How Our Aging Population Affects Long-Term Investing

- Market Insights

- 4 mins

The U.S. population, like those of many developed countries, is aging. According to the latest Census figures, a major shift occurred over the past two decades in which the share of the population under 50 declined, especially among those who are considered to be of prime working age. Even the youngest baby boomers are nearing retirement age while the oldest are almost 80. And while millennials have come of age and now outnumber boomers, this isn't enough to prevent the average age in the U.S. from shifting from 35.4 in 2000 to 38.8 today. What could these trends mean for the economy and markets in the years to come?

The U.S. population is aging

|

Demographic trends matter to investors both at a macroeconomic level and when creating personal financial plans. By their nature, these trends tell us about the long run trajectory of the country and economy. Thus, they are an important counterbalance to the short-term issues that investors, market economists, and financial news outlets often focus on. There are at least two important ways in which demographics affect all investors.

First, demographics are an important driver of economic growth. Traditional economic models make a distinction between short run and long run growth. Over the course of months, factors such as bad weather, supply chain disruptions, surging consumer demand, increased government spending, and more can affect growth in either direction. However, these factors tend to balance out in the long run.

What ultimately matters for the economy is simple: having enough qualified workers and boosting their productivity. Unfortunately, neither of these factors have been trending in the right direction. The aging population translates into an aging workforce. Even after taking immigration into account, the population is only growing by 0.7% per year, a rate that will decelerate to 0.4% in 2060 according to Census projections.

