7 Insights to Guide Investors in the Second Half of 2020

- Market Insights

- 7 mins

During the first half of 2020, investors experienced a global pandemic, an economic shutdown, the end of an eleven-year bull market, and now the early stages of an economic reboot. The U.S. stock market has experienced large swings in both directions, rising 20% in the second quarter after falling 20% in the first. Interest rates have remained low, especially with the Fed continuing to provide stimulus. With all that has happened in such a short amount of time, it's important to reflect on what we have learned and what may lie ahead.

The irony is that as we begin the second half, the S&P 500 is only a few percentage points from where it started the year. While this recovery happened unusually swiftly, and we're certainly not out of the woods yet, it is further evidence that staying invested and maintaining a long-term focus are core principles of investing to achieve financial goals.

Staying disciplined is difficult and often requires sound guidance and advice. As recently as March, it was unclear whether the novel coronavirus could be adequately contained. As the country was shut down, it was uncertain whether individuals and businesses would survive without paychecks and customer activity. As credit spreads widened, there was a fear that bankruptcies and defaults would ripple across the financial system, leading to a 2008-style crisis. Finally, it was unclear when and how the economy could reopen, and if it did, whether consumers and businesses would feel confident enough to spend.

Fortunately, we've learned a great deal since then. While we are still in the earliest stages with many more negative data points to come, there are clear signs that bouncing back is possible. Jobless claims and unemployment are still near historic levels, but have begun to come down steadily. Consumer spending has picked up as cities have reopened, although overall confidence is still low. Industrial activity has thawed as factories fire up again across the country. Credit markets have stabilized despite some large restructurings. Many parts of the stock market have fully recovered.

None of this is to say that the economic recovery will be easy. This is especially true in parts of the country that have seen a resurgence of COVID-19 cases and in industries that are deeply impacted by social distancing including restaurants, travel, retail and more. And while there are signs that customers are returning to these establishments, limited capacity will mean that the jobs that have been lost are increasingly at risk of becoming permanent.

Despite this, there have been companies that have not only survived the crisis, but have thrived. This is especially the case with technology companies across sectors. Not only has telecommuting and video conferencing become the norm for office workers, but the shift to online retail has accelerated. This is one reason that some sectors of the stock market have not only recovered from pre-crisis levels, but have achieved new highs.

Thus, investors should set proper expectations about the recovery going forward. Many economic forecasts, including by the Fed, expect a strong rebound in the second half of the year, but not enough to stem negative growth for 2020 overall. In fact, most economists and business leaders expect conditions to be uncertain until the end of 2021, at the earliest. While this partly depends on public health developments, including the possibility of a vaccine or other treatments, it also speaks to the severity of the economic crisis.

