How Corporate Taxes Could Impact Markets This Election Season

- Market Insights

- 6 mins

Get investing insights for US-connected global citizens.

Book a free consultation with our cross-border advisors.

As the presidential debate season kicks off, the current and former presidents’ divergent approaches to taxes will be on display. Naturally, this is a controversial topic fueled by strong political views on our nation’s priorities, government spending, entitlement programs, fairness around taxation, and much more. While taxes affect all parts of our financial lives, their impact on the stock market is not what many might guess. As the rhetoric from both sides of the aisle heats up, how can investors stay level-headed and stick to their long-term financial plans?

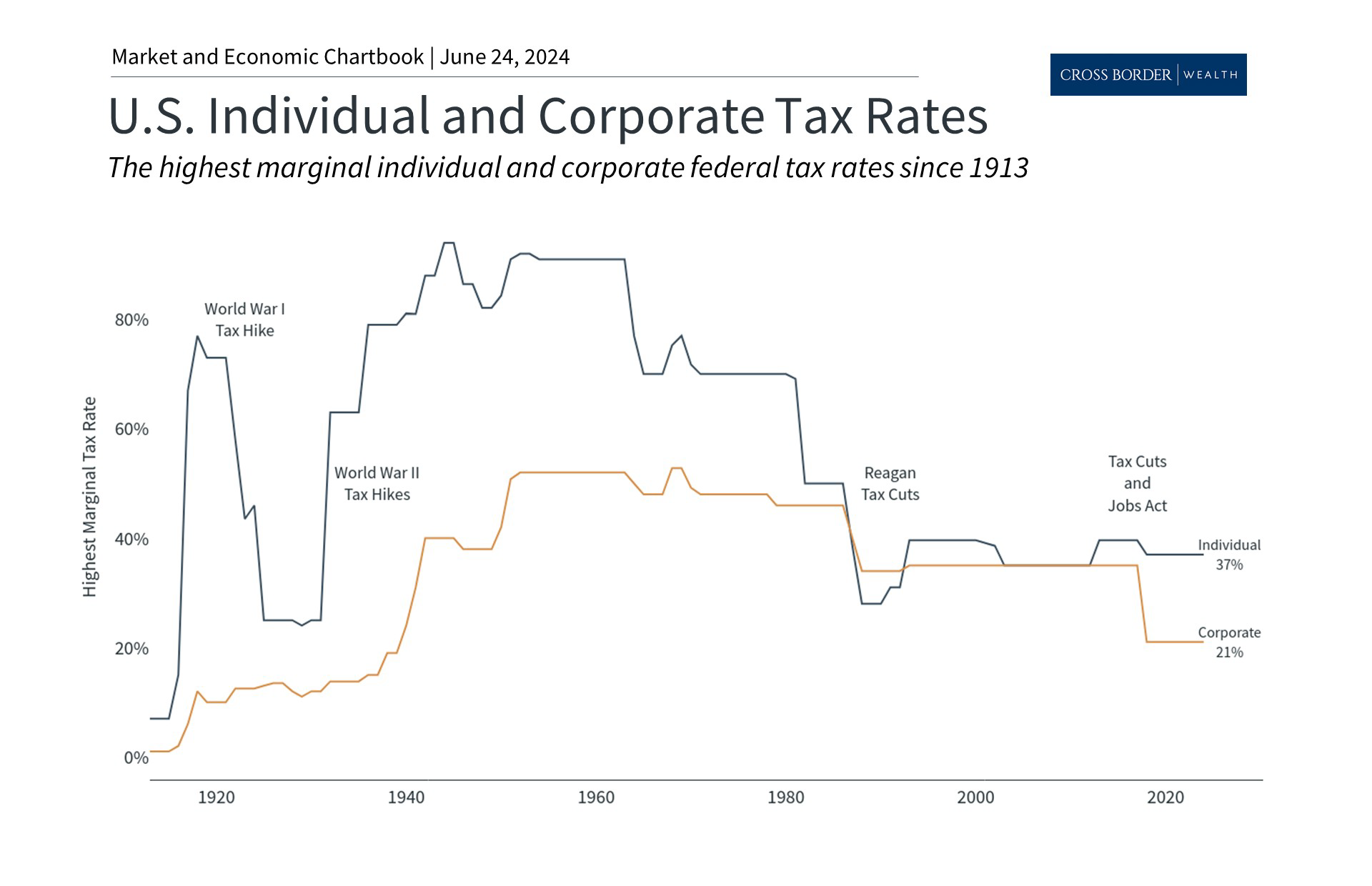

Tax rates have fluctuated throughout history

Past performance is not indicative of future results

Investors often focus on corporate tax rates because they can directly affect the profitability of large companies and thus their share prices. However, tax rates and the nation’s philosophy around taxes have both fluctuated throughout history. As the accompanying chart shows, corporate and individual tax rates were higher for much of the 20th century before declining during the Reagan era. The stereotype of each party is that Republicans favor lower taxes while Democrats support higher rates, particularly for corporate income taxes. Of course, the exact priorities and proposals of each party have evolved over the decades, especially around balancing the budget.

The cornerstone of President Trump’s tax policy was the 2017 Tax Cuts and Jobs Act, which reduced the corporate tax rate from 35% to 21%. To put that in context, the U.S. previously had the highest corporate tax rate of any OECD country, and the reduction puts us just below the OECD average. The corporate tax rate peaked at 52.8% in the late 1960s, although changing tax brackets make historical corporate tax comparisons challenging. Also, what corporations actually pay can differ significantly from statutory rates.

Unlike individual tax rates, the 2017 corporate tax cut is not set to expire, but can be changed by the party in power. While it is still early in the election cycle and the candidates’ platforms may change, President Biden has proposed raising the corporate tax rate to 28% and the corporate alternative minimum tax rate (CAMT) to 21% from 15%. CAMT, created as part of the Inflation Reduction Act of 2022, is intended to ensure that large profitable companies pay at least a minimum amount of taxes. While President Trump’s proposals are not yet clear, he has suggested to business leaders that he would cut the corporate tax rate to 20%.

Corporate taxes have become less important over time

Past performance is not indicative of future results

Politics aside, there is unfortunately no simple economic answer as to how taxes impact growth and markets. One important concept is known as the “Laffer curve” – the idea that tax receipts rise as tax rates do, but only up to a point. Ideally, tax policy balances societal priorities with economic growth.

