Market Pessimism and the Importance of Staying Invested

- Market Insights

- 5 mins

Get investing insights for US-connected global citizens.

Book a free consultation with our cross-border advisors.

Recent market swings have highlighted a gap between how investors feel and how markets have performed. As the famous Warren Buffett quote suggests, it has often been wise to be "fearful when others are greedy and greedy when others are fearful.” While this can seem counterintuitive when there are many economic and political concerns weighing on the market, having the discipline to stay invested has historically been the reason investors are rewarded in the long run.

While some investors are worried about the economy, tariffs, interest rates, and more, many of the underlying market drivers have remained strong. In times like these, the key to managing volatility isn't reacting to the market's ups and downs, but rather to maintain a well-constructed portfolio that aligns with your long-term goals and risk tolerance. How can investors maintain perspective on recent market moves and news headlines?

Investors are increasingly pessimistic

Past performance is not indicative of future results

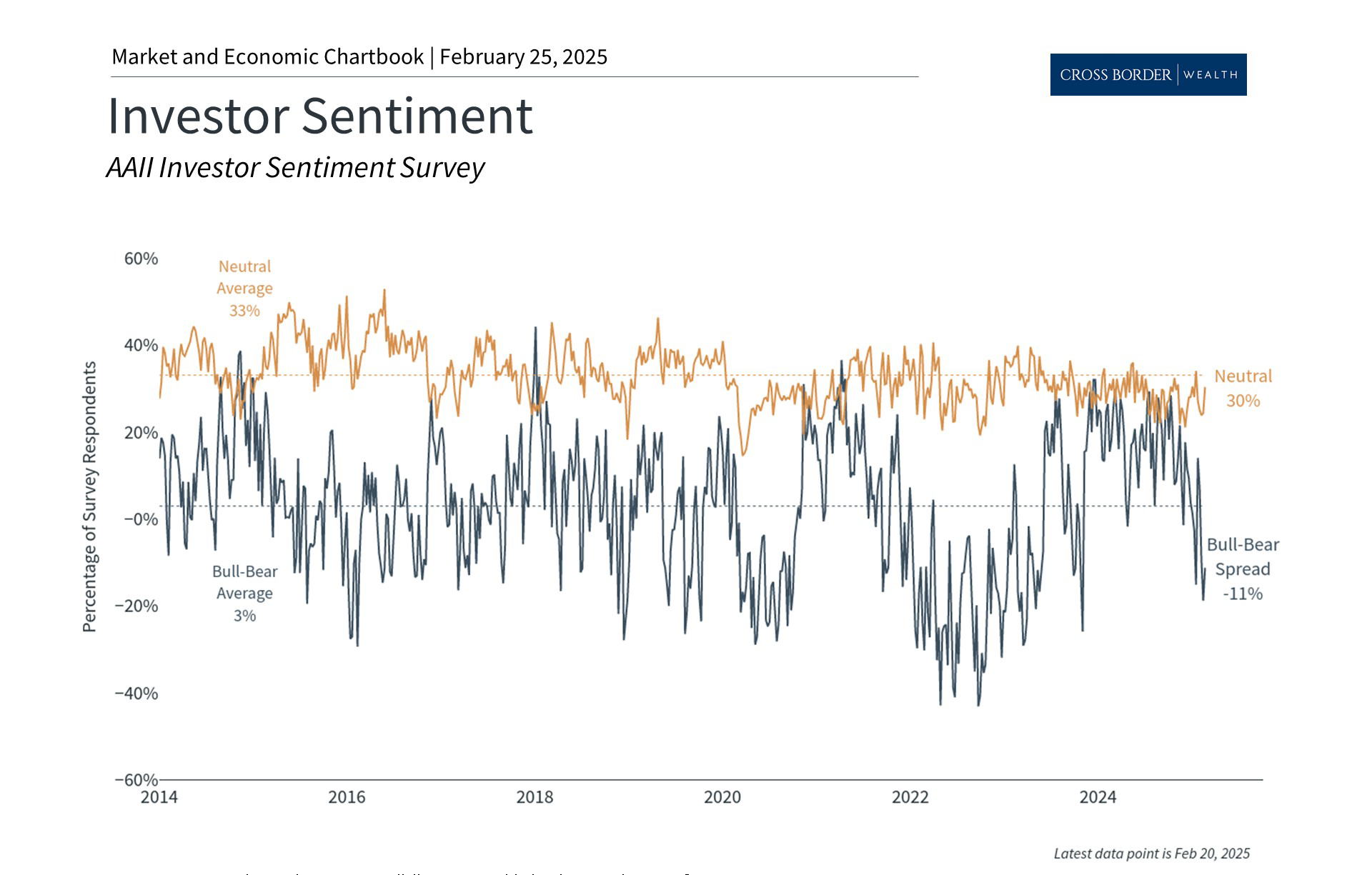

According to the latest AAII Investor Sentiment Survey, which measures how investors feel about the market, bearish attitudes have recently outpaced bullish ones by as much as 19%. This is the most pessimistic investors have felt since late 2023 when some expected the economy to fall into recession. It’s clear from the accompanying chart that these feelings can change quickly.

