How Qualified Domestic Trust Works

- Global Wealth Management

- 2 mins

Many people have been more curious about qualified domestic trusts as of late. QDOT is a type of trust that allows taxpayers who survive after their spouses have deceased to still take the marital deduction on estate taxes when the surviving spouse isn’t an American citizen. Typically, only an American citizen would be allowed to take the marital deduction. QDOT makes it possible for non-American citizens to enjoy this benefit, but only if the assets in question are placed in the QDOT.

How Does This All Work?

This all works pretty easily so long as you take the time to set up a QDOT. If you’re an American citizen who is married to a non-American citizen, then it’s worthwhile to set one up. Your spouse can be protected from having to pay high estate taxes if you take this important step. It’s seen as a good way to set your spouse up for a brighter future after you’re gone.

You can park all of your assets in this QDOT so that it will be eligible for the marital deduction. If you don’t place certain things in the QDOT, then these items will fall outside of its protection, so to speak. You must put anything in the QDOT that you wish to provide to your surviving spouse without them having to pay the high estate taxes. This is all fairly simple, but you have to remember to keep your QDOT updated over the years.

Limits of the QDOT

It’s important to note that having a QDOT does not eliminate the need to pay estate taxes. It merely delays this until the passing of the spouse who is not an American citizen. The children who would inherit the estate after this would need to pay estate taxes on everything. Some people don’t think this far ahead, but you need to know about this for estate planning purposes.

Should You Get a QDOT?

Setting up a QDOT is certainly a good idea if you have a spouse that doesn’t have American citizenship. If you want to protect assets for your spouse after your passing, then it’s the most logical option that is available to you. Work with specialists to get your QDOT set up today. All that you need is to ensure that at least one member of your marriage is an American citizen and you will be able to preserve assets for the future.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

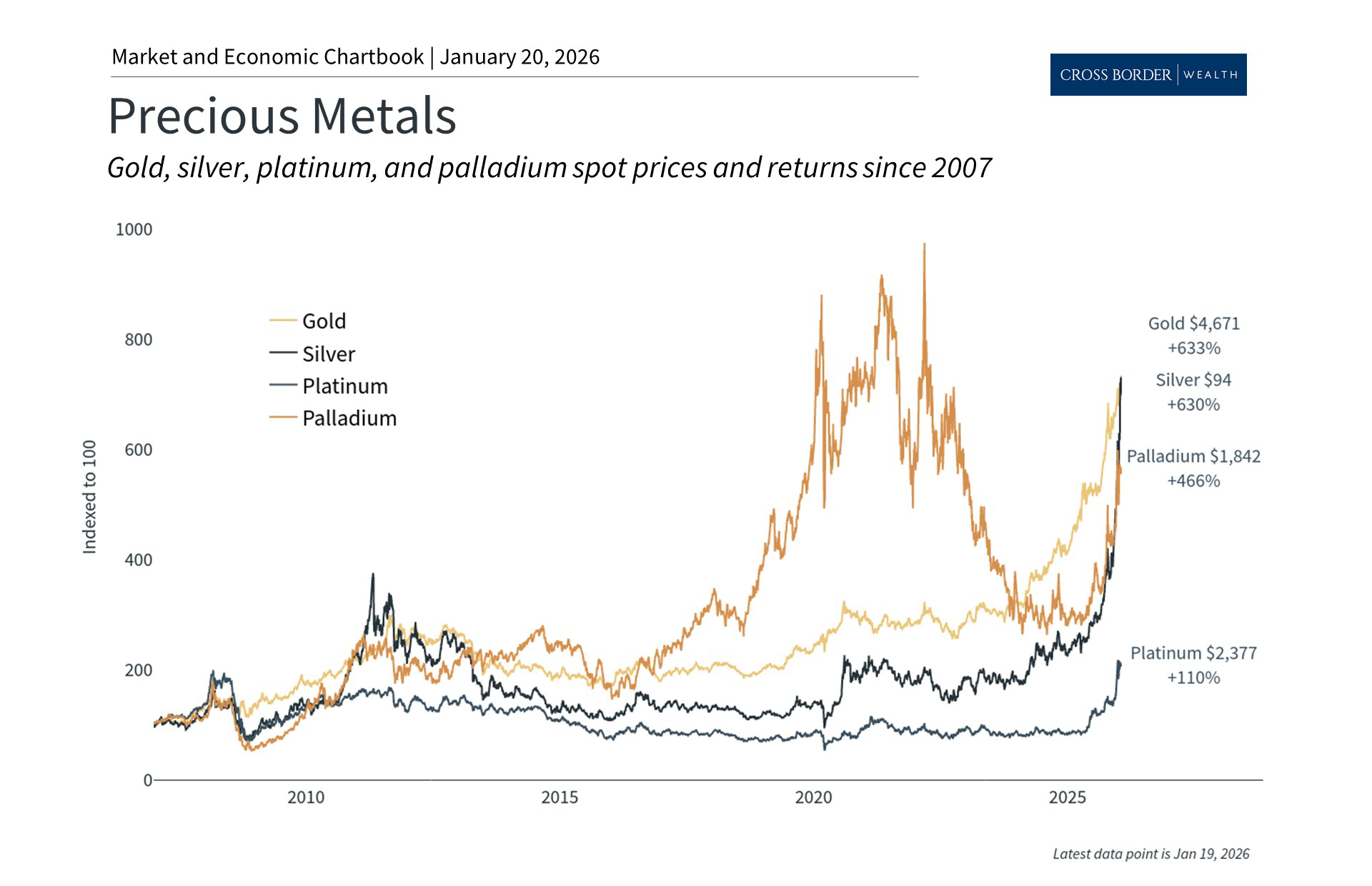

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.