Trust as Beneficiary of Traditional IRA or Retirement Plan

- US Pensions

- 12 mins

A trust is a legal entity that you can set up and use to hold property for the benefit of one or more individuals (the trust beneficiaries). Every trust has one or more trustees charged with the responsibility of (1) managing the trust property, and (2) distributing trust income and/or principal to the trust beneficiaries according to the terms of the trust agreement. (A trustee can be an individual or an institution, such as a bank.) Many different types of trusts can be used to achieve a variety of objectives.

You may be able to designate a trust as beneficiary of your IRA or employer-sponsored retirement plan, if the IRA custodian or plan administrator allows such a designation. If the trust meets certain requirements, the beneficiaries of the trust can be treated as the designated beneficiaries of the IRA or retirement plan for purposes of calculating the distributions that must be taken following your death (required post-death distributions).

Caution: This discussion applies to qualified employer-sponsored retirement plans and traditional IRAs, not to Roth IRAs. Special considerations apply to beneficiary designations for Roth IRAs.

Caution: Employer-sponsored qualified plans may require that you designate your spouse as beneficiary, unless your spouse signs a waiver allowing you to name a different beneficiary.

Naming a trust as beneficiary usually will not affect required minimum distributions during your life

Under federal law, you must begin taking annual required minimum distributions (RMDs) from your traditional IRA and most employer-sponsored retirement plans [including 401(k)s, 403(b)s, 457(b)s, SEPs, and SIMPLE plans] by your "required beginning date" — April 1 of the calendar year following the calendar year in which you reach age 72.

With employer-sponsored retirement plans, you can delay your first distribution from your current employer's plan until April 1 of the calendar year following the calendar year in which you retire if (1) you retire after age 72, (2) you are still participating in the employer's plan, and (3) you own 5 percent or less of the employer.

Your choice of beneficiary generally will not affect the calculation of your RMDs during your lifetime. An important exception exists, though, if your spouse is your sole designated beneficiary for the entire distribution year, and he or she is more than 10 years younger than you. The same exception may also apply if you name a trust as your sole beneficiary, and the sole beneficiary of the trust is your spouse who is more than 10 years younger than you.

If you name a trust as your beneficiary, the beneficiaries of the trust may be treated as the IRA or plan beneficiaries for purposes of required post-death distributions. See below for additional information.

Caution: If a trust is a designated beneficiary, all beneficiaries of the trust are considered in determining the oldest beneficiary. The only exception is an individual whose benefit is contingent on another beneficiary dying prior to the payout of the entire IRA or plan balance. For beneficiaries inheriting from a decedent dying after 2019, the life expectancy method can only be used for eligible designated beneficiaries (see below). It is unclear if a trust (other than certain trusts for disabled or chronically ill beneficiaries) can use the life expectancy method if the trust has beneficiaries other than one eligible designated beneficiary.

Caution: The calculation of RMDs is complex, as are the related tax and estate planning issues. For more information, consult a tax professional or estate planning attorney.

What rules must be followed for a trust beneficiary to qualify as a designated beneficiary?

Caution: The SECURE Act ushered in a new set of rules establishing what's known as an eligible designated beneficiary (EBD). Although the Act did not change the definition of a designated beneficiary (DB), the IRS has not yet clarified how the new rules will specifically apply to beneficiaries of trusts. The distinction between an EBD and a DB matters significantly in determining the rules surrounding distributions. See note below under "A trust beneficiary can be treated as the IRA or retirement plan beneficiary." An EDB is a beneficiary who meets at least one of the following criteria: the account owner's surviving spouse; the account owner's child who is under the age of majority (18, in most cases — once the child reaches the age of majority, he/she is no longered considered an eligible designated beneficiary); a disabled or chronically ill individual, as defined by the IRS; someone not more than ten years younger than the account owner. For more information, consult a tax professional or an estate planning attorney.

Certain special requirements must be met in order for an underlying beneficiary of a trust to qualify as a designated beneficiary of an IRA or retirement plan. The beneficiaries of a trust can be designated beneficiaries under the new IRS distribution rules only if the following four trust requirements are met in a timely manner:

- The trust beneficiaries must be individuals clearly identifiable (from the trust document) as designated beneficiaries as of September 30 following the year of your death.

Caution: Final IRS regulations state that trust beneficiaries may not use the "separate account" rules that might otherwise allow each beneficiary to use his or her life expectancy when calculating required post-death distributions. You may need to establish separate trusts for each beneficiary to accomplish this goal. Consult an estate planning attorney.