There is often a gap between how investors perceive markets and how they actually perform. Despite day-to-day market swings and worsening sentiment, major stock market indices have experienced positive returns over the past several months. This underscores the fact that investor sentiment is often a contrarian indicator. As Warren Buffett’s quote suggests, the greatest market opportunities tend to present themselves when investors are the most worried.

Historically, this is because investor emotions can change quickly and don’t always accurately reflect what will drive markets in the future. There are many historical examples of markets rallying despite investor negativity. A few include the “unloved bull market” after the 2008 global financial crisis, in 2017 amid trade war concerns, in 2020 following the pandemic, after 2022 when the market hit bear market levels, and many others. In reality, it’s when investors feel exuberant that extra caution is needed.

Proper portfolio construction balances risk and reward

Past performance is not indicative of future results

So, headlines on investor sentiment should be taken with the right historical perspective. The same is true when it comes to our own portfolios. We should have comfort in knowing our financial plans are built to weather changing market conditions and are aligned with our long-term goals, even if we may not feel fully comfortable with recent market moves.

Many economic fundamentals remain strong: unemployment is historically low, manufacturing is showing signs of life for the first time since 2022, CEOs are feeling confident, and productivity has improved over the past year. At the same time, stock market valuations are also approaching historic levels, which suggests broad market indices could face challenges in the long run.

