How Interest Rates Are Impacted by the Fed, Geopolitics and More

- Market Insights

- 4 mins

Interest rates have swung wildly in recent weeks due to the Fed, the conflict in Ukraine, and the spike in oil prices. The 10-year Treasury yield briefly exceeded 2% last week before falling back. For those who may not watch interest rates closely, these changes may seem insignificant. But not only do interest rates play important roles for investors, savers, and borrowers, they also provide an important signal of the health of the economy and financial system. How do rates at these levels affect investors and what do they tell us about the market environment?

On a theoretical level, interest rates reflect expected economic growth and inflation. Record levels of inflation over the past year have created upward pressure on rates. After all, an investor who buys a bond will require a higher interest rate if the dollars they receive in interest and principal payments will be worth less due to inflation. Strong economic growth also pushes interest rates higher since investors could find alternative ways to invest their money for higher returns.

On a more practical level, investors tend to buy Treasuries and other lower-risk bonds during times of stress and uncertainty as we're seeing today. This demand increases the prices of these bonds which lowers their yields, especially for bonds that reflect additional risks such as longer maturities. In this way, bonds help to balance riskier parts of portfolios, as we have seen during periods of volatility over the past decade.

Thus, there are at least two competing forces acting on interest rates today. On the one hand, inflation is forcing the Fed's hand as it plans to raise rates beginning next week. It is widely expected that the Fed will lift the federal funds rate by at least one-quarter of a percent for the first time since before the pandemic. The market still expects up to six rate hikes this year, or nearly one every Fed meeting, although this is subject to change. By raising rates, the Fed's goal is to contain inflation by gradually stepping on the brakes.

On the other hand, the conflict in Ukraine, sanctions against Russia, and the impact on oil prices is creating significant market uncertainty. Many stock market indices, including the S&P 500, Dow and Nasdaq, and have fallen into correction territory and interest rates have declined as a result. Oil prices have spiked even further with Brent crude now trading above $120 per barrel. The threat to economic growth is a reason for the Fed to keep rates steady while rising energy prices are a reason to raise rates to further combat inflation. This naturally puts the Fed in a bind.

However, it's also important to keep the broader historical context in mind. While interest rates have risen since the start of the year, they are only back to levels last seen at the start of 2020 and near their peaks in 2021. Over a multi-year horizon, interest rates are still significantly lower. In fact, it's still the case that interest rates have been declining since the late 1970s for a variety of reasons that have nothing to do with short-term crises. Technology, globalization, worldwide cash savings, and other factors have conspired to push interest rates lower decade after decade.

So, while interest rates do rise and fall within each business cycle, the overall trend has been lower across cycles. At the moment, high inflation and strong U.S. economic growth are expected to keep pushing rates higher over the long run. In the near-term, however, geopolitical risk is creating an environment of uncertainty. This means that the challenges investors have faced with low rates throughout the last decade will likely continue for some time.

For instance, for borrowers and home buyers, mortgage rates remain attractive despite increasing over the past several months. For savers, the challenge of generating sufficient income from cash and high-quality bonds will likely continue. This potentially means that finding alternative sources of income, from high-yield bonds to dividend-paying stocks, is still as important as it has been since 2008, especially with valuations more attractive today.

