Inheriting an IRA or Employer-Sponsored Retirement Plan

- US Pensions

- 15 mins

When the account owner of a traditional individual retirement account (IRA) or employer-sponsored retirement plan dies, the remaining funds in the account pass to the named beneficiary (or beneficiaries). Unlike many other inherited assets, these IRA or plan funds typically pass directly to the beneficiary without having to go through probate. (Probate is the court-supervised process of administering a will and proving it to be valid.)

These funds are usually subject to federal income tax, unlike some other inherited assets. The portion of a distribution that represents pre-tax or tax-deductible contributions and investment earnings is taxed, while the portion that represents after-tax or nondeductible contributions is not. The difference, of course, is that the beneficiary is the one who must pay the taxes after the account owner has died.

If you are an IRA or plan beneficiary, you might prefer to leave inherited funds in the account as long as you like. This would allow you to postpone taxable distributions indefinitely, while maximizing the tax-deferred growth potential of the funds. Unfortunately, you are not allowed to do this. You will generally be required to take distributions of the inherited funds at some point, possibly sooner than you would like. However, you may have more than one option for taking distributions, and the option you choose can be critical.

Caution: While Roth IRAs are subject to the same general rules, they are unique in that qualified distributions are free from federal income tax.

Caution: This discussion focuses on the general rules regarding options available to a beneficiary that inherits an IRA or employer-sponsored retirement plan. Your IRA or plan may specify the option(s) available to you.

Beneficiary designations

Primary, secondary, and final beneficiaries

Primary beneficiaries are the IRA owner's or plan participant's first choices to receive the funds. By contrast, secondary beneficiaries (also known as contingent beneficiaries) receive the funds only in the event that all of the primary beneficiaries die or disclaim (i.e., refuse to accept) the funds.

Designated beneficiaries

You may also come across the term "designated beneficiary," which is not the same thing as primary or secondary (contingent) beneficiary. Designated beneficiaries are individuals (and some types of trusts) who were named beneficiaries as of the date of death and — key point — who still have assets in the IRA or plan account as of September 30 of the year following the year of death, which is known as the "determination date." In other words, designated beneficiaries did not either 1) disclaim the inherited assets or 2) take a lump-sum distribution ("cash out") prior to the determination date. Financial organizations need to identify an account's designated beneficiary(ies) in order to determine the distribution options available and to appropriately calculate distribution amounts.

Note: Neither a charity, estate, nor some types of trusts can be designated beneficiaries.

Example(s): If an IRA owner dies and the primary beneficiary does not need the money, the primary beneficiary could make a disclaimer. This might allow the funds to pass to a secondary beneficiary with a greater financial need.

Note: In order to be valid for estate and gift tax purposes, a qualified disclaimer — refusal to accept benefits — must be signed by a beneficiary and meet other requirements no later than nine months after a death. Therefore, even though designated beneficiaries are determined on September 30 of the year following the year of a death, a disclaimer may need to be signed much earlier to meet the nine-months-after-death rule.

Example(s): A cash out can be an effective strategy in cases where the primary beneficiaries include both individuals and one or more charities. The charity (ineligible as a designated beneficiary) can take its entire share (income tax free) by the September 30 next-year date, leaving only the individuals as remaining beneficiaries who may qualify as designated beneficiaries.

Caution: IRS regulations clarify that a designated beneficiary who dies after the death of the IRA owner or plan participant, but prior to the September 30 determination date, is still treated as a designated beneficiary for purposes of calculating post-death distributions from the IRA or plan account.

Eligible designated beneficiaries

For IRA owners and plan participants dying after December 31, 2019, distributions to a designated beneficiary must be made by the end of a 10-year period unless the designated beneficiary is an eligible designated beneficiary. An eligible designated beneficiary is a designated beneficiary who is the surviving spouse of the employee or IRA owner, a minor child of the employee or IRA owner, disabled, a chronically ill individual, or an individual who is no more than 10 years younger than the employee or IRA owner. There are special rules for certain trusts for disabled or chronically ill beneficiaries.

Factors that determine post-death distribution options

First, if you have inherited an employer-sponsored retirement plan account, the plan is generally allowed to specify the post-death distribution options available to you. These options may not be as flexible as the options permitted under the final IRS distribution rules. For example, depending on whether a plan participant died before or after his or her required beginning date, some plans may provide a different default payout method than the IRS rules. In such a case, you may not be able to elect another payout method as an alternative to the plan's default method. Your first step should be to consult the retirement plan administrator regarding your post-death options as a beneficiary.

