Special Update: Perspective on the Market Sell-Off and the Fed

- Market Insights

- 8 mins

Need guidance on your cross-border financial planning?

Book a free consultation with our cross-border advisors.

To paraphrase Ernest Hemingway, shifts in the stock market often occur “gradually, then suddenly.” Over the past month, the market has rotated from large cap technology stocks to small caps and other sectors. Following the latest jobs report, however, global stocks experienced a sharp pullback due to concerns over the timing of Fed rate cuts, a weakening labor market, and disappointing tech earnings. Financial markets are on edge as investors adjust to a changing economic landscape.

Specifically, the Nasdaq is now in correction territory, defined as a 10% decline from recent highs. The S&P 500 has pulled back 5.7% from its high three weeks earlier, while the Dow has been steadier with a decline of 3.5%. The VIX, often described as the market’s “fear gauge,” has surged to its highest level since early 2023. The 10-year Treasury yield has now fallen below 3.8%, a sharp decline from 4.7% only three months ago.

Ironically, current macroeconomic conditions – inflation returning to 2%, low but rising unemployment, falling interest rates, and double-digit stock market gains – are exactly what investors had hoped for at the start of the year. Now more than ever, investors need perspective to navigate markets and stay on track to achieve their financial goals. How should investors view recent stock market swings as they position for the coming months?

Investors need perspective in volatile markets

Past performance is not indicative of future results

Investors focused on recent performance alone would no doubt wonder if the cycle is over. While recent market events are still playing out, it’s important to remember that not only are stock market swings normal, but they can also be healthy if they are the result of investors adjusting to new economic facts. This is especially true if valuations improve as prices adjust and corporate earnings continue to grow.