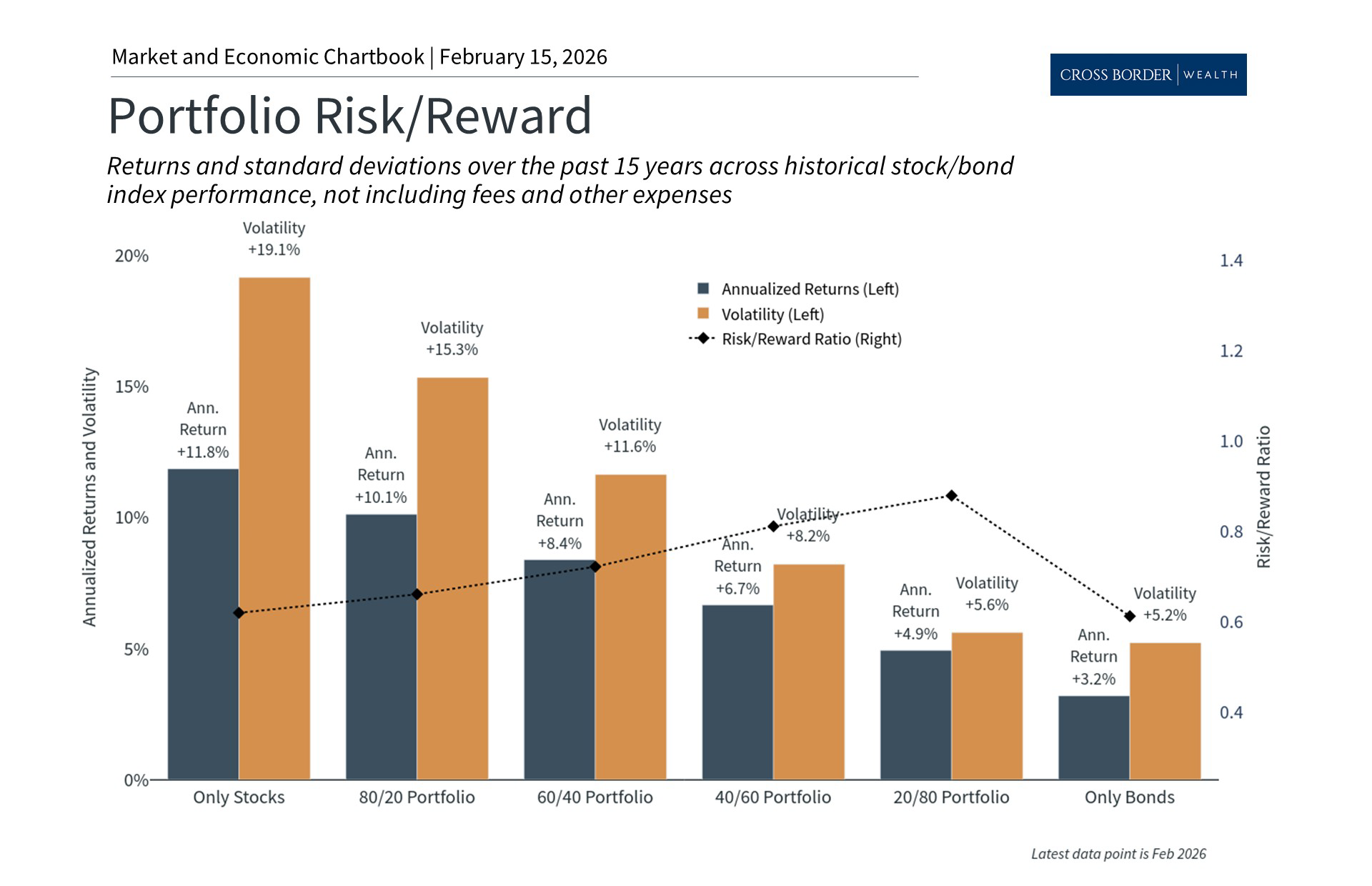

Ultimately, this period highlights the importance of staying diversified across asset classes. Stocks and bonds each play unique roles in the portfolio. In times of stress over the past decade, fixed income has helped to keep portfolios stable when investors need it the most. Below are three charts that help provide perspective on interest rates.

1. Interest rates have had a rocky few years

Interest rates have increased this year across the yield curve due to inflation and the Fed. Still, the 10-year Treasury yield is only near levels last seen in 2021 and 2020, and is still significantly lower than it was in 2019.

2. Rates are still low by historical standards

While rates do rise and fall during business cycles, they have been declining across cycles for 40 years. With inflation surging, driven in no small part by energy prices, this time could be different. Still, investors could face the challenges of low rates in the near term as market uncertainty continues.

3. Portfolio yield is still scarce in this environment

One of the primary challenges of low rates is the scarcity of portfolio income. This is especially true once inflation is taken into consideration since this erodes the purchasing power of cash savings over time. This is an important reason for investors to stay focused on the long run by holding an appropriate portfolio that can generate sufficient growth to meet financial goals.

The bottom line? Interest rates continue to face significant uncertainty, creating challenges for portfolios. Investors ought to stay diversified across stocks and bonds and focus on the long-term trends.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.

.jpg)