The other factor that determines post-death options is the type of beneficiary. Individual beneficiaries generally have more options and flexibility than nonindividual beneficiaries. For example, post-death options are severely limited if the IRA owner or plan participant dies with his or her estate as a beneficiary. This could occur if the estate is named as a beneficiary, or if there are no named beneficiaries (in which case the estate becomes the "default" beneficiary). The same limited options apply when one or more charities are named as beneficiary. Special rules apply when a trust is named as beneficiary. Under certain conditions, the underlying trust beneficiaries can be treated as the IRA or plan beneficiaries for distribution purposes.

For individuals who qualify as designated beneficiaries, the options available further depend on whether the beneficiary is a spouse or another individual. Depending on plan provisions and other factors, non-spousal individuals may have several post-death options. These options may include using the life expectancy method, receiving a lump-sum distribution, taking distributions under the five-year rule, or disclaiming the funds. (See below for a description of each.) The life expectancy method (if available) is often the most favorable method in terms of providing the longest possible payout period (thereby spreading out income taxes and maximizing tax-deferred growth).

A surviving spouse generally has all of the options available to other designated beneficiaries, plus two additional options. A surviving spouse beneficiary can elect to roll over inherited funds to his or her own IRA or plan account (if permitted by the receiving plan), providing income tax and estate planning benefits. A surviving spouse who is the sole beneficiary may also elect to leave the funds in an inherited IRA and treat that IRA as his or her own account. (The option to treat the account as his/her own does not apply to inherited retirement plans.) A surviving spouse who elects to treat an IRA as his or her own can use factors from the favorable uniform lifetime table to determine required distributions. In most cases, it will be in a surviving spouse's best interest to exercise one of the two additional options (unless he or she needs the money immediately).

Tip: Nonspouse beneficiaries cannot roll over inherited funds to their own IRA or plan. However, a non-spouse beneficiary may make a direct rollover of certain death benefits from an employer-sponsored retirement plan to an inherited IRA. (See Non-spouse rollover to an inherited IRA below.)

Tip: If a retirement plan participant died before beginning to take required minimum distributions, a surviving spouse can generally wait until the year the participant would have reached age 72 (70½ if attained prior to 2020) to begin taking distributions from the account.

Tip: Once a post-death payout method is in place, the IRA or plan beneficiary is usually allowed to take larger distributions than required (including, in most cases, a lump-sum distribution of the beneficiary's entire share). However, if the beneficiary receives less than required in any year, a 50% federal penalty tax will apply to the undistributed required amount. This penalty tax would be in addition to regular income tax.

Post-death distribution options for designated beneficiaries

Remember, only individuals who meet certain requirements can be designated beneficiaries of an IRA or retirement plan account. The post-death distribution options available to designated beneficiaries generally include one or more of the following. (Be sure to talk to the administrator of an inherited employer-sponsored plan account to determine the options available.)

Life expectancy method

This method involves taking distributions over a beneficiary's single life expectancy (or, in some cases, over the deceased account owner's remaining single life expectancy). If the account owner was younger than 72 (70½ if attained prior to 2020) when he or she died, the distributions must begin no later than December 31 of the year following the year of the IRA owner's or plan participant's death [or, for spouses of the account holder, by December 31 of the year in which the account owner would have turned 72 (70½ if attained prior to 2020), whichever is later]. If the account owner was 72 (70½ if attained prior to 2020) or older, distributions must begin by December 31 of the year after the year of death. If the account owner reached age 72 (70½ if attained prior to 2020) (or for employer-sponsored plans, an alternative required beginning date) in the year of death but had not taken his/her first RMD, the beneficiary must take at least that amount by December 31 of that year.

A surviving spouse who elects to treat an IRA inherited from his or her spouse as his or her own can delay distributions until the surviving spouse reaches age 72 (70½ if attained prior to 2020) and can use factors from the favorable uniform lifetime table (rather than the single life expectancy table) to determine required distributions.

