Perspectives on Consumer Pessimism and Economic Risk

- Market Insights

- 5 mins

Get investing insights for US-connected global citizens.

Book a free consultation with our cross-border advisors.

Concerns over the economy have intensified, leading to a challenging investment environment. The S&P 500 briefly fell into correction territory recently (a decline of 10% or more), while the Nasdaq and major technology stocks have led the downturn. In times like these, it's important for investors to remember that market uncertainty is a normal part of investing. While downturns are never pleasant, history shows that those who stick to their financial plans are in a better position to achieve their long-term goals.

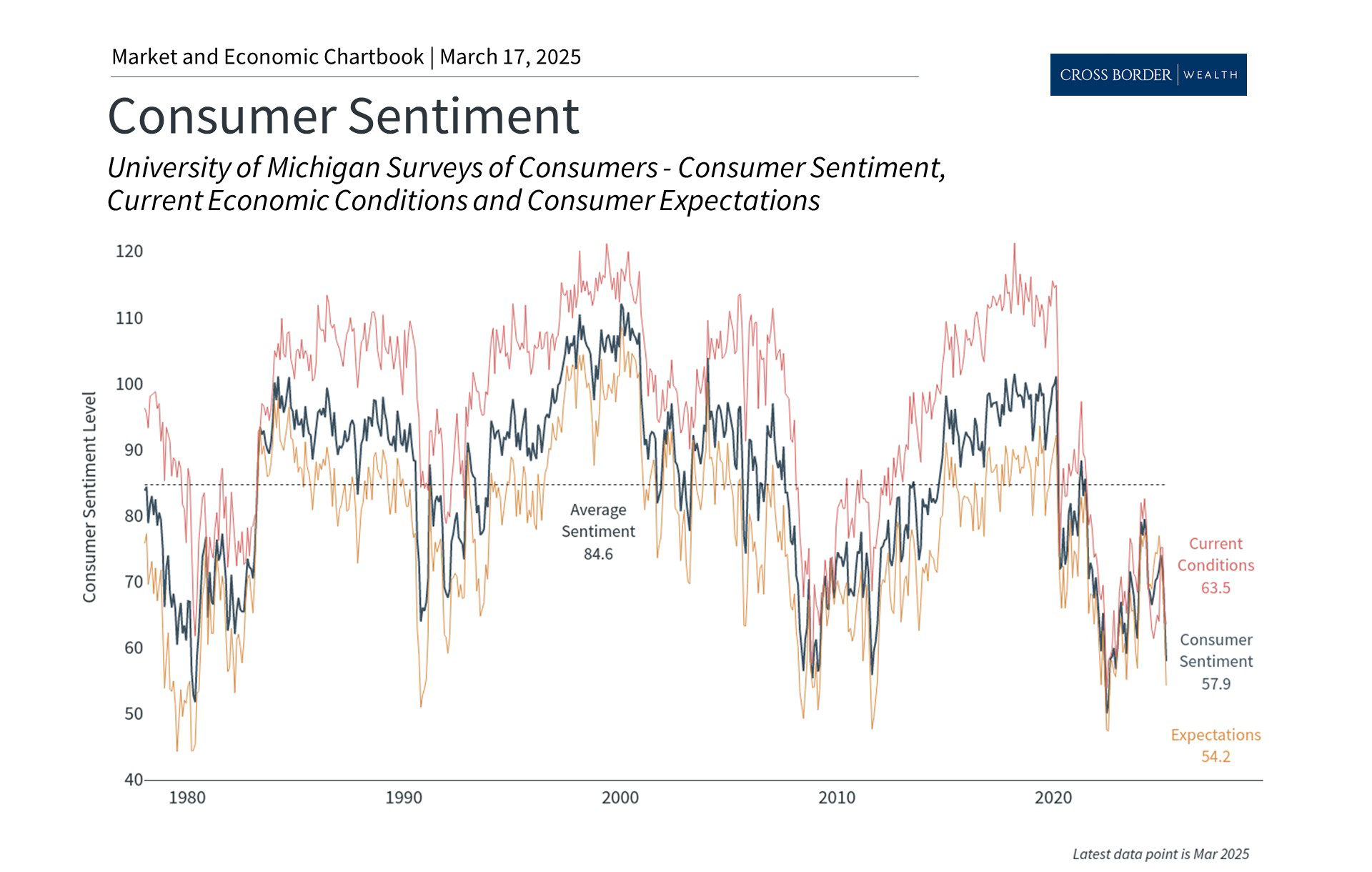

Consumer sentiment has fallen due to tariffs and inflation

Past performance is not indicative of future results

So, what is underpinning investor concerns? A key factor is whether tariffs and inflation will harm consumer spending. This is because consumers are the backbone of the U.S. economy, with consumer spending making up more than two-thirds of annual GDP. When consumers feel confident about their finances and the world, they tend to spend more on goods and services, which drives economic growth and corporate profits. Conversely, when uncertainty rises, consumers often tighten their belts, which can ripple through the entire economy.

Recent data suggest that consumer sentiment, which measures how consumers feel about current and future conditions, has worsened alongside the stock market. According to the University of Michigan Surveys of Consumers, overall consumer sentiment has fallen to a level of 57.9 from a high of 79.4 a year ago, and is approaching the historic low of 50.0 in mid-2022. Much of this is driven by the expectation among consumers that inflation could rise as high as 4.9% in the coming year.

Tariff uncertainties are the latest reason for consumers to feel nervous about the economy, especially when it comes to inflation. Historically, tariffs increase the prices of imported goods, as demonstrated when washing machine prices rose following 2018 tariff implementation. When businesses face higher import costs due to tariffs, they must choose between absorbing costs, negotiating with suppliers, or passing expenses to consumers.

It’s not surprising that how consumers feel and how much they spend are usually related, and the latest retail sales report for February shows a slowdown in spending in some categories. However, this relationship has been unusual in recent years: although consumers may feel uneasy in this economic environment, spending has generally remained robust. This has led to a mix of conflicting data that needs to be viewed with a broader perspective.