Proponents of cutting the corporate tax rate argue that lower taxes give companies long-term incentives to invest in productivity and can boost global competitiveness. In theory, corporate taxes are really taxes on individuals including shareholders, workers, customers, etc. On the other hand, given the ever-growing federal deficit and debt, proponents of raising corporate taxes argue that it is an important way to raise needed revenue.

As the accompanying chart shows, the share of revenue from corporate taxes has declined dramatically from 27% in 1950 to just 9.4% today. In contrast, individual income taxes have remained an important share of government receipts, growing from 40% to 49% over the same period. Social insurance and retirement receipts have helped to make up the difference, rising to 36.4% from 11.0%, as other taxes including excise taxes have declined in importance as a source of government funding.

Thus, although corporate taxes receive significant attention from investors, the reality is that they make up a relatively small fraction of total tax revenues today. While it may seem counterintuitive, history shows that the stock market has performed well across different tax regimes. This is partly because corporations adapt to new tax rules quickly and minimize their tax bills through a variety of strategies. It’s also because recent presidents have tended to maintain existing tax policies to avoid raising tax burdens.

With that said, the other side of the tax coin is the level of government spending. Today, there is no clear path to reducing spending to lower the debt and deficit. In fact, the Congressional Budget Office has revised their estimates for the cumulative deficit from 2025 to 2034 up by $2.1 trillion dollars, roughly 10%. The growing national debt and mounting interest payments make it likely that additional revenue will be needed to plug this gap in the future.

Growth happens under both parties

Past performance is not indicative of future results

Ultimately, when it comes to market performance, investors should not overreact to broad tax policy changes or political outcomes. The chart above shows that the stock market has performed well under both parties across a variety of tax regimes and other policies. This is because market returns depend far more on business cycles which typically last many years and decades, making them less sensitive to individual policy changes. The idea that markets will crash solely because of the outcome of an election or a change in tax policy is not supported by history.

Of course, achieving our financial goals is not just about market returns. When it comes to our personal financial plans, tax and estate planning could not be more important. Investors concerned about the impact of specific tax policies are encouraged to seek the advice of a trusted financial advisor.

The bottom line? While tax policies will be at the center of the upcoming election, investors should maintain a broader perspective. Staying invested is still the best way to achieve financial goals across different political outcomes.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.