Bitcoin, Copper, Gold, and Silver: A Portfolio Perspective

- Market Insights

- 5 mins

One of the biggest challenges for investors is balancing long-term goals with short-term market moves. This is just as true when financial markets are rallying as when they are struggling. New developments in the stock market, cryptocurrencies, commodities, and other asset classes naturally capture investor and media attention. This can create pressure to react to daily headlines and even lead to a fear of missing out.

As long-term investors have learned over the boom-and-bust cycles of the past several decades, there are no free lunches. This is why stocks, bonds, and other asset classes remain the foundation of portfolios since they can help investors achieve the balance of risk and reward they need to reach their financial goals. In contrast, short-term market exuberance, whether it’s for tech stocks or Bitcoin, can reverse quickly and without notice.

Thus, the key to successful investing lies not in trying to time these swings, but in constructing a portfolio that can benefit from different characteristics, while maintaining focus on long-term financial plans. After all, what truly matters isn’t whether your portfolio contains the investment everyone’s talking about this week, but whether you're able to retire comfortably, provide for your family, buy a house, or give to charitable causes.

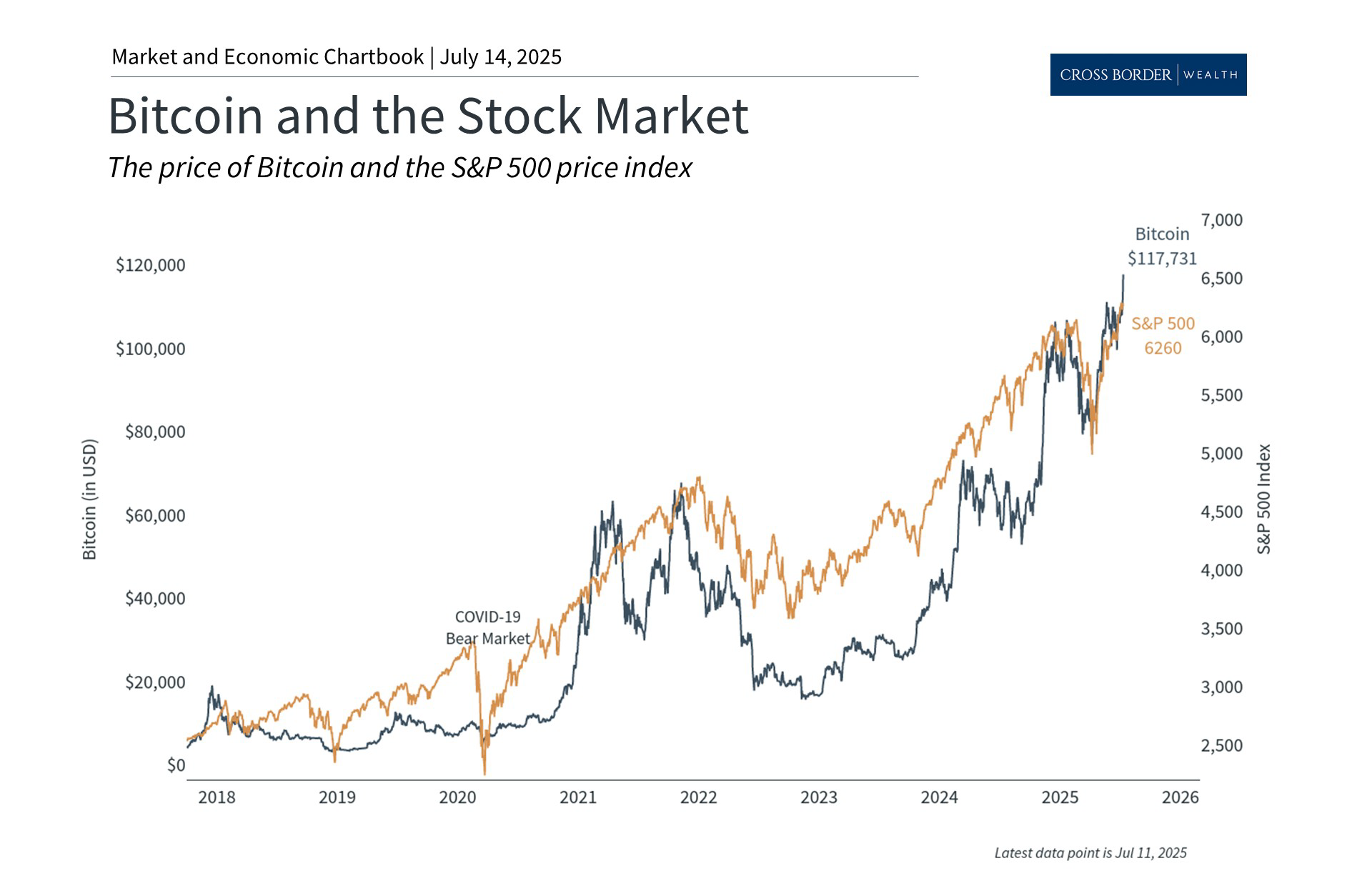

With Bitcoin surging to new all-time highs, copper reaching record levels, and precious metals such as gold and silver rising, investors face a tricky balancing act. The recent rallies in these assets reflect improving conditions that have lifted all asset classes, as well as specific policy changes in Washington and growing interest among institutional investors. How can investors maintain a portfolio perspective when considering these asset classes, rather than viewing them as standalone investments?

