What Is the Role of Gold in a Portfolio?

- Market Insights

- 5 mins

To say that the past six months have been a rollercoaster ride for investors would be an understatement. With the pandemic resulting in the first global recession since 2008, the stock market crashing then swiftly recovering, and the impact of the nationwide shutdown on our everyday lives, it's understandable that many investors would prefer stability and safety.

Thus, it's no surprise that the price of gold has risen to its highest level since 2011. In this context, it's especially relevant for investors to understand how gold can be an important supporting cast member rather than the center of attention.

Gold can serve at least two important but different investment purposes. First, as a precious metal with consumer and industrial uses, the value of gold can rise over time due to limited supply but steadily increasing demand. As a result, it can serve as a store of value when the world is uncertain and can also protect against inflation as the economy heats up or as central banks increase stimulus, as they have done this year.

Indeed, much of the rise in gold prices over the past two decades occurred during the global financial crisis as the Fed grew its balance sheet and amid the ensuing global challenges. Not only did the price of gold increase immediately after 2008, but it rose during the Eurozone crisis and peaked in 2011 when the U.S. debt was downgraded.

It's clear that many investors flock to gold for safety when markets get choppy. In many ways, this is no different from how some investors view cash - as a market timing tool to protect them from short-term stock market gyrations. However, it's important to distinguish between gold as a one-off investment and as a part of a portfolio tailored to achieve financial goals.