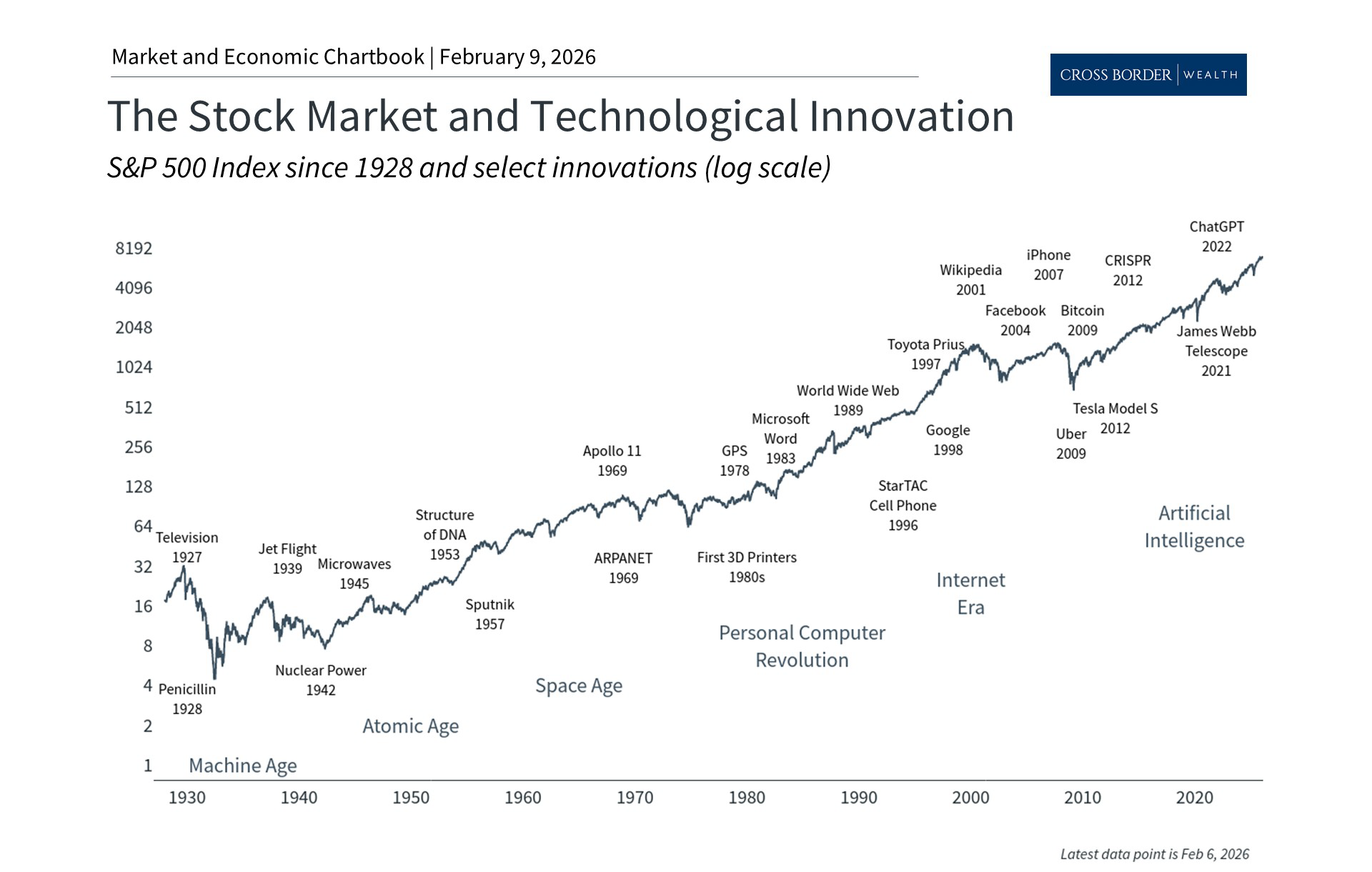

It takes a long time to train new workers and to gain important experience, especially in skilled jobs whether it's manufacturing, engineering, or medicine. This is why, prior to the pandemic, economists worried about an era of slower growth, coining terms such as “secular stagnation.” Additionally, to the extent that older populations spend less and hold assets that are less risky, consumer spending trends and market valuations can shift as well. The strong growth rates since the pandemic don't change these broader facts about our population.

To keep economic growth on track, something will have to give. One way is for each worker to accomplish more - i.e., to be more productive. Unfortunately, productivity growth has been meager as business investment spending has stalled. Some believe that new technologies including robotic automation, AI and the blockchain could ignite a new era of productivity growth, but the jury is still out. A more likely possibility is that retirement continues to be redefined. With greater life expectancy and better health, many retirees are already seeking to stay engaged in the workforce longer, whether it's through part-time work, consulting, advising roles, or other flexible arrangements.

Higher life expectancies increase longevity risk

|

Second, these demographic trends affect individual investors as they plan for retirement. According to the Social Security Administration, there is wide variation across life expectancies for both men and women. For instance, 40-year-old men and women today have a life expectancy of 79 and 83, respectively, as shown in the accompanying chart. However, the 90th percentile could live well into their 90s. Similarly, men and women who are 65 years old today could live to 83 and 86, on average, while the 90th percentile could live to 94 and 97, respectively. The difference of a decade or longer can have dramatic implications for investment portfolios and financial plans.

The prospect of living longer than expected is often referred to as “longevity risk.” This risk is asymmetric in that running out of funds is far worse for most households than leaving money behind to loved ones, charities, and more. This means that life expectancy is an important input to any financial plan. Ultimately, managing longevity risk is one reason why all individuals can benefit from professional financial advice.

Portfolios should be constructed with longevity risk in mind

|

This is especially relevant in today’s market environment with both inflation and interest rates finally rising. On the one hand, rising prices are most harmful to those who rely on their hard-earned savings for income. On the other hand, rates have finally climbed to levels that can generate sufficient yield. Thus, there are unique challenges in today's market environment to crafting a portfolio that can generate enough income while preserving spending power for the future. And, while all investors would prefer high returns with little risk, the reality is that a balance is needed to achieve these objectives.

