Qualified Domestic Relations Order

- US Pensions

- 10 mins

What is a qualified domestic relations order (QDRO)?

A qualified domestic relations order (QDRO) is a court judgment, decree, or order establishing the marital property rights of a spouse, former spouse, child, or dependent of a pension plan participant with respect to certain qualified retirement plans. Several requirements and restrictions apply.

To what extent are retirement assets subject to divorce court jurisdiction?

A retirement plan is a form of property. Like houses, cars, and bank accounts, a retirement plan can be divided between spouses at the time of a divorce. For example, if one spouse participates in a pension plan at work while the other spouse remains at home to care for the children, a judge has numerous options with respect to the retirement plan. Among other choices, he or she can award all of the pension to the working spouse, award all of it to the nonworking spouse, or split it equally (50/50). Judges often use QDROs to effect these pension assignments. In a marriage of long duration, a pension plan may be one of the most valuable marital assets.

How are retirement plans classified?

Many different kinds of retirement plans exist, with individual retirement accounts (IRAs) being one of the more common forms. In terms of employer-sponsored retirement plans, plans are classified as either qualified or nonqualified. Basically, qualified plans are those that satisfy federal requirements and are afforded special tax treatment. Most qualified plans can be further categorized as either defined contribution plans or defined benefit plans.

- Defined contribution plans - Each participant in a defined contribution plan has an individual account. When you retire, you're entitled to receive your entire account balance. Funding depends on the type of plan. With some plans, the employees are the only ones who contribute, and with others, the employers do all the contributing or may match employee contributions dollar for dollar (or according to a certain percentage). Typical examples of defined contribution plans include 401(k) plans and profit-sharing plans.

- Defined benefit plans - A defined benefit plan does not use individual accounts. Instead, benefits for the participants in the plan are fixed under a particular formula. Specified benefits are paid to participants based on such factors as age, length of service, and amount of compensation. Generally, the plan promises to pay the employee a certain amount per month at retirement time based on enumerated factors.

Before you think about dividing pension plans, it's important to understand the difference between defined contribution plans and defined benefit plans.

What requirements and restrictions apply to QDROs?

A QDRO provides for child support, alimony payments, or marital property rights for a spouse, former spouse, child, or other dependent of a qualified plan participant and is made pursuant to a state domestic relations law. It creates or recognizes the existence of the right of the individual other than the plan participant (i.e., the alternate payee) to receive all or a portion of a participant's benefits under a qualified retirement plan.

A QDRO must satisfy certain requirements. It must clearly specify:

- The name and last known mailing address of the participant and each alternate payee covered by the order

- The amount or percentage of the participant's benefits the plan must pay to each alternative payee (or the manner in which such amount or percentage is to be determined)

- The number of payments or periods to which the order relates, and

- Each qualified retirement plan to which the order applies

However, a QDRO may not require the plan to do any of the following:

- Mandate increased benefits

- Pay benefits to an alternate payee that must already be paid to a different alternate payee under another QDRO, or

- Provide a type or form of benefit (or any option) not otherwise provided under the plan

For instance, the QDRO can't require the plan to provide cost-of-living increases if the plan doesn't already have cost-of-living provisions. Furthermore, a spouse's plan can't allocate 60 percent of the benefits to his or her former spouse if 50 percent of the benefits had previously been allocated to another prior spouse.

In what ways may retirement plans be divided pursuant to a QDRO?

The QDRO specifies what the plan administrator is to do with the spouse's share of the plan. If under the plan a participant has no right to an immediate cash payment, a QDRO can't require the plan administrator to make an immediate cash payment to a spouse. Instead, a QDRO will probably be used to segregate plan assets into a subtrust for the benefit of the alternate payee-spouse, with cash distributions made at the earliest time they would be permitted under plan provisions.

Defined contribution plans are easy to value because the money is in an individual account and the plan administrator usually provides a quarterly report of the value. Defined benefit plans can pose a problem, however, and often require the services of an actuary to ascertain the present value of the fund. An actuary may be necessary, for example, if your eventual pension payout is tied to your compensation during your three highest paid years.

Example(s): John is 50 years old and has a defined benefit plan that has no cash value right now. When John retires, he currently expects to receive $1,200 per month. His ex-wife, Mary, will get a portion of the payout. If there is a 50 percent split of the present value according to a QDRO, John and Mary will each get $600 per month at retirement time. However, if John actually receives $1,800 per month when he retires, Mary will still only get $600 per month.