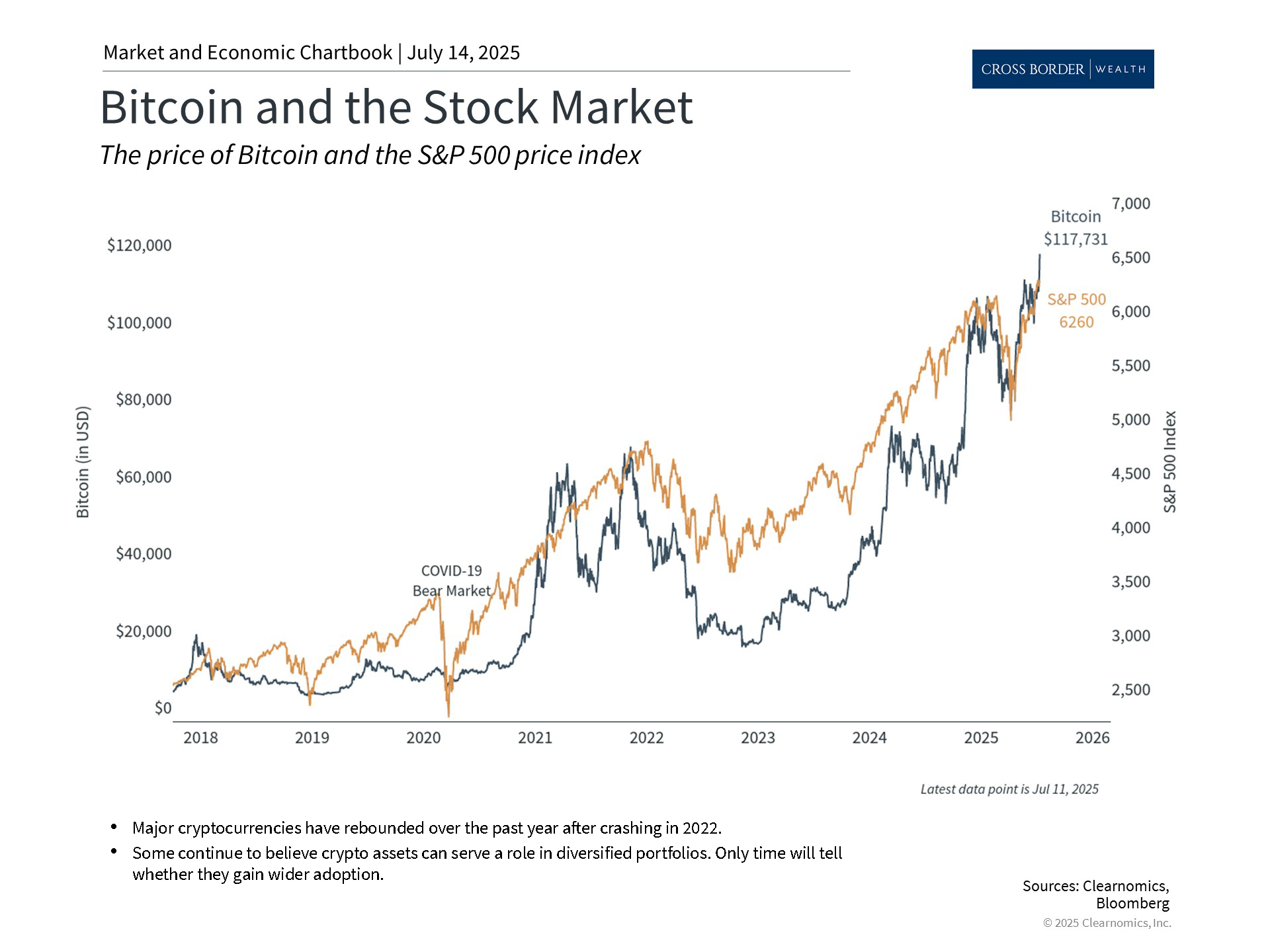

Bitcoin is prone to extreme swings

Past performance is not indicative of future results

Bitcoin has surged to new highs as Congress considers several cryptocurrency regulations during what is being called “Crypto Week.” In particular, the House of Representatives is looking at the GENIUS Act, which would regulate stablecoins, digital currencies designed to maintain their value which are often pegged to the U.S. dollar. It will also consider the CLARITY Act, which would provide a clearer framework for regulating cryptocurrencies, and the Anti-CBDC Surveillance State Act, which prevents the Federal Reserve from creating a digital currency.