One reason for steady spending despite poor sentiment is that the job market remains strong. The unemployment rate of 4.1% remains near historic lows. There are 7.7 million job openings, for a ratio of more than 1 job per unemployed individual. Having job prospects may help bolster confidence and could help to support consumer spending in spite of recent uncertainty. Additionally, employers are more likely to raise wages if they know their workers could be considering other job opportunities.

Consumer preferences have also evolved in the past few years, with spending increasingly focused on services and experiences rather than physical goods. Case in point: inflation for services remains well above average while the prices of many goods have declined, according to Consumer Price Index data. Goods are tangible items that consumers can purchase and own, such as electronics, clothing, or furniture, whereas services represent intangible offerings such as dining out, travel, memberships, healthcare, education, and entertainment.

Household savings rates have fallen while debt has steadily risen

Past performance is not indicative of future results

The other side of the spending coin is savings and debt. While the savings rate has recovered somewhat, suggesting that households are saving 4.6% of their paychecks, this remains below the historical average of 6.2%, as shown in the accompanying chart. This means that consumers have been slow to rebuild their rainy day funds and are choosing to spend extra income (above inflation), rather than save.

Some investors worry that resilient spending has been fueled by a rising level of consumer debt. According to the latest Federal Reserve Bank of New York report, credit card balances grew to $1.2 trillion in Q4 2024, but it’s important to put this figure into context. While individual debt levels are likely to be growing, aggregated data points like debt balances tend to rise as the population and economy grow. In other words, these figures usually only contract with a sharp slowdown of economic growth or a recession. As a percent of income, consumer credit has risen, but still remains below concerning levels.

Household net worth remains near historic peaks

Past performance is not indicative of future results

Despite concerns about rising debt levels, U.S. household net worth has reached record levels, providing a strong foundation for the financial health of consumers. This "wealth effect," or the idea that consumers spend more when their perceived wealth increases, is driven by strong asset prices, real estate, and more.

It’s important to recognize that this is not evenly distributed across all economic segments, and there can be variation among different demographic groups and income levels. Some households continue to struggle with debt and limited savings, even as overall net worth statistics paint a positive picture.

While household net worth and consumer spending provide no guarantee a recession will be avoided, they do suggest that the economy is more resilient than some might fear.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.