Segregation of plan assets

One option is to segregate the alternate payee's portion of the plan until the employee reaches retirement age. At that time, the alternate payee can access the funds. With this approach, the alternate payee is treated as a participant in the plan. The employee's defined contribution plan balance (or defined benefit plan accrued benefit) is valued as of a certain date, and that benefit is divided between the participant and the alternate payee in accordance with the QDRO. Once divided, the alternate payee is treated similarly to a terminated participant with a vested deferred benefit.

There are certain advantages to this approach. For example, if you're the alternate payee, you're probably assured of receiving some retirement income in the future. Also, you won't have to deal with the problems of how to invest your money right now and how to value the plan today.

However, staying in the plan maintains your economic ties with your ex-spouse, so you might lose some money if your ex-spouse takes early retirement. Also, you will not be able to control the investment decisions for your share of the retirement assets. And finally, your share of the plan will generally not be accessible to you until your ex-spouse reaches retirement age.

Current distribution of plan assets

If the plan allows, the plan administrator can distribute (to the alternate payee) the full amount of money due. The alternate payee can then either keep the money and pay tax on it now, or roll it into an IRA within 60 days, delaying taxation until later. There are also certain advantages to this approach. For example, if you need cash now for living expenses, you can keep all of the distribution. Also, you're able to control the investment decisions.

There are some drawbacks. For example, you may be subject to income tax (and perhaps the 10 percent penalty tax) if you don't roll the money into an IRA account within 60 days. Also, requesting a current distribution requires you to make your own investment decisions. And finally, you'll lose the long-term tax-sheltering advantage as well as the retirement savings if you spend the money now.

Tip: The IRS has authority to waive the 60-day rule for rollovers under certain circumstances, such as proven hardship.

Aside from QDROs, what options may spouses consider with respect to retirement plan assets?

One option is to trade retirement assets for something else. For example, a divorcing couple can simply decide that one spouse gets the entire retirement plan and the other gets the house plus alimony. Or perhaps the other spouse gets a big cash buyout right now instead of a claim on the pension assets.

There are advantages to avoiding QDROs. You will save time and money by not having to draft a QDRO. QDROs can be very expensive, especially when actuaries must be hired. Trading assets can simplify the property settlement considerably, which saves attorney's fees. Also, you may be able to trade for an asset you really want, like the house.

However, you may jeopardize your future financial security if you relinquish pension rights today. Also, you and your spouse may not have enough other assets to make a fair division if one of you keeps the entire retirement plan. And if the retirement plan is a defined benefit plan, it will have to be valued in order to determine what amount of other assets would make an equitable offset.

Tip: Remember that QDROs don't apply to most nonqualified retirement plans, such as certain annuity plans and certain deferred compensation plans. So, if your spouse's plan is a nonqualified one, the specific QDRO rules may not have to be followed.

Tip: Also, the QDRO rules don't apply to IRAs. Nevertheless, it is possible for a QDRO to require a distribution of pension benefits to an employee and then a transfer of the distribution to an IRA for the benefit of the former spouse.

When retirement plans are divided pursuant to a court order, what are the income-tax ramifications?

- Tax impact of QDRO on plan participant - If a QDRO orders a distribution of funds from a participant's plan to a spouse or former spouse, those funds will not represent taxable income to the plan participant. The 10 percent early withdrawal penalty will not apply. If the alternate payee is a child or dependent (rather than a spouse), then the distribution will be taxed to the plan participant. In such a case, the 10 percent early withdrawal penalty will still not apply.

- Tax impact on plan participant if there is no QDRO - If there is no QDRO and retirement plan assets are distributed to a spouse (or anyone else), then the distribution will be taxed to the plan participant. Furthermore, the 10 percent early withdrawal penalty may apply. Beware, also, of withholding requirements.

- Tax impact of QDRO on former spouse (or alternate payee) - A spouse or former spouse who receives a distribution under a QDRO steps into the shoes of the plan participant. As a result, such distributions become taxable to the spouse rather than to the plan participant. The money will be included in the alternate payee's gross income for the year of distribution. However, any cost basis that the participant had in the plan must be apportioned. It will be allocated on a pro rata basis between the present value of the alternate payee's interest and the total present value of all the benefits payable with respect to the plan participant.

Example(s): Assume John was married to Mary and had a vested balance in his 401(k) plan of $300,000. John had made after-tax contributions to the plan in the amount of $30,000. When John and Mary negotiated a divorce, it was decided that Mary would get 50 percent of the plan assets immediately ($150,000). John's $30,000 after-tax basis in the plan will be allocated to him and Mary based on the ratio of their respective interests in the plan. Thus, $15,000 of the $150,000 distribution to Mary will be nontaxable. The remaining $135,000 will be taxable to Mary unless she rolls this money over into an IRA within 60 days of receipt. Since the distribution was made pursuant to a QDRO, there will not be a 10 percent early withdrawal penalty.