- The trust must be valid under state law. A trust that would be valid under state law, except for the fact that the trust lacks a trust "corpus" or principal, will qualify.

- The trust must be irrevocable, or (by its terms) become irrevocable upon the death of the IRA owner or plan participant.

- The trust document, all amendments, and the list of trust beneficiaries (including contingent and remainder beneficiaries) must be provided to the IRA custodian or plan administrator by the October 31 following the year of your death.

Caution: There is an exception to the above deadline in cases where the sole beneficiary of the trust is your spouse who is more than 10 years younger than you, and you want to base lifetime RMDs on joint and survivor life expectancy. In this case, trust documentation should be provided before lifetime RMDs begin.

In addition to these requirements, a surviving spouse will not be considered the sole beneficiary of a trust if any of the IRA or plan funds in the trust can be accumulated during the surviving spouse's lifetime for the benefit of remainder beneficiaries.

Caution: You should consult an estate planning attorney regarding the above requirements, as a mistake may prove costly.

Advantages of naming a trust as beneficiary

A trust beneficiary can be treated as the IRA or retirement plan beneficiary

As mentioned, if you name a trust as beneficiary of your IRA or plan and meet certain requirements, the individuals named as beneficiaries of the trust can be treated as the designated beneficiaries of the IRA or plan. This is significant because it typically allows you to provide the individual trust beneficiaries with the same post-death options they would have if you named them directly as the IRA or plan beneficiaries. These individuals will generally have the opportunity to calculate post-death distributions using the life expectancy method (provided that the IRA custodian or plan administrator permits this method, and that the beneficiaries are eligible designated beneficiaries), potentially stretching distributions over many years. A longer post-death payout period will spread out the beneficiaries' income tax liability on the funds and prolong tax-deferred growth in the IRA or plan.

One situation in which naming a trust as the IRA or plan beneficiary will limit post-death distribution options is when you want to provide for your surviving spouse. In this case, naming your spouse directly as IRA or plan beneficiary is generally a better strategy for income tax planning purposes (but maybe not death tax planning purposes) than naming a trust that has your spouse as beneficiary.

Caution: If the life expectancy method is used, post-death distributions must begin no later than the December 31 following the year of your death, and must be based on the single life expectancy of the oldest beneficiary of the trust (i.e., the one with the shortest life expectancy).

Caution: If the trust you have designated as IRA or plan beneficiary is not properly designed, you may be treated as if you died without a designated beneficiary. That would likely limit the payout period for post-death distributions, in many cases considerably.

Note: For decedents dying after 2019, the life expectancy method can only be used if the designated beneficiary is an eligible designated beneficiary. An eligible designated beneficiary is a designated beneficiary who is the spouse or a minor child of the IRA owner or plan participant, a disabled or chronically ill individual, or other individual who is not more than ten years younger than the IRA owner or plan participant (such as a close-in-age sibling). Special rules apply in the case of certain trusts for disabled or chronically ill beneficiaries. In any other case, it is unclear if a trust can use the life expectancy method if the trust has beneficiaries other than one eligible designated beneficiary.

Naming a trust can allow you to retain control after your death

When you designate one or more individuals directly as beneficiaries of your IRA or retirement plan, after your death, those individuals are generally free to do with the inherited funds as they please. This could mean, among other things, withdrawing all of the funds in one lump sum and incurring a large income tax bill. However, you can retain some control over the funds after your death by setting up a trust for the benefit of your intended beneficiaries, and then naming that trust directly as beneficiary of your IRA or plan. Your intended beneficiaries will still receive the IRA or plan funds after you die, but generally according to your wishes as spelled out in the trust document, provided IRS rules are followed. This often gives you the ability to control the timing and amounts of distributions, preventing your children or other trust beneficiaries from squandering the funds.

Caution: In some cases, the tradeoff for receiving tax benefits may involve following IRS rules on distributions instead of completely designing your own distribution provisions for your trust. Also, income that is retained in a trust and not paid out to beneficiaries may be heavily taxed for income tax purposes.

Assets held in a trust may be protected from creditors

IRA or retirement plan funds left to a properly drafted trust for the benefit of your intended beneficiaries may enjoy considerable protection against their creditors, at least as long as those funds remain in the trust. In fact, leaving retirement assets to your beneficiaries via a trust will often provide greater creditor protection than if you left those assets directly to your beneficiaries. This can be a major advantage if one or more of your beneficiaries has substantial unsecured debts. Consult an estate planning attorney for further details, and to find out what type of trust will provide the most creditor protection.

