Monthly Market Update for November: Volatility Amid AI and Fed Uncertainty

- Market Insights

- 5 mins

In November, markets experienced a brief period of volatility that affected many asset classes. While major indices have delivered strong year-to-date returns across stocks, bonds, and international investments, investors continue to worry about artificial intelligence-related stocks and the path of Fed rate cuts. At the same time, the government shutdown delayed the publication of key economic reports, making it more difficult to judge how the economy is doing.

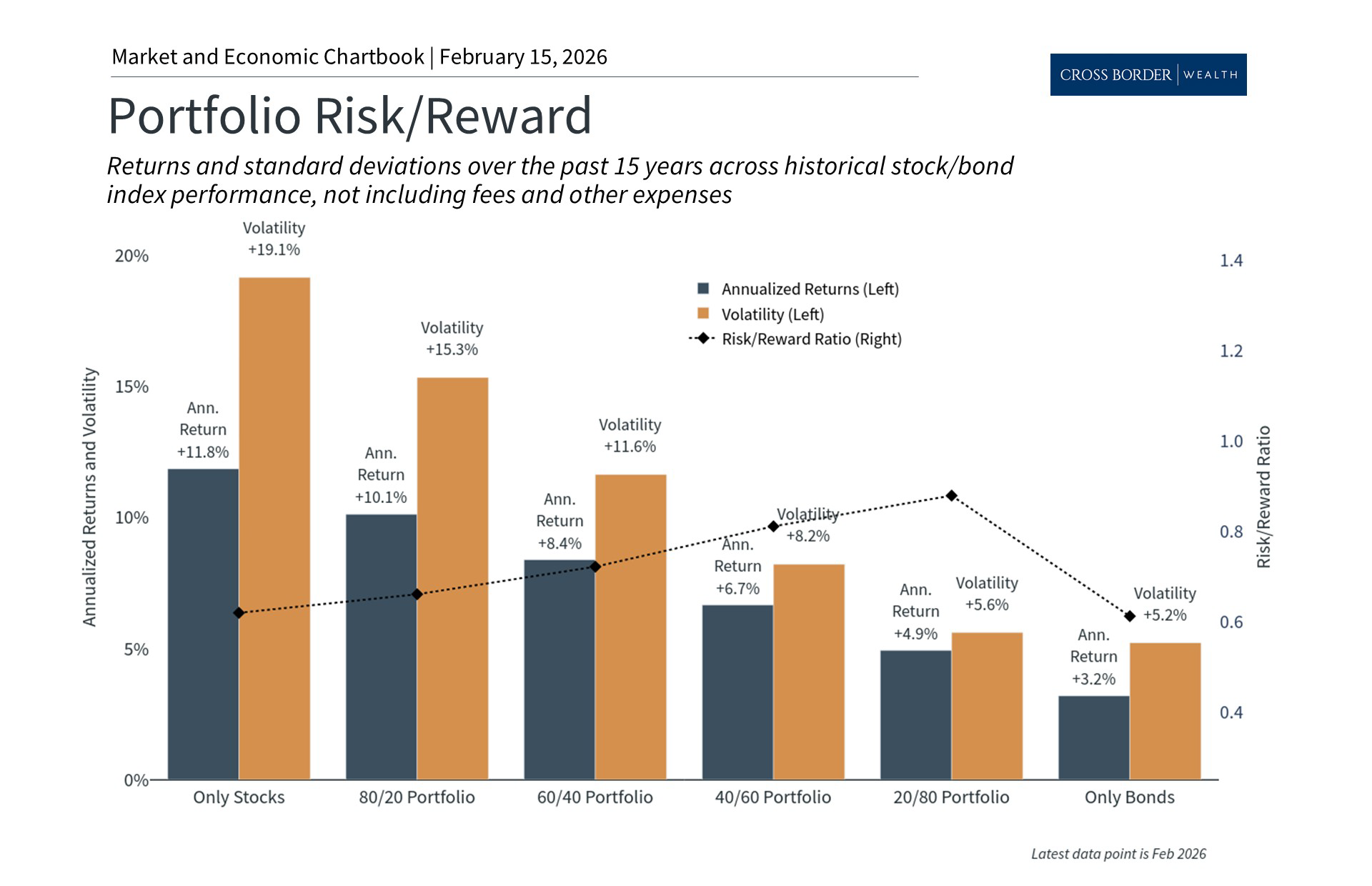

Despite this market volatility, many asset classes stabilized and rebounded by the end of the month. For long-term investors, this underscores the importance of maintaining an appropriate portfolio that can navigate the ups and downs of the market. Successful investing requires staying focused on long-term goals rather than chasing short-term performance or reacting to headlines.