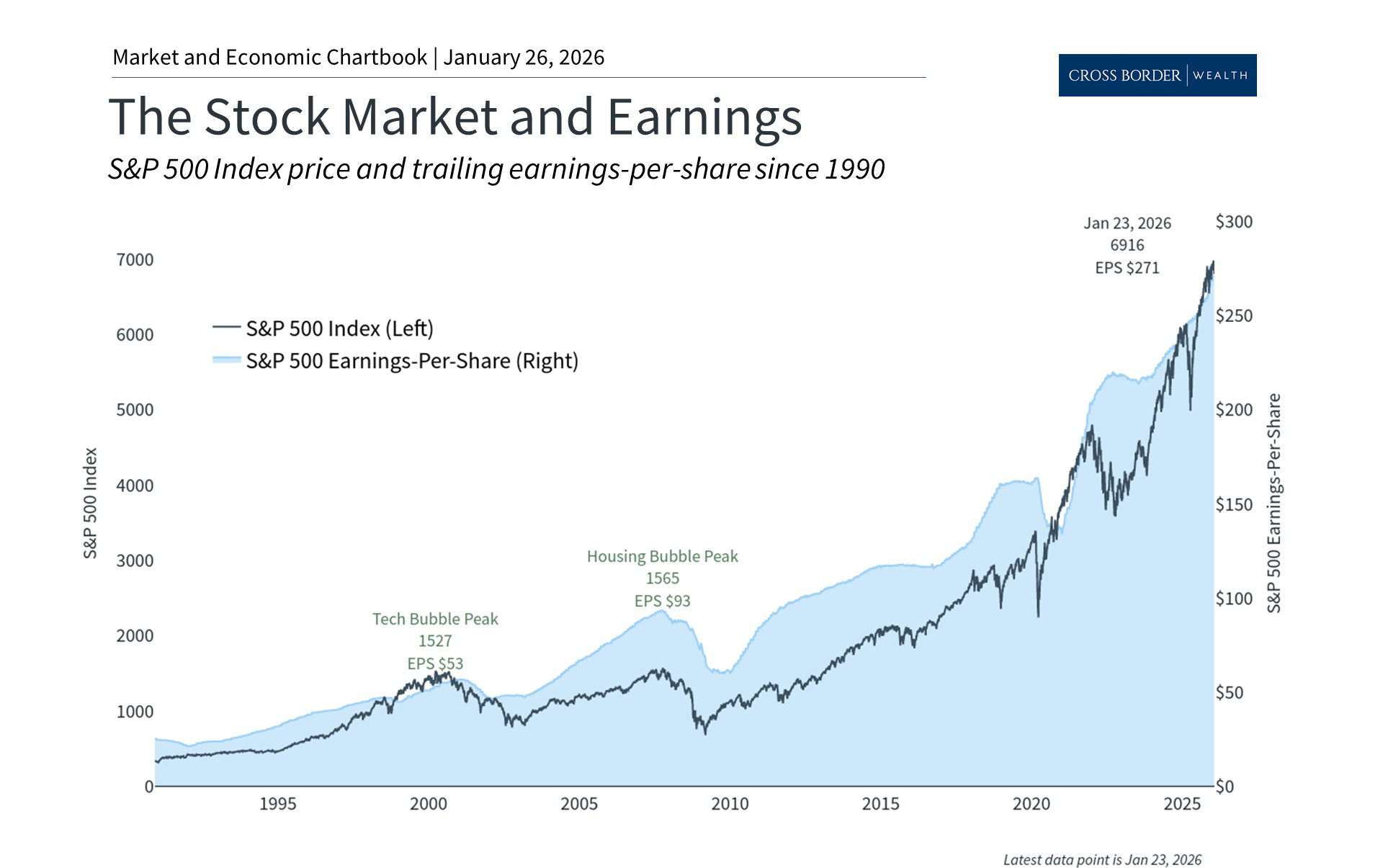

Thus, the second and more important purpose of gold is to help diversify portfolios, especially in times of financial distress. The relationship between gold and the stock market since 2008 makes this fairly clear. Although gold outperformed stocks during the global financial crisis as expected, it fell in value and flat-lined for years while the stock market was climbing to new record highs. More recently, gold prices have increased due to the pandemic and ensuing economic shutdown. But while stock prices have been volatile, they have staged a recovery as well.

This means that while stocks are slightly ahead of gold when tracing their performance back to their 2007 peaks, they have taken very different routes. To experienced investors, this is a tell-tale sign that holding these assets with the right proportions in a portfolio can help create a smoother ride across market cycles.

The relationship between interest rates and gold show a familiar pattern as well - gold prices have tended to rise as interest rates fall. Thus, gold prices have behaved similarly to bond prices - yet more reason to believe that gold is better suited as a portfolio diversifier than as a standalone investment.

Although gold can play an important role, why are stocks and bonds still the primary asset classes for most investors? For those investors that need income, gold does not generate yield or pay interest. So, while it can protect investors from short-term uncertainty, especially when the Fed is involved, it may not help with other income needs. For those investors who need growth, the stock market simply has a much longer track record of creating long-term wealth. Gold might protect wealth in times of uncertainty, but it will do little to create it.

One last important note is that gold itself can be extremely volatile. In particular, for those investors worried about stock market volatility, short-term movements in gold can be as bad or worse. For instance, gold prices began to plummet in late 2012 when the global economy began to heat up. The Fed was still expanding its balance sheet and interest rates would still be at zero percent for 3 more years. Just as with the stock market, movements in gold may run counter to expectations.

Ultimately, the choice to invest in gold - or any individual asset - should be viewed in the context of a diversified portfolio and long-term financial goals. Here are three charts on this frequently-asked investor topic:

1. The COVID-19 crisis continues to create market uncertainty

U.S. States and COVID-19

Find this chart under "Public Health"

Although many early hot spots for the novel coronavirus have managed to control the pandemic, other states are now seeing an acceleration in new confirmed cases. Financial markets have been volatile as a result of this on-going uncertainty.

2. Gold can serve as a stock market diversifier

Gold and the Stock Market

Find this chart under "Gold"

Gold and the stock market have performed quite differently since 2007. Gold, like many types of bonds, did offset much of the market volatility experienced during the financial crisis in 2008. However, stocks have risen steadily since then, even in 2020 as the COVID-19 crisis rages on.

Also, unlike gold, stocks pay dividends which provide income over time. Reinvesting those dividends has resulted in stocks outpacing gold over the past ten years. Thus, both can serve as important components of a diversified portfolio.

3. Gold can serve as a store of value when interest rates fall

Gold and Interest Rates

Find this chart under "Gold"

Gold and interest rates are intimately connected. Gold can be less attractive when real interest rates are high and it's possible to generate significant investment income. The opposite is also true - gold can be attractive when inflation is rising, real interest rates are falling, or when there is significant market uncertainty. This has been true over the past several months as global interest rates have plummeted and bond prices have risen.

The bottom line? Gold can serve as an important component of a diversified portfolio. However, it should be held alongside other major asset classes to create a smoother ride toward long-term financial goals.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.