For IRA owners and plan participants dying after December 31, 2019, the life expectancy method will generally be available only if the designated beneficiary is an eligible designated beneficiary. An eligible designated beneficiary is a designated beneficiary who is the surviving spouse of the employee or IRA owner, a minor child of the employee or IRA owner, disabled, a chronically ill individual, or an individual who is no more than 10 years younger than the employee or IRA owner.

Five-year rule

This method involves taking distributions in any amount and at any time within a five-year period. The five-year period ends on December 31 of the year during which the fifth anniversary of the IRA owner's or plan participant's death occurs. If there is no designated beneficiary and the death occurred before the account owner's required beginning date, the five-year rule is the default rule. In other cases, the life expectancy method is the default rule. However, a designated beneficiary can often still elect the five-year rule as an alternative payout method. From a tax standpoint, it is usually not as desirable as the life expectancy method.

Note: The 5 year-period for defined contribution plans (other than 457 plans for nongovernmental tax-exempt organizations) and IRAs is determined without regard to calendar year 2020. Thus, if the decedent died in 2015 to 2019 and distributions are subject to the 5-year rule, 2020 would be within the 5-year period and the 5-year period would effectively be extended to 6 years.

Ten-year rule

This method involves taking distributions in any amount and at any time within a ten-year period. The ten-year period ends on December 31 of the year during which the tenth anniversary of the IRA owner's or plan participant's death occurs. For IRA owners and plan participants dying after December 31, 2019, distributions to a designated beneficiary must be made by the end of a 10-year period unless the designated beneficiary is an eligible designated beneficiary (see above). The ten-year rule also applies after the death of an eligible designated beneficiary or after a minor child reaches the age of majority.

Lump-sum distribution

This distribution method involves withdrawing a beneficiary's entire interest in an inherited IRA or retirement plan account within one tax year. This can take the form of a single distribution of the entire interest, or multiple distributions spread over the one-year period. In most cases, any designated beneficiary can elect a lump-sum distribution of his or her share of an inherited IRA or plan account. However, other post-death payout options are typically available, and will usually be more attractive from a tax standpoint. A lump-sum distribution can have very undesirable tax consequences.

Roll over the remaining interest

This special post-death option is available only to surviving spouses who are designated beneficiaries. It involves "rolling over" the surviving spouse's interest in the inherited IRA or plan account to the spouse's own IRA or plan. A surviving spouse can generally elect this option regardless of whether the IRA owner or plan participant had begun taking lifetime required minimum distributions (RMDs). Once in the spouse's IRA or plan, the funds continue to grow tax deferred, and distributions need not begin until the spouse's own required beginning date. Also, the spouse can name beneficiaries of his or her choice.

Disclaim the inherited funds

Any designated beneficiary can opt to disclaim his or her share of the inherited IRA or plan account. Disclaiming simply means refusing to accept the inherited funds, allowing them to pass to another individual or entity (i.e., a secondary beneficiary). A qualified disclaimer must be completed within nine months of the date of death. This nine-month deadline usually occurs before the September 30 next-year date. Disclaiming sometimes makes sense for tax and/or personal reasons.

Post-death distribution options for non-designated beneficiaries

Charities and estates can be beneficiaries of an IRA or retirement plan account, but they cannot be designated beneficiaries because they are not individuals. In addition, individuals who are beneficiaries of an IRA or plan may not qualify as designated beneficiaries under certain conditions. The post-death distribution options available to non-designated beneficiaries generally include one or more of the following.

Five-year rule

If an IRA owner or retirement plan participant dies before his or her required beginning date for lifetime RMDs, and there are no designated beneficiaries on the account, required post-death distributions generally must be taken according to the five-year rule.

Distributions over the account owner's remaining life expectancy

If an IRA owner or retirement plan participant dies on or after his or her required beginning date for lifetime RMDs, and there are no designated beneficiaries on the account, required post-death distributions generally must be taken over the account owner's remaining single life expectancy (calculated in the year of death according to IRS life expectancy tables).

Lump-sum distribution

As an alternative to either of the above payout methods, a non-designated beneficiary (just as a designated beneficiary) generally has the option of receiving a lump-sum distribution of the inherited IRA or plan funds. Again, though, this may not be advisable from a tax standpoint.

Disclaim the inherited funds

As an alternative to any of the above payout methods, a non-designated beneficiary (just as a designated beneficiary) generally has the option of disclaiming inherited IRA or retirement plan funds.