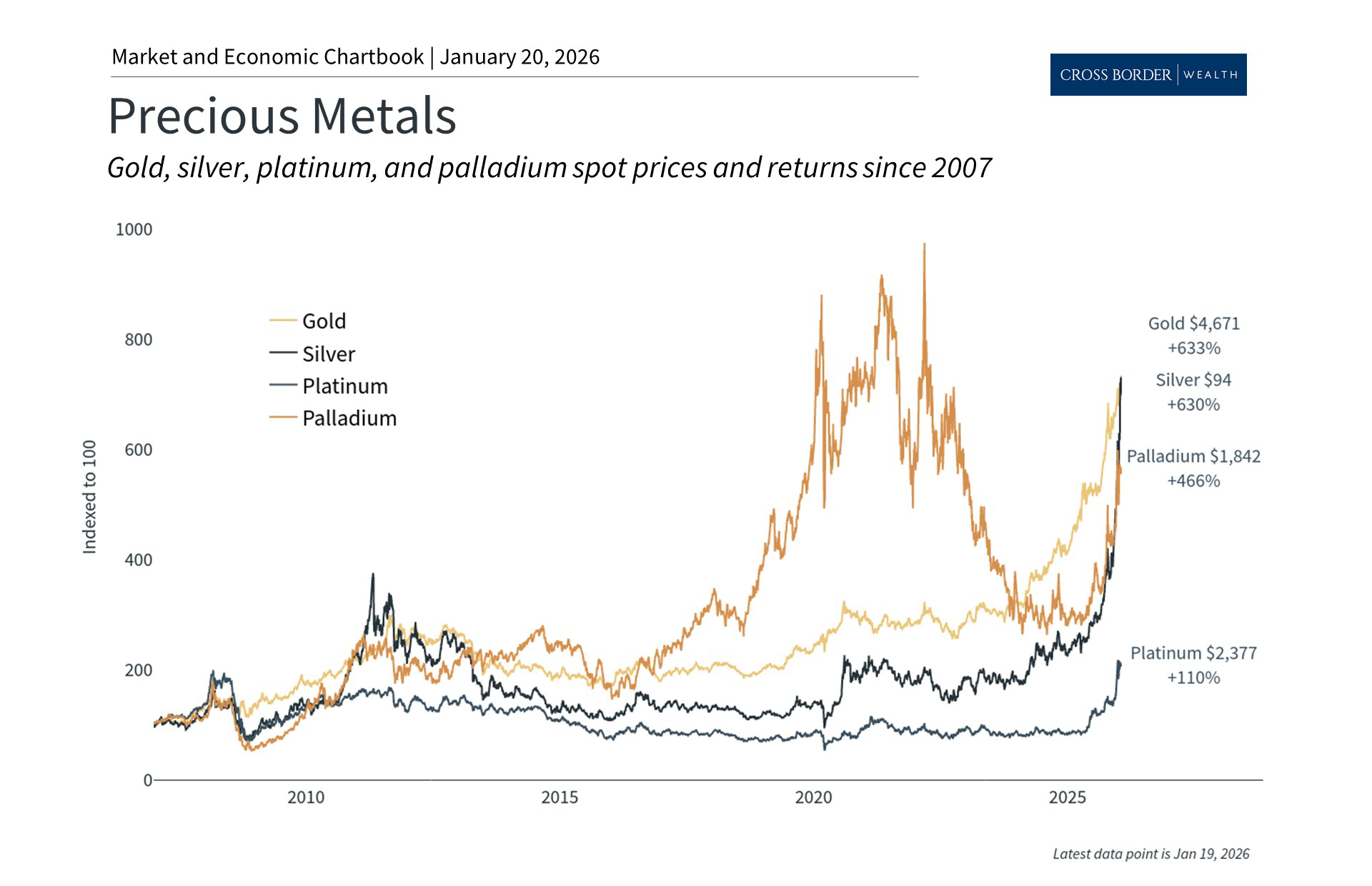

When facing conflicting market signals and investor pessimism, the solution is not to try to time the market or to exit the market altogether. Instead, these factors are a reminder of the importance of portfolio construction. The accompanying chart shows that risk and reward are two sides of the same coin and need to be managed together. If higher valuations suggest an asset class or sector will face greater risks, then it may be appropriate to tilt toward other investments.

When done right, the balance of stocks, bonds, and other asset classes takes various market and economic scenarios into account, managing risk and returns to keep you on track toward your financial goals. What’s more, market pullbacks can present opportunities to rebalance and add high-quality investments at better prices. Maintaining this discipline and developing an appropriate plan is why it’s important to work with a trusted advisor when developing investment strategies.

Staying invested is the best way to navigate volatility

Past performance is not indicative of future results

For these reasons, there is perhaps nothing more important for long-term investors than to simply stay invested. History has consistently shown that staying invested through market cycles is one of the best ways to build wealth over years and decades. Regardless of the causes of short-term market uncertainty, trying to time the market is difficult and often backfires.

The accompanying chart shows that, over the past 25 years, holding on after pullbacks was superior to getting out of the market, even for brief periods. While past performance is no guarantee of future results, the fact that investor sentiment can shift so quickly is why those who are able to stay disciplined are often rewarded.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.