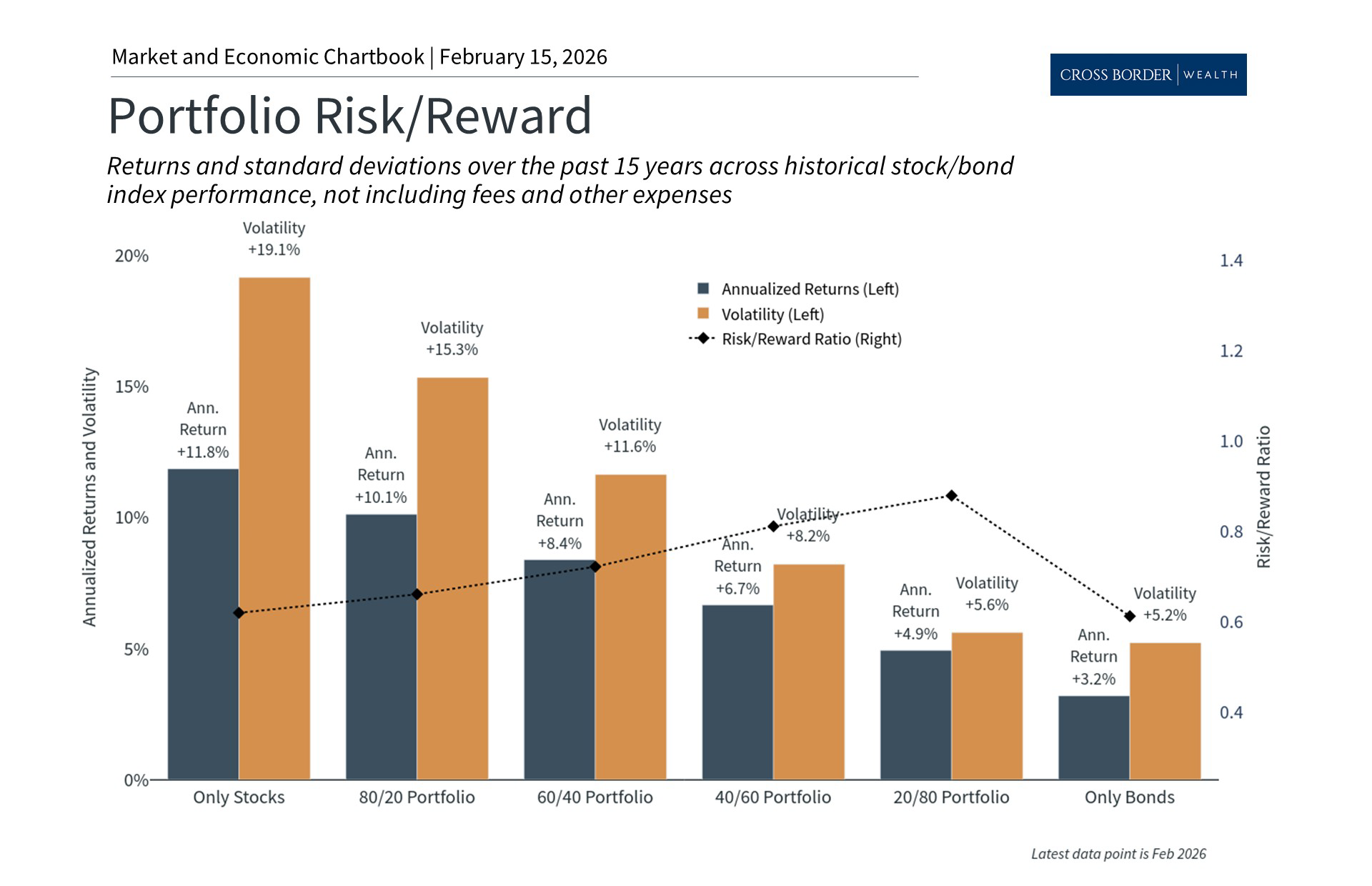

Thus, as is always the case, long-term investors should continue to be disciplined and patient. Holding a diversified portfolio has not only been the best way to weather this particular storm, but has been the way to do so across history. With so much uncertainty in the world during the second half of the year amid the pandemic, presidential election, trade disputes, and other factors, staying balanced still the best way to achieve financial goals.

Below are seven key insights and trends for investors to follow in the second half of the year.

1. The COVID-19 crisis continues to create economic uncertainty

U.S. States and COVID-19

Find this chart under "Public Health"

When it comes down to it, the crisis is rooted in public health. Although many early hot spots for the novel coronavirus have managed to control the pandemic, other states are now seeing an acceleration in new confirmed cases. Financial markets have been volatile as these patterns call into question the ability for the economy to reopen smoothly.

2. Still, there are early signs of an economic recovery

Citi Economic Surprise Index

Find this chart under "U.S. Economy"

Although the economic data is still generally negative - which will also be the case for Q2 GDP when it is released - there are also signs that a bounce-back is possible. Many new data points have shown that unemployment is stabilizing and that consumers are beginning to open their wallets again. While it will take time to reach pre-crisis levels of growth, these are positive signs that a recovery is possible.

3. Unemployment is beginning to stabilize

Unemployment Rates

Find this chart under "Labor Market"

The job market has also shown very early signs of stabilizing after reaching record levels. Not only did the unemployment rate skyrocket to levels not seen since the Great Depression but weekly jobless claims show that nearly 20 million Americans are still out of work. The good news is that more recent data suggest that furloughed employees are being recalled and unemployment is slowly improving.

4. Consumer spending has picked up as well

Consumer Spending

Find this chart under "Consumer Spending"

One of the key considerations for the recovery is whether consumers will feel financially secure and comfortable enough to spend. After all, the national savings rate jumped to 33% while the country was on lockdown.

Fortunately, there are initial signs that consumers are feeling more confident. Retail sales have bounced from their recent lows, especially for online digital retailers. This will be important as the recovery continues since consumer spending is the foundation of the economy.

5. The Fed and Congress will keep stimulating the economy

Federal Funds Rate

Find this chart under "Global Central Banks"

Although government support is a controversial topic for many, actions by the Federal Reserve and emergency legislation by Congress arguably helped keep businesses and individuals on life support. Fed stimulus, in particular, helped to keep the financial system functioning smoothly, especially during the period when credit markets were unstable.

It's unclear what long-term consequences this historic level of government stimulus will bring. The Fed has projected that it will keep interest rates at zero percent through 2022. Only time will tell if they will shift their policy stance once the economy successfully comes out the other side.

6. Corporate earnings may take years to recover

S&P 500 Earnings Per Share

Find this chart under "Corporate Earnings"

The economic impact of the shutdown to the stock market is primarily through corporate earnings. Not only are earnings incredibly uncertain, but many companies stopped providing guidance. This creates challenges for understanding the outlook for profitability and market valuations.

Overall, estimates suggest that 2020 and possibly 2021 will be "lost years" for corporate earnings growth. However, this is well understood by investors at this stage. Rather than looking backwards at the impact of the COVID-19 crisis on corporate performance, investors should look forward at how profits will react once spending starts up again.

7. Stocks tend to rise with economic growth over the long run

Stocks Since the Great Depression

Find this chart under "U.S. Stock Market"

Ultimately, the last six months have been further proof that investors should focus on the long run. Not only does staying disciplined help investors to manage their portfolios, but it helps them to sleep well at night too.

Better yet, investors who held diversified portfolios during the crisis were likely well-positioned as the stock market became volatile and bond prices rose. These lessons will most likely be as true going forward as they have been historically.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.