Non-spouse rollover to an inherited IRA

Note: For IRA owners and plan participants dying after December 31, 2019, distributions to a designated beneficiary must be made by the end of a 10-year period unless the designated beneficiary is an eligible designated beneficiary (see above). The benefits in the IRS Notice discussed below are likely to be more restricted if death occurred after 2019.

While nonspouse beneficiaries cannot roll over inherited funds from an employer plan to their own IRA, they can make a direct (trustee to trustee) rollover from a 401(k), 403(b), or governmental 457(b) plan to an inherited IRA. If a nonspouse beneficiary elects a direct rollover, the amount directly rolled over is not includible in gross income in the year of the distribution.

The ability to make a rollover to an IRA is significant because employer plans often require faster payouts to nonspouse beneficiaries than the law requires, accelerating taxation for these individuals. IRAs on the other hand generally allow distributions to be spread over the maximum period permitted by law, permitting tax deferral for the longest period of time. The IRS provided guidance on nonspouse rollovers from employer sponsored plans to IRAs. IRS Notice 2007-7 provides that:

- The IRA must be established in a manner that identifies it as an inherited IRA, and also identifies the deceased employee and the beneficiary, for example, "Tom Smith as beneficiary of John Smith."

- An indirect rollover — where the beneficiary receives the distribution and then rolls the funds over to an IRA within 60 days — is not allowed

- A plan can make a direct rollover to an IRA on behalf of a trust where the trust is the deceased employee's named beneficiary, provided the beneficiaries of the trust can be treated as designated beneficiaries under IRS required minimum distribution (RMD) rules, and the trust is identified as the IRA beneficiary.

- The nonspouse beneficiary can't roll over RMDs to the inherited IRA.

The Notice provides complex rules for determining both the RMDs ineligible for rollover from the employer plan, and the RMDs required from the IRA after the rollover:

1. The employee dies before his or her required beginning date, and the five-year rule applies. Under the five-year rule, no amount has to be distributed by the retirement plan to the beneficiary until the end of the fifth calendar year following the year of the employee's death. In that year, the entire remaining amount that the beneficiary is entitled to under the plan must be distributed. Notice 2007-7 provides that the beneficiary can directly roll over his or her entire benefit until the end of the fourth year. On or after January 1 of the fifth year following the year in which the employee died, no amount payable to the beneficiary is eligible for rollover. Most importantly, Notice 2007-7 provides that if the beneficiary was subject to the five-year rule in the employer plan, the five-year rule will continue to apply to for purposes of determining RMDs from the inherited IRA after the rollover.

However, even where the five-year rule applies, a special rule allows a nonspouse beneficiary to determine the RMD under the employer plan using the life expectancy rule, roll the balance over to an inherited IRA, and continue to take RMDs from the IRA using the life expectancy rule — which provides the maximum tax deferral for the beneficiary. To use this special rule the rollover must occur no later than the end of the year following the year in which the employee dies.

Example(s): Sam, a participant in his employer's 401(k) plan, dies on June 1, 2018. The 401(k) plan provides that beneficiaries must receive their entire balance from the plan under the five-year rule. Therefore June, Sam's beneficiary, must receive the entire balance no later than December 31, 2023. June would like to defer taxes on her inherited funds for as long as possible. If she makes a direct rollover to an inherited IRA by December 31, 2019, she will be able to use the life expectancy rule, rather than the five-year rule, when calculating her RMDs from the IRA. Her rollover must be reduced by the amount of RMDs that would have been required under the employer plan using the life expectancy rule. If June fails to make her rollover by December 31, 2019, then she will still be able to make a rollover to an inherited IRA (no later than December 31, 2023), but will have to continue to use the five-year rule when calculating her RMDs from the IRA. That is, she will still be required to receive all the funds in the inherited IRA no later than December 31, 2023.

2. The employee dies before his or her required beginning date, and the life expectancy rule applies. If the life expectancy rule applies, the amount ineligible for rollover includes all undistributed RMDs for the year in which the direct rollover occurs and any prior year. After the rollover, the life expectancy rule continues to apply in determining RMDs from the inherited IRA. RMDs are determined using the same applicable distribution period as would have been used under the employer plan if the direct rollover had not occurred.

