How Investors Can Take Advantage of Attractive Valuations

- Market Insights

- 4 mins

As the economy responds to inflationary pressures, investors continue to struggle with daily price swings across the stock market. This level of market volatility can be disorienting for even the most experienced investors, and some may even want to wait it out on the sidelines. While this may be tempting, history shows that this is neither the best approach to lower risk nor to take advantage of a future recovery. Instead, in challenging markets such as these, long-term investors can use valuations as a North Star to guide them over the coming years and decades. What do valuations tell us about long run returns today?

First, it's important to discuss why valuations matter. In short, valuation measures are the best tools that investors have to gauge the attractiveness of the stock market over years and decades. Unlike stock prices on their own, valuations don't just tell you how much something costs, but tell you what you get for your money in terms of earnings, book value, cash flow, dividends, and other fundamental measures. After all, holding shares of a company means you are entitled to a portion of its profitability, so paying an appropriate price for this can improve the odds of future gains.

Valuations are highly correlated with long-run returns

Valuations are correlated with long-term portfolio returns for this reason - i.e., buying when the market is cheap improves the chances of success, and vice versa. The chart above shows how the forward price-to-earnings ratio, which uses earnings estimates over the next twelve months, correspond to subsequent 1-year and 10-year annualized returns. The dots for 10-year annualized returns cluster more tightly around the trend line than do 1-year returns which can vary significantly.

The fact that any metric is this highly correlated with stock market returns is quite amazing. To a large extent, the reason this pattern exists is exactly because it is difficult to stay invested when markets fall and valuations are the most attractive. Just think about how most investors feel today, or back in March 2020, or during 2008. Staying patient is much easier said than done, but this data emphasizes how important it is in order to achieve financial goals.