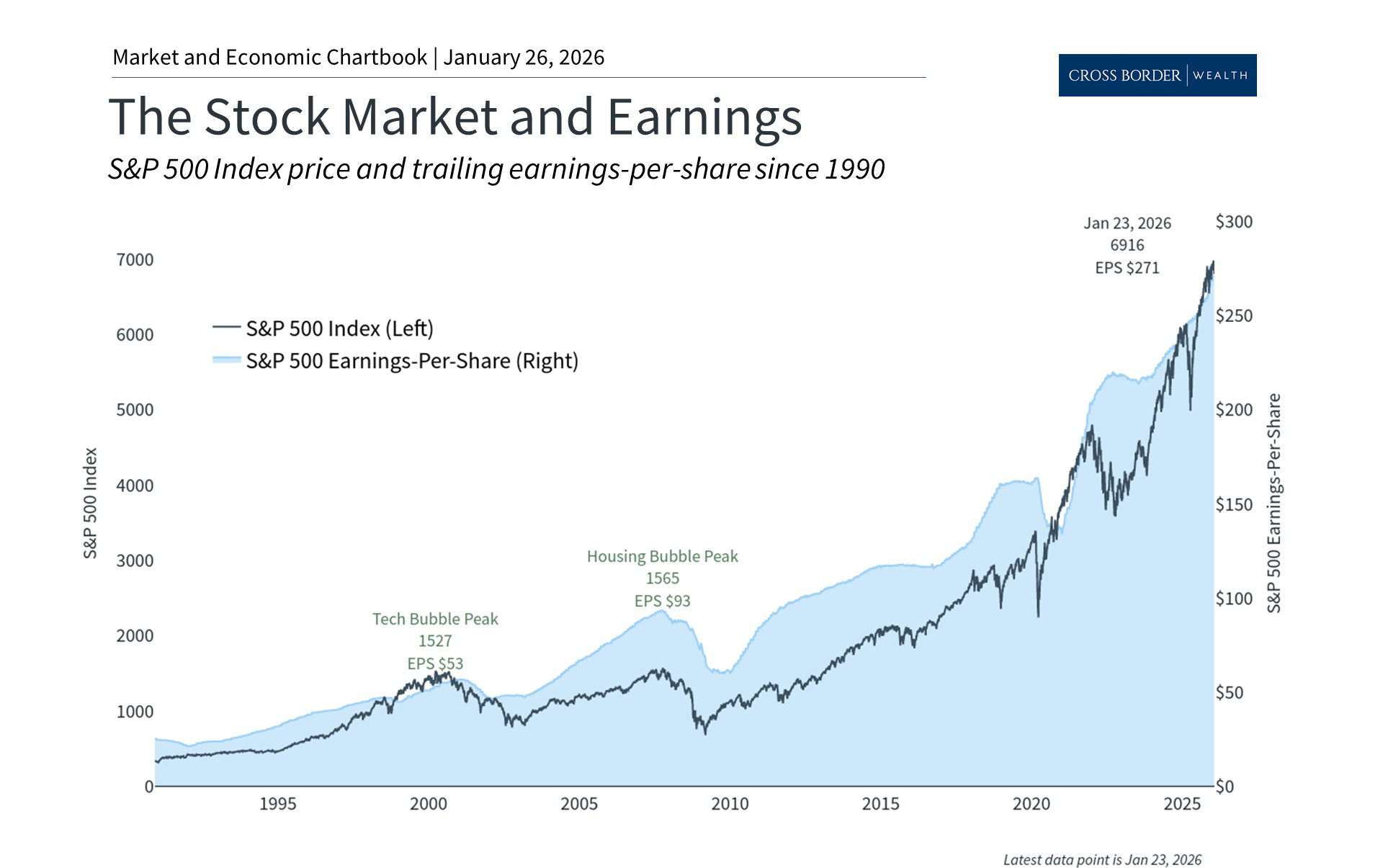

This discussion applies just as much to younger investors since these demographic trends are unlikely to change in their lifetimes. In fact, these challenges may only grow as medical advancements boost life expectancies and as the economy slows. Thus, saving for retirement is arguably more important than ever, especially since market valuations are at their most attractive levels in years. Recent legislation such as the Secure 2.0 Act, which makes it easier to save and invest for retirement, underscores these facts.

The bottom line? Demographic trends are a headwind to economic growth while longer life expectancies increase longevity risk for individuals. Holding an appropriate portfolio to balance these risks while achieving long run returns is still the best way for investors to achieve their financial goals.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.

.jpg)