Tip: Distributions to children and other dependents will be taxable to the plan participant.

- If the alternate payee is the spouse or former spouse, the taxable part of any distribution received by such person will qualify as an eligible rollover distribution. Thus, it can be rolled over into an IRA within 60 days of receipt. If the alternate payee is a child or other dependent, the money may not be rolled over into an IRA.

- Tax impact on former spouse if there is no QDRO - If there is no QDRO, the former spouse doesn't include the distribution in gross income; the distribution is taxable to the plan participant. Also, the plan participant may be subject to the 10 percent early withdrawal penalty. Such a distribution doesn't qualify to be rolled over into an IRA.

Tip: Distributions from a Section 457 plan made pursuant to a QDRO are taxed under the same rules that apply to qualified plans.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

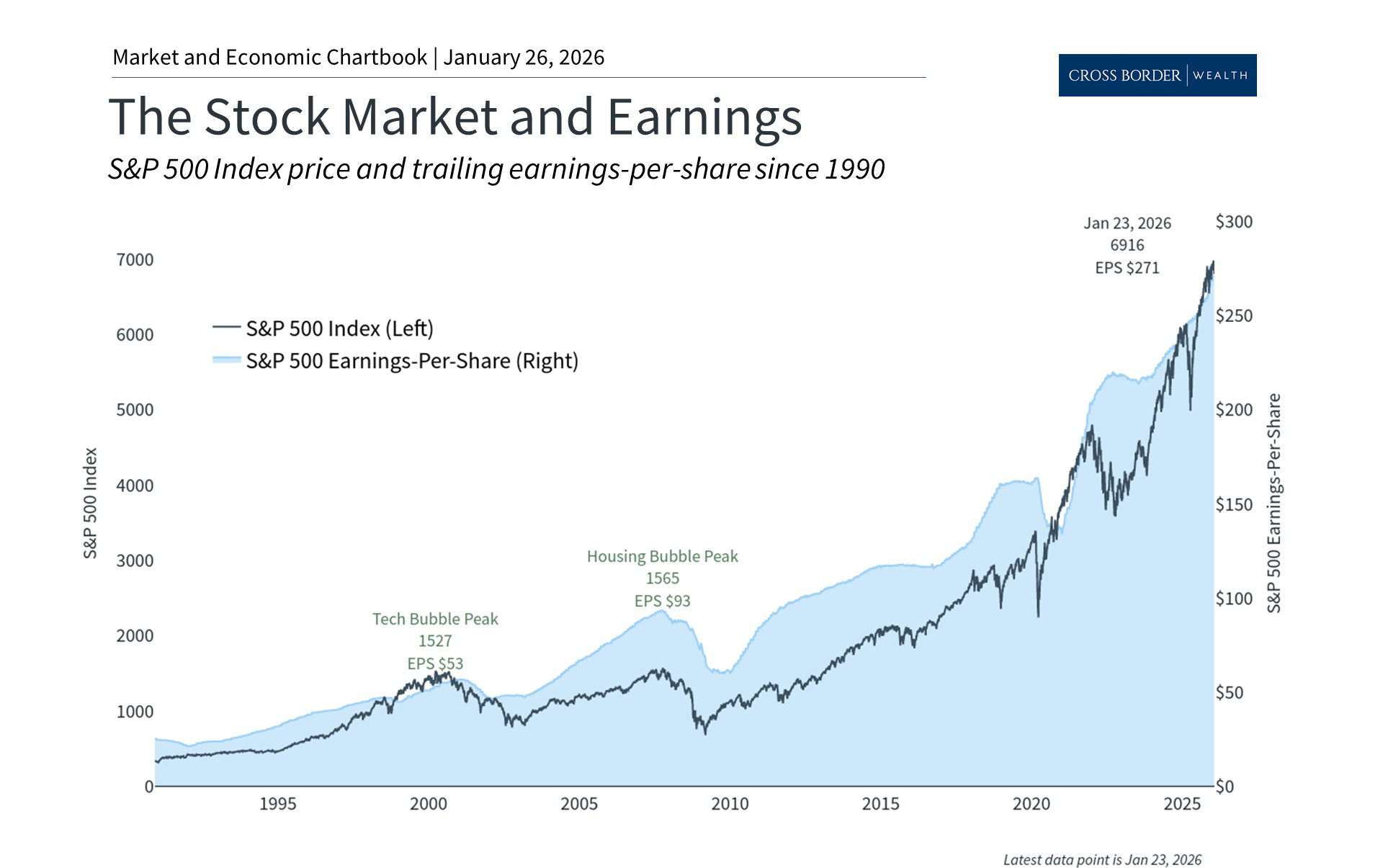

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.