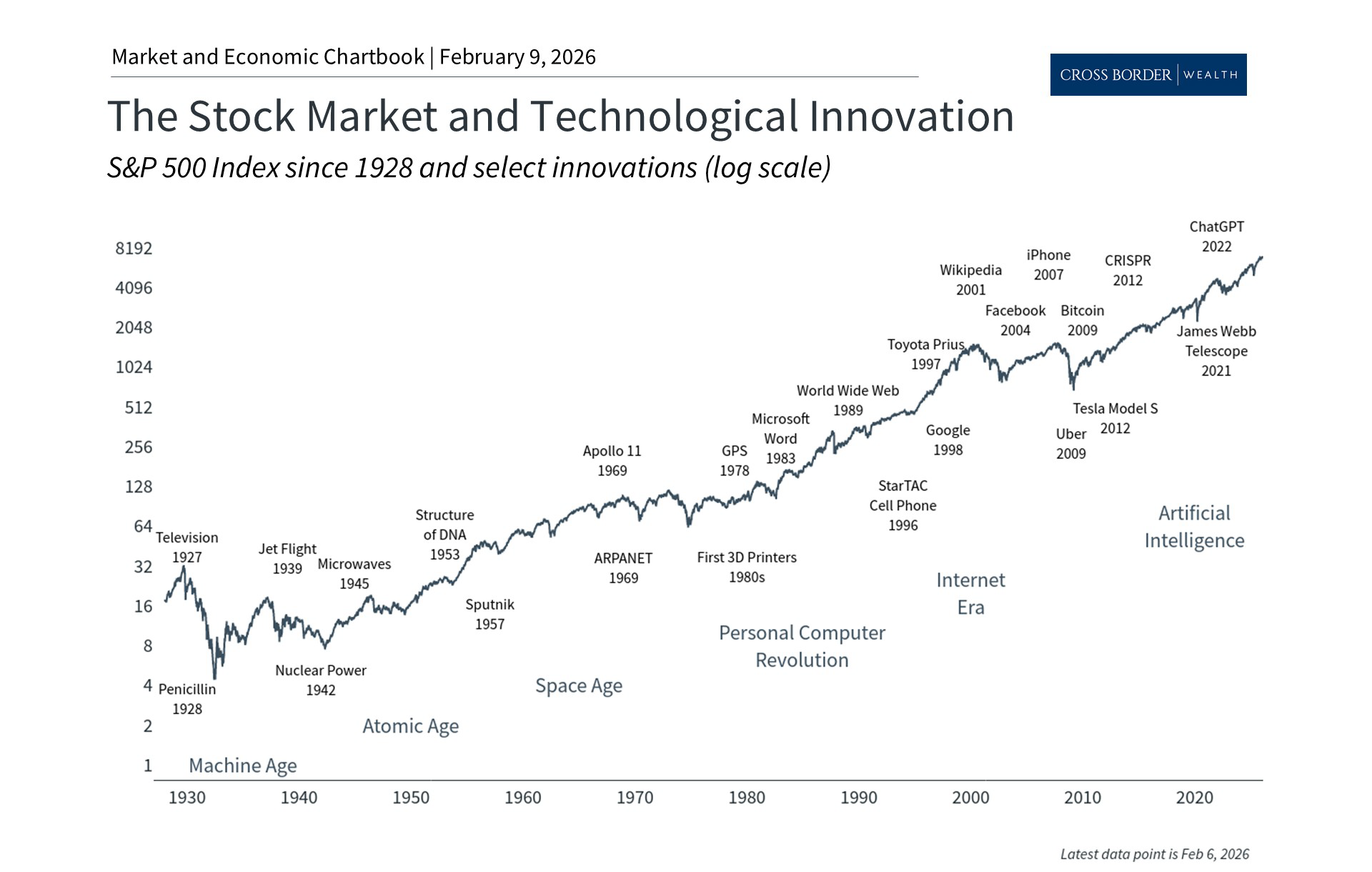

There are other reasons valuations are much better indicators than prices alone. Prices can rise over long periods of time, just as they have for the U.S. stock market over the past century, despite bear markets and short-term corrections. Comparing prices today to previous peaks and troughs doesn't make much sense across these distinct time periods. Valuations, on the other hand, "normalize" prices by some important measure such as sales, earnings or cash flow, and can thus be a guide across different market cycles. This adjustment makes prices more comparable over time to determine whether an asset class, sector or individual investment is attractive.