A QTIP trust for your spouse may be beneficial

A qualified terminable interest property (QTIP) trust is a type of marital trust that allows you to provide for your surviving spouse during his or her lifetime, defer estate tax at your death, and control who the ultimate beneficiaries will be. If you name this type of trust as the beneficiary of some or all of your retirement assets, your spouse will receive distributions during his or her lifetime and, to the extent the entire account is not consumed, the balance may be left to your children and/or other beneficiaries. Retirement plan assets left to this type of trust are not subject to estate tax at your death, but the remaining assets will be included in your spouse's taxable estate at his or her death. Consult an estate planning attorney for further details.

Caution: To use a QTIP, your spouse must be a U.S. citizen. If your spouse is not a U.S. citizen, a special type of trust known as a qualified domestic trust (QDOT) may be appropriate. With a QDOT, as with a QTIP, all trust income is paid to your surviving spouse during his or her lifetime. However, unlike a QTIP where remaining trust assets are included in the surviving spouse's estate at his or her death for estate tax purposes, the assets will be taxed in the first spouse's estate at the surviving spouse's death or upon the earlier withdrawal of principal. Consult an estate planning attorney for further details.

A credit shelter trust may be beneficial

In some cases, you may want to name a certain kind of estate-tax-saving trust as the beneficiary of some or all of your IRA or retirement plan assets. This type of trust goes under many names, including "credit shelter trust," "B trust," "bypass trust," and "exemption trust." The size of the trust is usually tied to the size of the federal applicable exclusion amount.

The purpose of this type of trust generally is to allow your spouse (or other trust beneficiaries) to benefit from the assets placed in the trust, but to exclude those assets from estate tax, not only at your death, but also at your surviving spouse's death. Consult an estate planning attorney for further details.

Caution: If too much or all of your estate goes into this type of trust under the increasing applicable exclusion amount, then your surviving spouse may not be adequately provided for, unless you have specific provisions added to the trust document.

Caution: Since this type of trust may be forever exempt from estate tax, you may not want to diminish its value by funding it with retirement assets that are subject to income tax. If possible, other assets might be more appropriate sources of funding for the trust.

Caution: This may not be the proper strategy for some married couples. A tax law passed in 2001 replaced the state death credit with a deduction starting in 2005. As a result, many of the states that imposed a death tax equal to the credit decoupled their tax systems, imposing a stand-alone death tax. Many of these states allow an exemption that is less than the federal exemption. This may leave some couples vulnerable to higher state death taxation. See your financial professional for more information.

Tip: In 2011 and later years, the unused basic exclusion amount of a deceased spouse is portable and can be used by the surviving spouse. Portability of the exclusion may provide some protection against wasting of the exclusion of the first spouse to die and reduce the need for a credit shelter or bypass trust.

Disadvantages of naming a trust as beneficiary

Naming a trust for the benefit of your spouse may limit post-death options

If you want to provide for your spouse after your death, you can set up a trust for the benefit of your spouse, and then name that trust directly as beneficiary of your IRA or retirement plan. Your spouse, as beneficiary of the trust, could then be considered an eligible designated beneficiary of the IRA or plan (as long as all of the above requirements are met). However, think carefully and seek professional advice before making this beneficiary choice. The use of a trust may limit or rule out certain post-death options that would otherwise be available to your spouse if he or she were named directly as beneficiary of the IRA or plan.

For example, under the minimum required distribution rules, your spouse would lose the right to treat an inherited IRA as his or her own account (even if your spouse were the sole beneficiary of the trust). If you want your spouse to ultimately receive your IRA or plan assets, the best way to achieve this goal is typically to directly name your spouse as beneficiary of those assets (unless there are specific reasons for using a trust instead). Naming your spouse as primary beneficiary provides greater options and maximum flexibility in terms of post-death distribution planning.

Caution: Nonspouse beneficiaries cannot roll over inherited funds to their own IRA or plan. However, a nonspouse beneficiary can make a direct rollover of certain death benefits from an employer-sponsored retirement plan to an inherited IRA (traditional or Roth).

Trusts can be complicated and costly to set up

Setting up a trust can be expensive, and maintaining it from year to year can be burdensome and complicated. So, the cost of establishing the trust and the effort involved in properly administering the trust should be weighed against the perceived advantages of using a trust as an IRA or retirement plan beneficiary. In addition, remember that if the trust is not properly drafted, you may be treated as if you died without a designated beneficiary for your IRA or plan. That would likely shorten the payout period for required post-death distributions. Provisions of your trust need to take into account laws regarding the payout of trust income in connection with estate tax planning issues. Also, funding a trust that is exempt from death tax (e.g., credit shelter trust) with assets that have a built-in income tax liability reduces the net amount really in this trust.