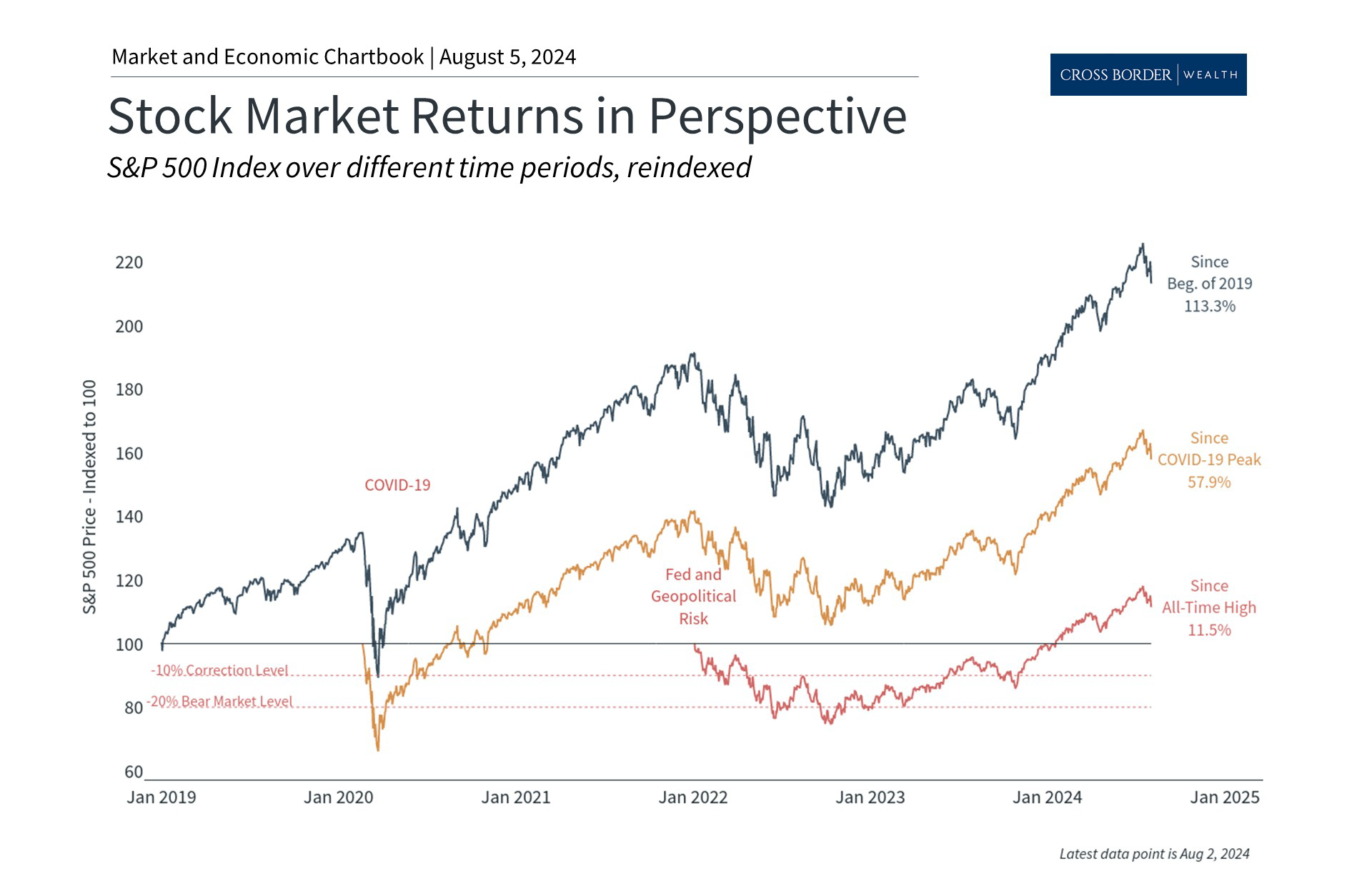

For many investors, the volatility since 2020 may already seem like a distant memory after the steady recovery of the past year and a half. As the accompanying chart shows, the S&P 500 has gained 113% over the past five years, including the pandemic collapse and the 2022 bear market. While market pullbacks are never pleasant, viewing the market on these timescales does help to put the current decline in perspective.

It's no secret that technology-related stocks, particularly those related to artificial intelligence, have contributed greatly to these market returns. The Magnificent Seven, a group of stocks including Nvidia that benefits from recent trends, is still up a whopping 162% since the beginning of 2023, and has gained 362% since early 2020.

The rotation and now pullback in these stocks is the result of investor concerns over the magnitude of the rally and large tech company earnings. Whether AI and large language models can live up to their lofty promises has yet to be seen, and it’s not surprising that investors are growing antsy at seeing a return on the billions invested by large companies in these technologies.

So far, market fundamentals still appear to be strong regardless of how stocks move in the short run. Profit forecasts are still positive, with S&P 500 earnings expected to grow 13% over the next 12 months. More than half of S&P 500 sectors are expected to grow earnings by double digits, and all 11 sectors are forecasted to experience positive growth. In the long run, earnings are what drive stock market returns, and thus the health of the economy matters more than short-term stock and sector-specific trading activity.

Concerns are growing that the Fed has made a policy mistake

Past performance is not indicative of future results

This is why concerns around the Fed have spooked the market in recent days. The Fed has now kept rates unchanged for over a year as it seeks “greater confidence” that inflation is returning to its 2% target. However, its focus on inflation is now resulting in a weakening labor market, which some fear could spiral toward a “hard landing.”

It’s important to remember how fickle market expectations have been. The year began with investors believing the Fed would need to cut rates several times due to an imminent recession. Expectations then shifted after a few hotter-than-expected inflation reports, with investors believing the Fed would not cut at all this year. Today, markets expect the Fed to cut in September and possibly at each subsequent meeting. These swings show how difficult it is to get monetary policy right, even as backseat drivers.

These dynamics have shifted the Fed’s focus to the labor market, with the Fed acknowledging that it is “attentive to the risks to both sides of its dual mandate.” The latest jobs report showed that the economy added 114,000 new jobs in July, lower than the consensus estimate of 175,000. Unemployment, which was expected to remain at 4.1%, rose to 4.3%. While this is still relatively low compared to history, it is the highest rate of unemployment we’ve seen since the pandemic (and mid-2017 before that).

One reason economists are concerned about this increase in unemployment is an economic indicator known as the Sahm rule, shown in the accompanying chart. The Sahm rule, named after a former Fed economist, predicts the onset of recessions based on the trend in unemployment. The simple intuition is that a sudden jump in the unemployment rate is highly correlated with economic downturns. In fact, the very definition of a recession depends on the state of the job market.

The jobs report for July has officially triggered the Sahm rule, suggesting that the current unemployment rate is consistent with the historical pattern of recessions. However, it’s important to keep in mind that immigration and higher labor force participation, both positive factors, were key drivers in rising unemployment. Additionally, Sahm herself has stated that this is more of a “historical regularity” and not a hard-and-fast physical law. In other words, with unemployment still near historic lows, a rise in unemployment to 4.3% should be watched carefully but does not necessarily mean a recession is imminent.

Regardless, both sides of the Fed’s mandate – maximum employment and stable prices – now point strongly to a September rate cut. Investors are now worried that the Fed has waited too long to cut rates.

Whether this is the case has yet to be seen. There have been several historical instances that could be called “soft landings.” Perhaps the most notable occurred from 1994 to 1995 under Fed chair Alan Greenspan when the Fed doubled the federal funds rate from 3% to 6%. Inflation remained under control and the economy continued to grow, avoiding a recession.

Despite the positive outcome, this was a harrowing time for investors since it resulted in the worst bear market for bonds up to that point. However, it’s clear that the outcome was positive in the long run, since it set up the conditions for stocks and bonds to continue their long bull runs.

Historical hard landings, on the other hand, have often been the result of policy missteps rather than just sub-optimal timing. The Great Depression, for instance, was worsened by the Fed’s decision to tighten monetary policy at a time when expansion was needed. Similarly, the high inflation of the 1970s can be attributed to the Fed's overly accommodative stance when prices were rising rapidly. In both instances, the Fed’s actions were essentially the opposite of what economic conditions required, underscoring how severe policy mistakes can be.

Where does the Fed stand today? Very few argue that the Fed has made the wrong moves per se – just that they have not timed them well. While many may wish the Fed had cut rates at its last meeting, it is likely they will do so soon.