What drove November’s performance and how can investors maintain perspective as we approach the end of the year?

Key Market and Economic Drivers in November

- The S&P 500 rose slightly by 0.1% in November, the Dow Jones Industrial Average gained 0.3%, and the Nasdaq declined 1.5%. Year-to-date, the S&P 500 is up 16.4%, the Dow is up 12.2%, and the Nasdaq is up 21.0%.

- The VIX, a measure of stock market volatility, finished lower at 16.35 after climbing as high as 26.42 mid-month.

- The Bloomberg U.S. Aggregate Bond Index rose 0.6% in November but is up 7.5% year-to-date. The 10-year Treasury yield ended the month lower at 4.02%, after briefly falling under 4%.

- International developed markets gained 0.5% in U.S. dollar terms based on the MSCI EAFE Index, while emerging markets fell 2.5% based on the MSCI EM Index. Year-to-date, the MSCI EAFE Index has gained 24.3% and the MSCI EM Index 27.1%.

- The U.S. dollar index ended the month at 99.46 and briefly crossed the 100 level.

- Bitcoin experienced a significant decline of about 17% in November, ending the month at $91,176.

- Gold prices ended the month higher at $4,218 but still below the October all-time high of $4,336.

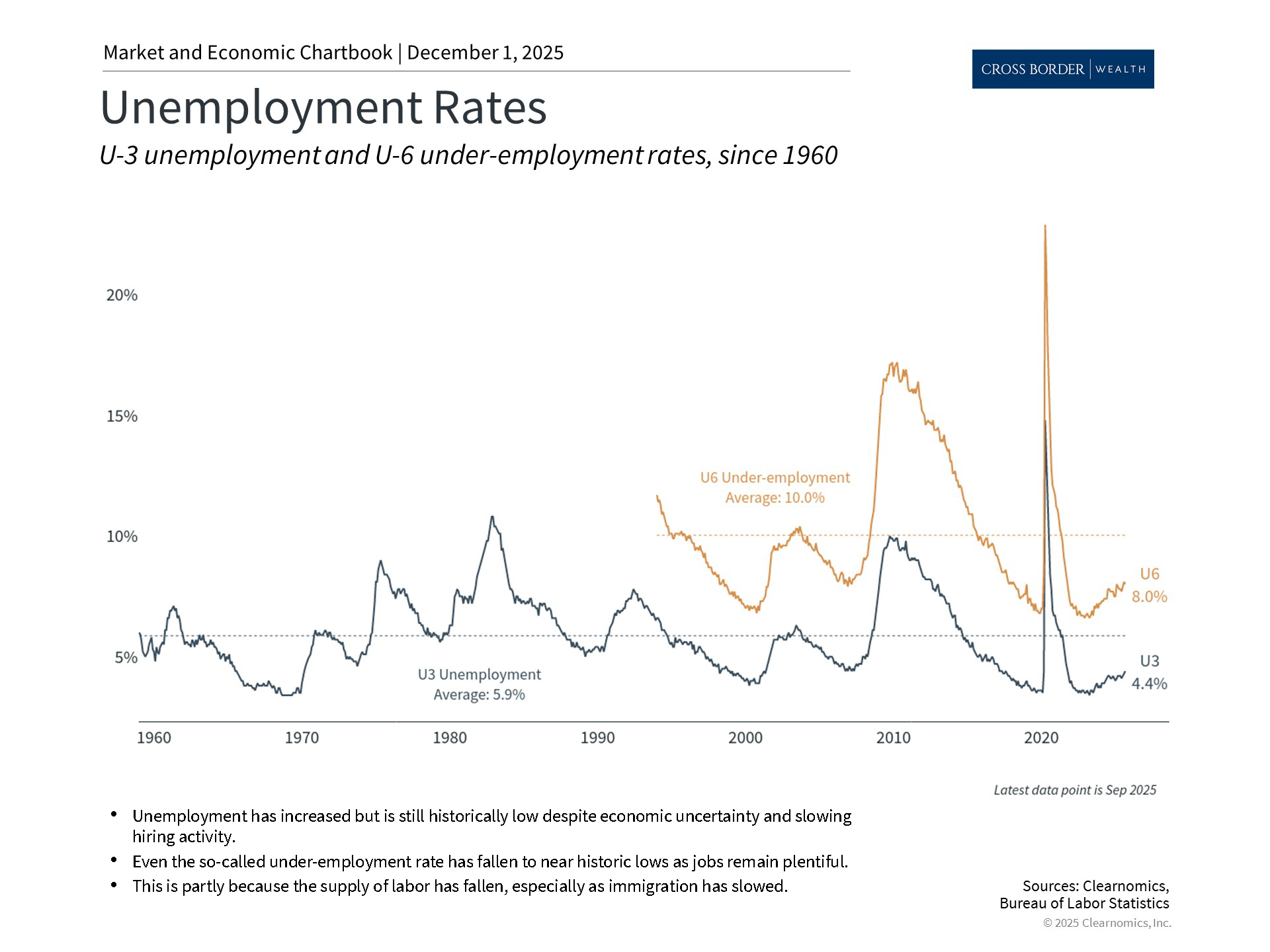

- The September jobs report, which was delayed due to the government shutdown, showed that the economy added 119,000 new jobs and the unemployment rate ticked higher to 4.4% that month. There will be no October jobs report.