Also, depending on the purpose of the trust and other factors, a trust may not be worthwhile. Depending on the size of your estate and the amount of the estate tax exemption in the year of your death, using a trust for estate tax purposes may or may not make sense. Consult an estate planning attorney for further guidance.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

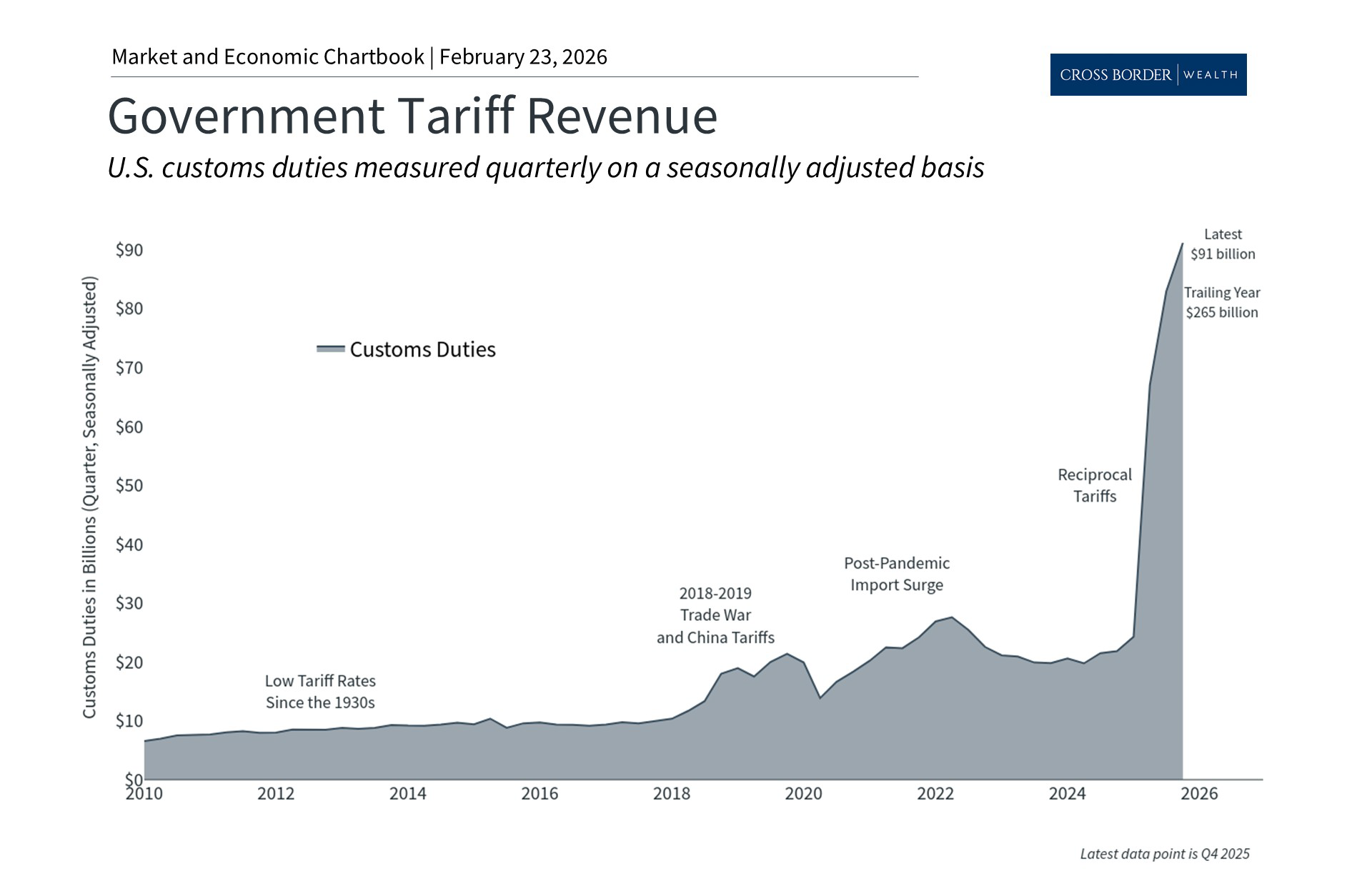

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.