Just a year ago, many believed a recession would be imminent due to inflation. Even academic indicators of recession, such as the “inverted yield curve” or the “Sahm Rule,” have not proven to be reliable this time around.

Instead, not only has the economy grown steadily in the past few years, markets have also performed well. Despite the current pullback, the S&P 500 has gained over 60% since the market bottom in late 2022,2 while the Nasdaq has risen 78%.3

Of course, like a stopped clock that happens to be right twice a day, there will eventually be a recession. However, these examples show that predicting the timing of economic downturns is difficult. Investing based on the assumption of an economic downturn can lead to suboptimal financial decisions, which is why it’s important to build portfolios that focus on long-term goals rather than near-term uncertainties.

Why have recession concerns risen?

Historically, recessions occur when the business cycle enters its later stages, or an external shock takes place, such as a pandemic or financial crisis. The current business cycle has shown signs of slowing, but has not contracted just yet. Instead, a possible trade war represents an outside shock to consumers, businesses, and global supply chains. Additionally, slower growth - or even two consecutive quarters of negative growth - are quite different from situations like the 2008 global financial crisis or 2020 pandemic shutdown.

The administration has said there may be a period of short-term "turbulence" in the economy. Even if tariffs do not directly harm growth, they have created an environment of uncertainty, as shown in the chart above. The administration has acted more swiftly with broad tariffs compared to President Trump’s first term, making the outcome harder to predict. Only time will tell if tariffs reach rates not seen since the 1930s, or if agreements with major trading partners will be reached.

It’s important to remember that tariffs are often used as a negotiating tactic for broader policy objectives. In the past, market reactions to tariff announcements were more dramatic than their actual economic impact. In 2018, the market fell as tariffs were implemented, but earnings growth was still strong and GDP was almost 3% that year.

While this uncertainty may be uncomfortable and has led to market swings, it’s in periods of economic strength that policy shifts can be most easily absorbed.

Chart: The economy has grown steadily despite investor fears

Past performance is not indicative of future results

Beyond tariffs, the economic data is causing concern, including hotter-than-expected inflation and mixed jobs numbers. For example, the Consumer Price Index reversed course recently and rose above 3.0% for the first time since last summer.

Adding to this uncertainty, federal government jobs fell by 10,000 in February according to the Bureau of Labor Statistics, and more are expected. While federal workers account for less than 2% of the workforce, there is concern of ripple effects on the private sector and job growth overall. Despite this, the economy still added a healthy number of jobs in the latest report.

The price sensitivity of the consumer and their outlook on the job market have also worsened. Consumers now expect inflation of 3.5% over the next five years, the highest level since 1995, according to a University of Michigan survey. This has translated into feelings of deep pessimism about their financial situation in the next 5 years.

The irony is that markets have forgotten about the reasons for their post-election optimism: the possibility of pro-growth policies around manufacturing, energy, taxes, and regulation. As the chart above shows, consumer spending has driven the economy in recent years. Some economists hope that policy changes could boost business spending as well. An extension of the Tax Cuts and Jobs Act (TCJA) is currently being considered by Congress, and regulatory changes are in progress as well.

Chart: The S&P 500 experiences pullbacks on a regular basis

Past performance is not indicative of future results

While the thought of a recession can be unpleasant, it’s important to remember that periods of slower economic growth are a natural part of the business cycle. Forecasts are not always correct, and even when they are, markets do not always behave in expected ways. While the past is no guarantee of the future, the market declines and subsequent sharp recoveries in 2020 and 2022 are recent examples of situations where markets can quickly change their tune.

Similarly, short-term market pullbacks are a natural part of investing. As the accompanying chart shows, the S&P 500 experiences pullbacks on a regular basis, even as it has risen in the long run. It’s important to maintain a broader perspective amid heightened economic concerns.

1Standard & Poor’s and Nasdaq have declined 1.9% and 5.8%, respectively, as of March 7, 2025

2S&P 500 price return from September 20, 2022 to March 7, 2025

3Nasdaq Composite price return from December 22, 2022 to March 7, 2025

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.