Markets briefly experienced a "risk off" environment

Past performance is not indicative of future results

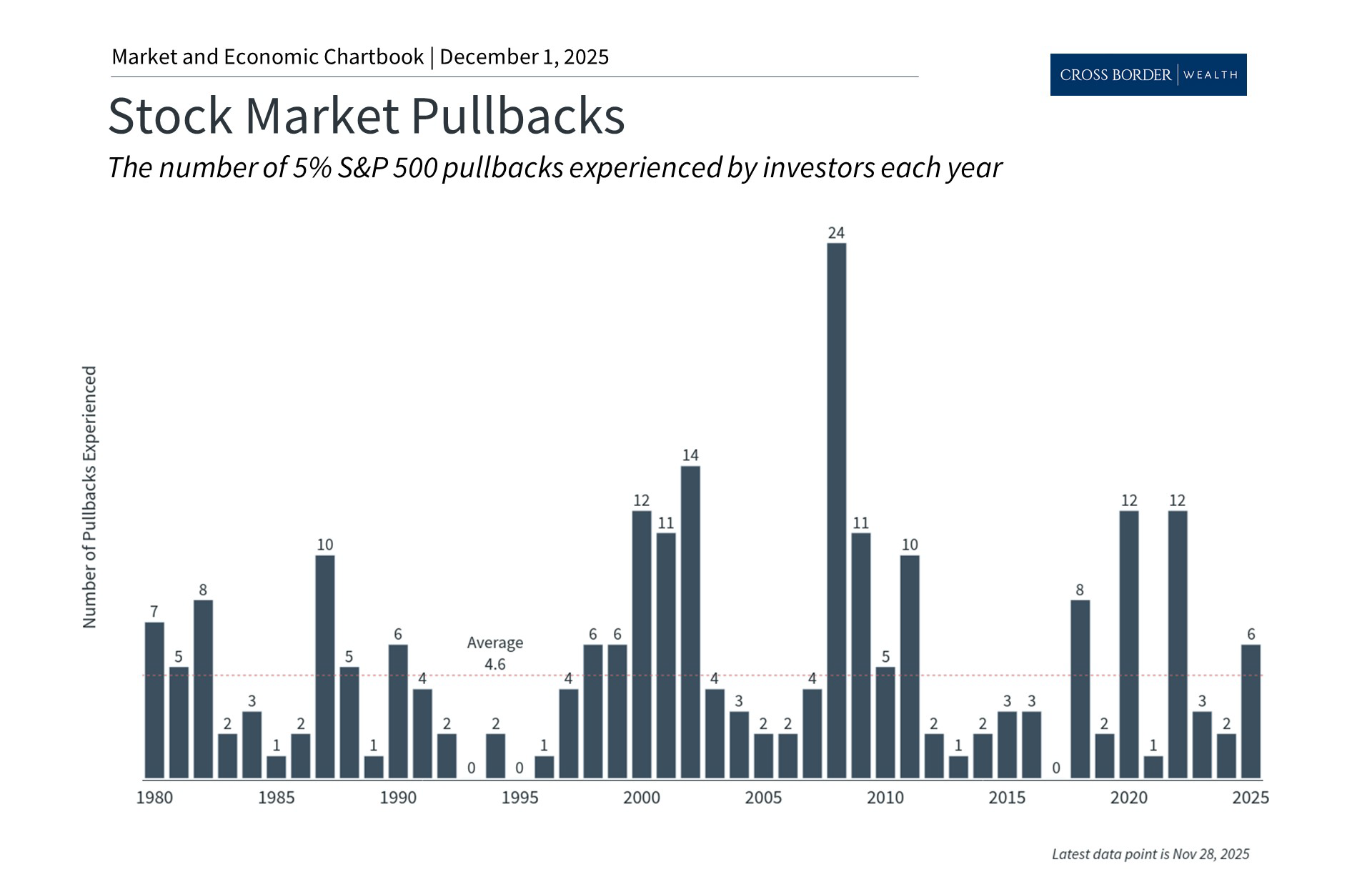

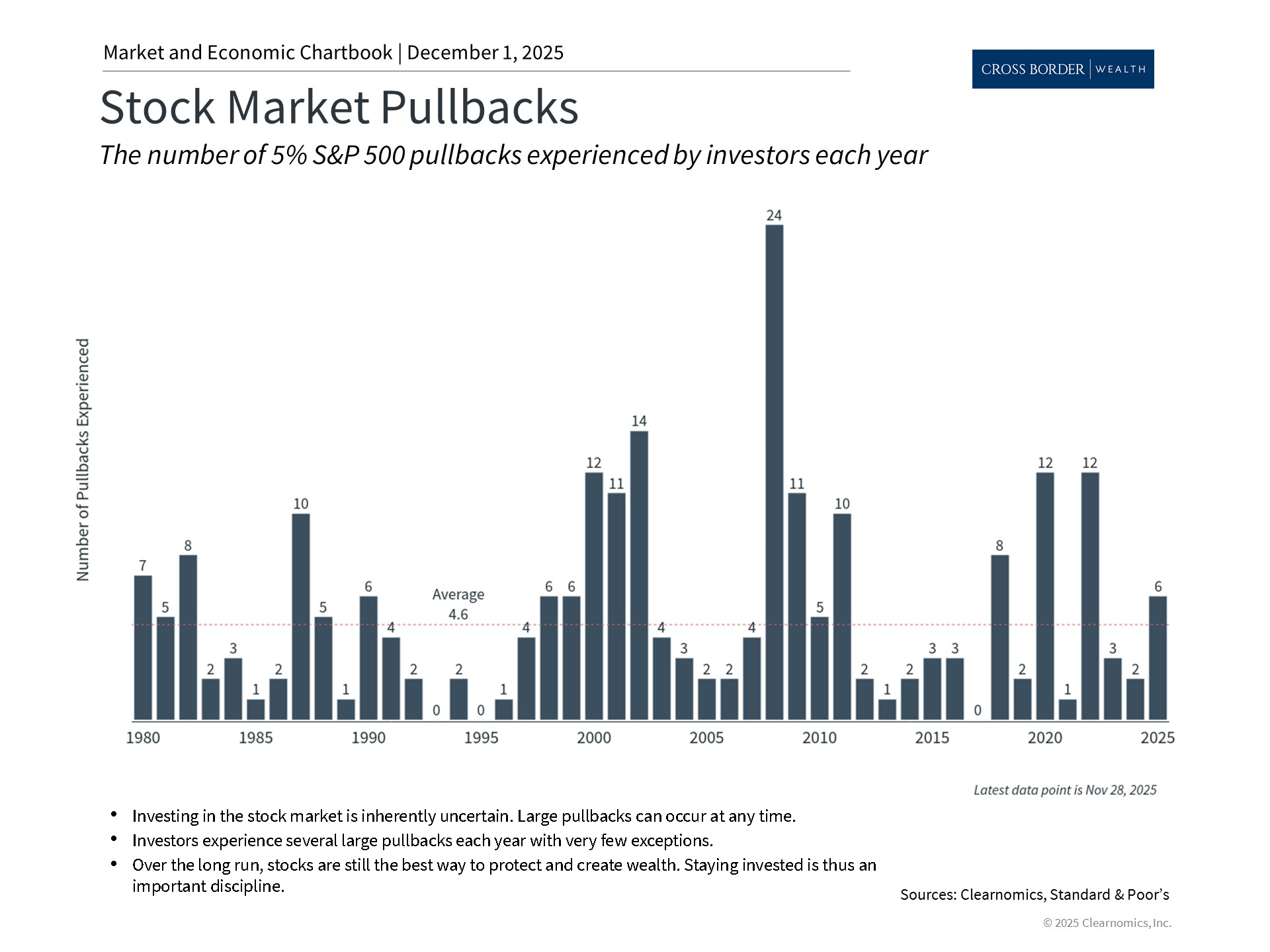

November saw investors temporarily move away from risk assets such as technology stocks, high-yield bonds, cryptocurrencies, and other investments. This was primarily due to questions around the sustainability of AI investments and investors adjusting their expectations around upcoming Fed rate cuts. There have now been six declines of 5% or worse for the S&P 500 this year, the most since 2022 but still close to the historical average. Some major asset classes rebounded in the final days of the month, and the S&P 500 ended slightly positive.

During the month, AI-related technology stocks experienced their worst week since April. Concerns about their spending and debt levels, profit margins, and questions around a potential bubble created volatility. Yet beneath this, fundamentals remained strong with companies such as Nvidia reporting healthy revenue and earnings growth for the third quarter. Some stocks, including those in the Magnificent 7, rebounded following these reports.