3. The employee dies on or after his or her required beginning date. If an employee dies on or after his or her required beginning date, the amount ineligible for rollover includes all undistributed RMDs for the year in which the direct rollover occurs and any prior year, including years before the employee's death. After the rollover, the life expectancy rule continues to apply in determining RMDs from the inherited IRA. The RMD under the IRA for any year after the employee's death must be determined using the same applicable distribution period as would have been used under the employer plan if the direct rollover had not occurred.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

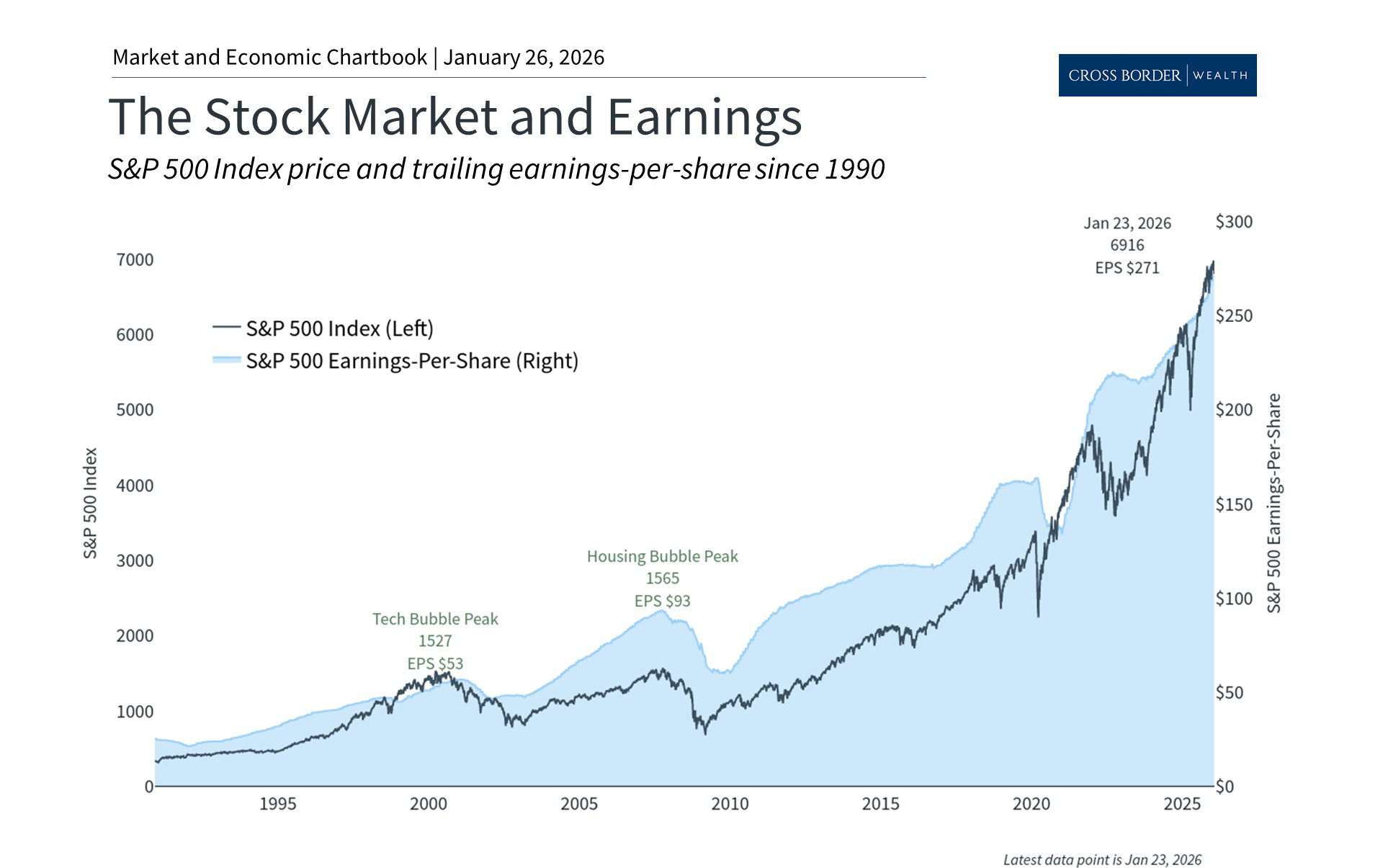

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.