Investing is about both returns and managing risk

Past performance is not indicative of future results

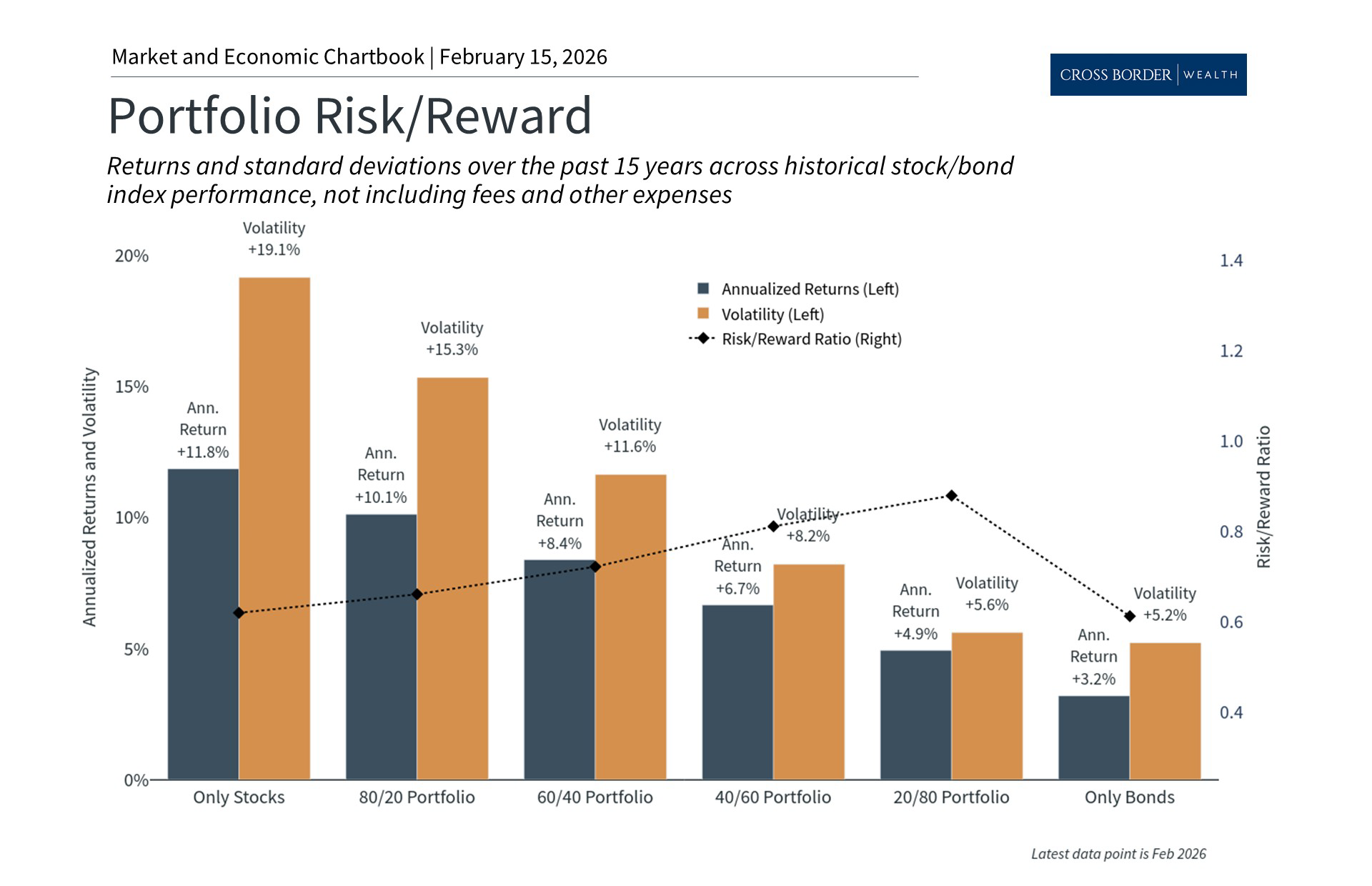

Investing is never a sure thing. In the classic book “A Random Walk Down Wall Street,” author Burton Malkiel writes that “the stock market is like a gambling casino where the odds are rigged in favor of the players.” Investing in the stock market comes with many risks that can be managed with proper portfolio construction and a long time horizon. History shows that despite the ups and downs of the market, staying invested is still the best way to grow wealth and achieve financial goals over the course of decades.

Stocks never move up in a straight line, so how we react to market volatility is perhaps more important than the volatility itself. The S&P 500 has now experienced its second 5% or worse pullback this year. As the accompanying chart shows, this is below the average of 4 to 5 pullbacks experienced in the average year, and the dozens during bear markets.

Additionally, current market concerns driven by tech stocks, the Fed, and the labor market all have their silver linings. The economy is still quite healthy, corporate earnings are still growing, and if interest rates do sustainably fall, many other parts of the market could benefit. As in past episodes of volatility, seeing past the current market moves and headlines is needed to benefit from the long-term trend.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.