Cryptocurrencies experienced a sharp correction during this risk-off period. Bitcoin fell over 30% from its early October highs above $125,000, briefly trading below $85,000 and wiping out its year-to-date gains. While the adoption of cryptocurrencies by investors has grown, such periods demonstrate that these and similar assets can be highly speculative and prone to boom-and-bust cycles. For this reason, ongoing risk management and maintaining a proper asset allocation continue to be important.

The bond market rose in November, partly driven by a decline in long-term interest rates with the 10-year Treasury yield briefly falling below 4% once again. This was the result of new expectations around government policy which could result in lower rates in the long run. Year-to-date, the Bloomberg U.S. Aggregate Bond Index has gained 7.5%, the best performance since 2020. This has helped provide balance to diversified portfolios.

The government shutdown ended but economic uncertainty remains

Past performance is not indicative of future results

The longest government shutdown in history ended after 43 days, but the federal government will only be fully funded through the end of January 2026. This means that political uncertainty will be in the headlines again in only a couple of months. That said, markets were generally able to look past the shutdown, even with greater challenges due to a lack of economic data.

The Bureau of Labor Statistics released the long-awaited September jobs report, which was originally scheduled to be published in October. This report showed that job gains exceeded expectations that month, rebounding from weakness over the summer. However, the revised figures show that 4,000 jobs were lost in August, the second month of negative jobs growth this year. The unemployment rate edged up to 4.4% in September, its highest level since October 2021, although this is still low by historical standards.

A full October jobs report will not be published since surveys of households and businesses were not conducted during that month, but some of the data will be published with November’s report on a delayed basis.