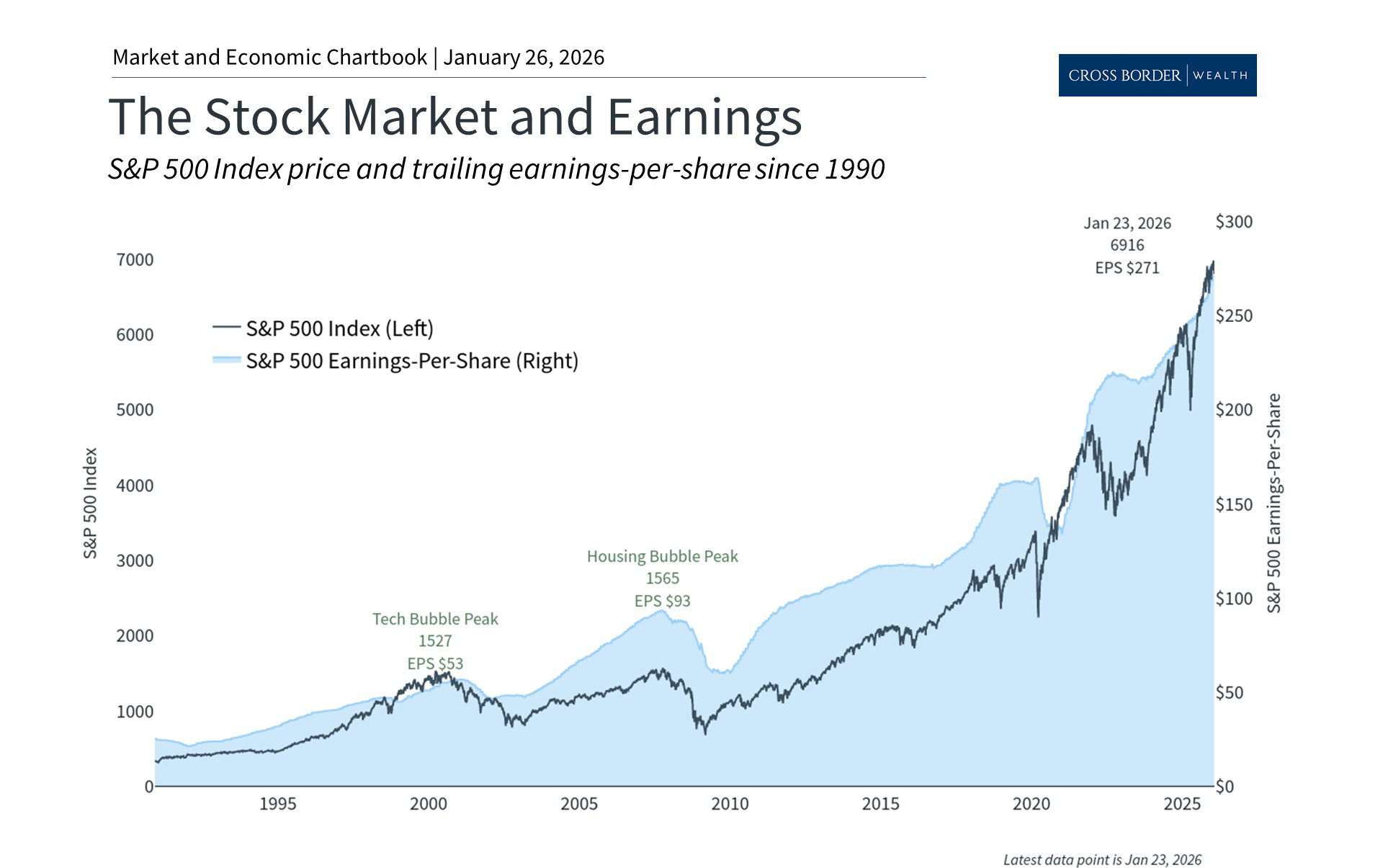

Today, various measures of value are far more attractive than they were even six months ago. As the chart below shows, the price-to-earnings ratio of the S&P 500 has fallen from near the peaks last seen during the dot-com bubble of the late 1990s and early 2000s, back toward the long run historical average. This closely-watched measure using next-twelve-month earnings estimates is hovering around 16.1x. Similarly, the Shiller P/E ratio, also known as the cyclically-adjusted P/E since it uses ten years of inflation-adjusted earnings, has declined to 28.9 from almost 39 at the end of 2021.

Stock market valuations are more attractive today

This same pattern can be found across a wide variety of valuation measures, from price-to-sales to dividend yields. Across asset classes, especially public equities, valuations are much more attractive today than at any point since mid-2020. Could valuations fluctuate further? Of course. If the market declines, valuation levels could look even more attractive. Conversely, if earnings decline as the economy decelerates, this could push valuations higher since lower profits mean that share prices are more expensive.

However, the point is that valuations are not a timing tool. As discussed above, valuations have very little historical correlation with returns over shorter time periods including one-year periods. It's over several years or more that they begin to correspond to more attractive expected returns. For this reason, valuations are among the most important tools for constructing long run portfolios. This is true even though markets can continue to rise or fall regardless of valuations in the meantime.

Different sizes, styles and sectors are more cheaply valued

Thus, in today's difficult market environment in which all asset classes face significant uncertainty, investors ought to focus on valuation measures and not just daily price swings. The broad market is now cheaper than it has been in years, and many sizes, styles and sectors are more attractive as well. Large-cap growth stocks are still quite expensive after their significant run, despite this year's drawdown. However, market sentiment has shifted in favor of areas such as value whose valuations are still much lower. Ultimately, diversifying across all of these areas, with an eye toward relative attractiveness, can help investors to position for future growth.

The bottom line? Where valuations go from here will be important for the direction of long run returns. However, investors should continue to stay invested and diversified as the cycle shifts from a bear market to an eventual recovery.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.