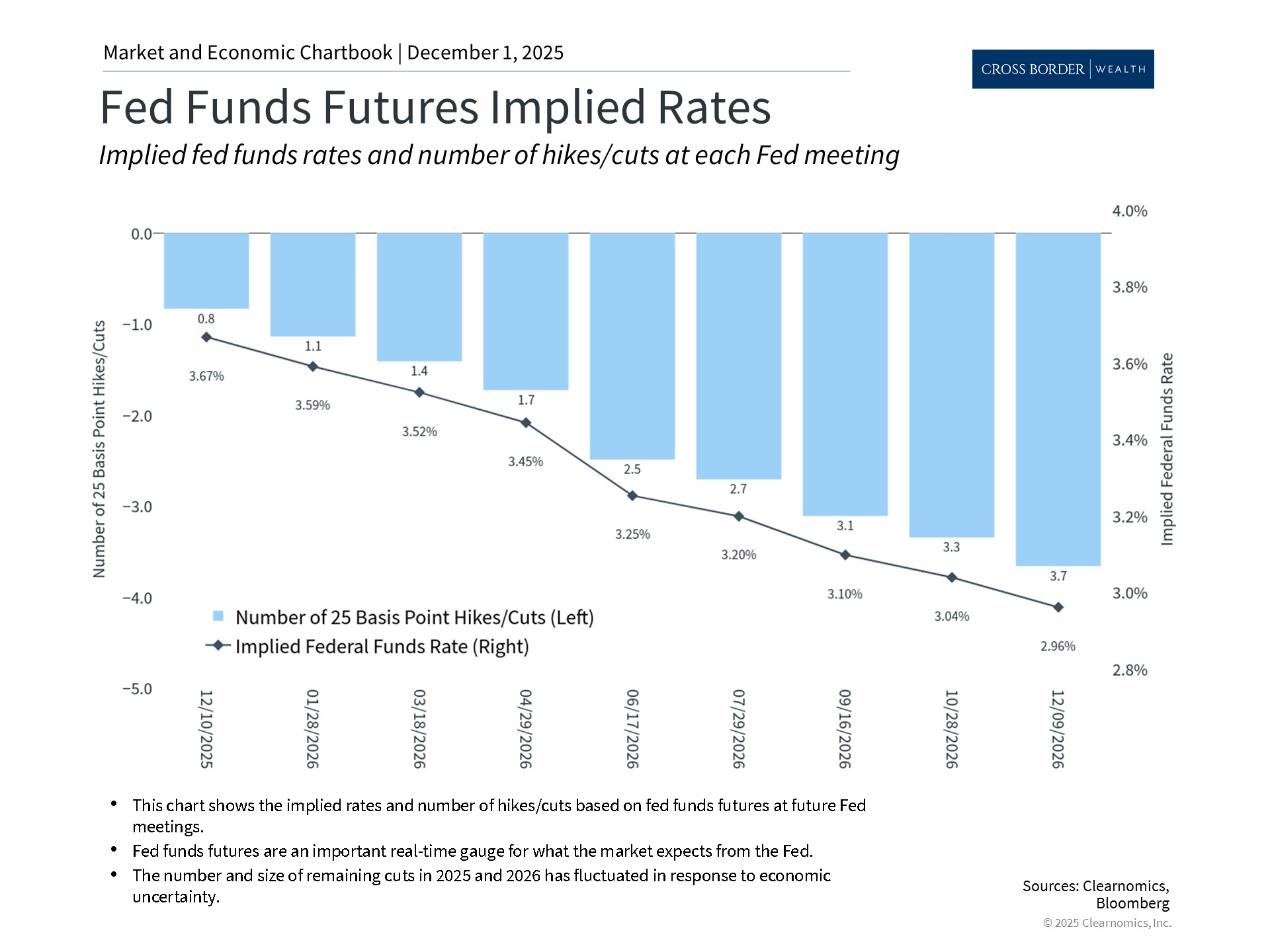

Market expectations for the next Fed rate cut have shifted

Past performance is not indicative of future results

These data delays mean that the Federal Reserve will enter its mid-December meeting without the full economic picture. Expectations for a rate cut at the next Fed meeting have shifted dramatically, with the probability dropping in mid-November before rebounding once again. At the moment, market-based expectations suggest the Fed will cut rates in December and then again in April or June 2026.

Other economic data, such as consumer confidence, have also worsened. The preliminary estimate of the University of Michigan’s Index of Consumer Sentiment declined from 53.6 to 50.3 in November. This reflects ongoing concerns among Americans about job security, higher prices, and their overall financial situations. While many households are feeling the financial pinch, poor sentiment over the past few years has not translated into reduced spending or corporate revenues.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.