In general, Bitcoin and other cryptocurrencies attract investor attention due to their extreme market moves, growing interest among institutional investors, new vehicles such as ETFs, and concerns over fiscal and monetary trends. Many of these topics are complex and speculative. For long-term investors, the most important question is whether cryptocurrencies can play important roles in portfolios.

Whether Bitcoin fits in a portfolio depends on your specific goals and risk tolerance. The reality is that Bitcoin experiences price fluctuations several times greater than the stock market. During the 2022 bear market, for example, Bitcoin fell over 75% while the S&P 500 declined about 25%. This demonstrates that digital currencies can amplify portfolio risk during times of market stress. Bitcoin did experience a stronger rebound, but as the chart above shows, the S&P 500 and Bitcoin have behaved similarly since 2018, albeit with different paths.

It’s also important to note that not all cryptocurrencies have experienced the same price movements as Bitcoin. Ethereum, another well-known cryptocurrency, is negative this year, and has declined about 25% from its high last December. There are also countless other cryptocurrencies and “meme coins” that have followed different paths. As always, it’s important to not react to headlines and to carefully consider these assets in a portfolio context.

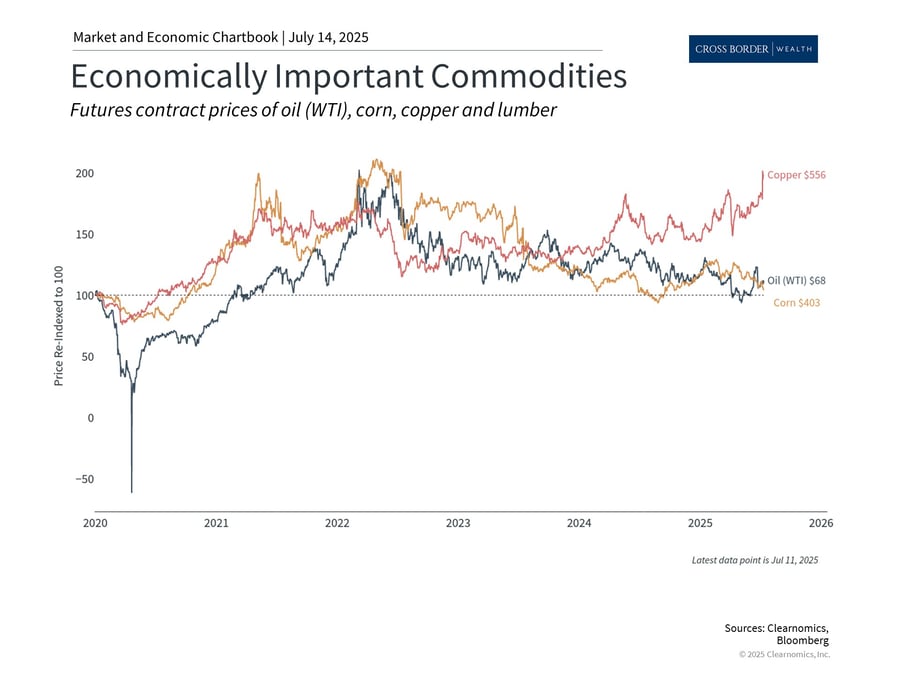

The copper rally reflects growth trends and tariffs

Past performance is not indicative of future results

Copper, another asset that has garnered recent media attention, surged to record highs following the White House announcement of 50% tariffs on copper imports.

Copper is vital to the economy, as an industrial metal essential to construction, electrical infrastructure, electronics, and renewable energy projects. For this reason, copper is often used as an economic indicator, sometimes known as "Dr. Copper," since its price movements are sometimes used to predict economic trends.

Today, the United States relies on imports for 45% of its copper consumption, primarily from Chile, Canada, Mexico, and Peru. Tariff policies may help to spur domestic production in the long run, but will also impact pricing and supply chains in the short run. Additionally, China's substantial copper use makes the metal sensitive to global economic conditions and trade relationships.

How does this affect investors? Like Bitcoin and other volatile assets, it’s important to distinguish between sharp price movements and whether an asset fits well within a portfolio. Trying to predict the next move for copper is akin to predicting the exact path of the economy and trade policy. Instead, investors should focus on whether copper and other assets help to improve the characteristics of their portfolios, alongside other economically-sensitive asset classes, including stocks.

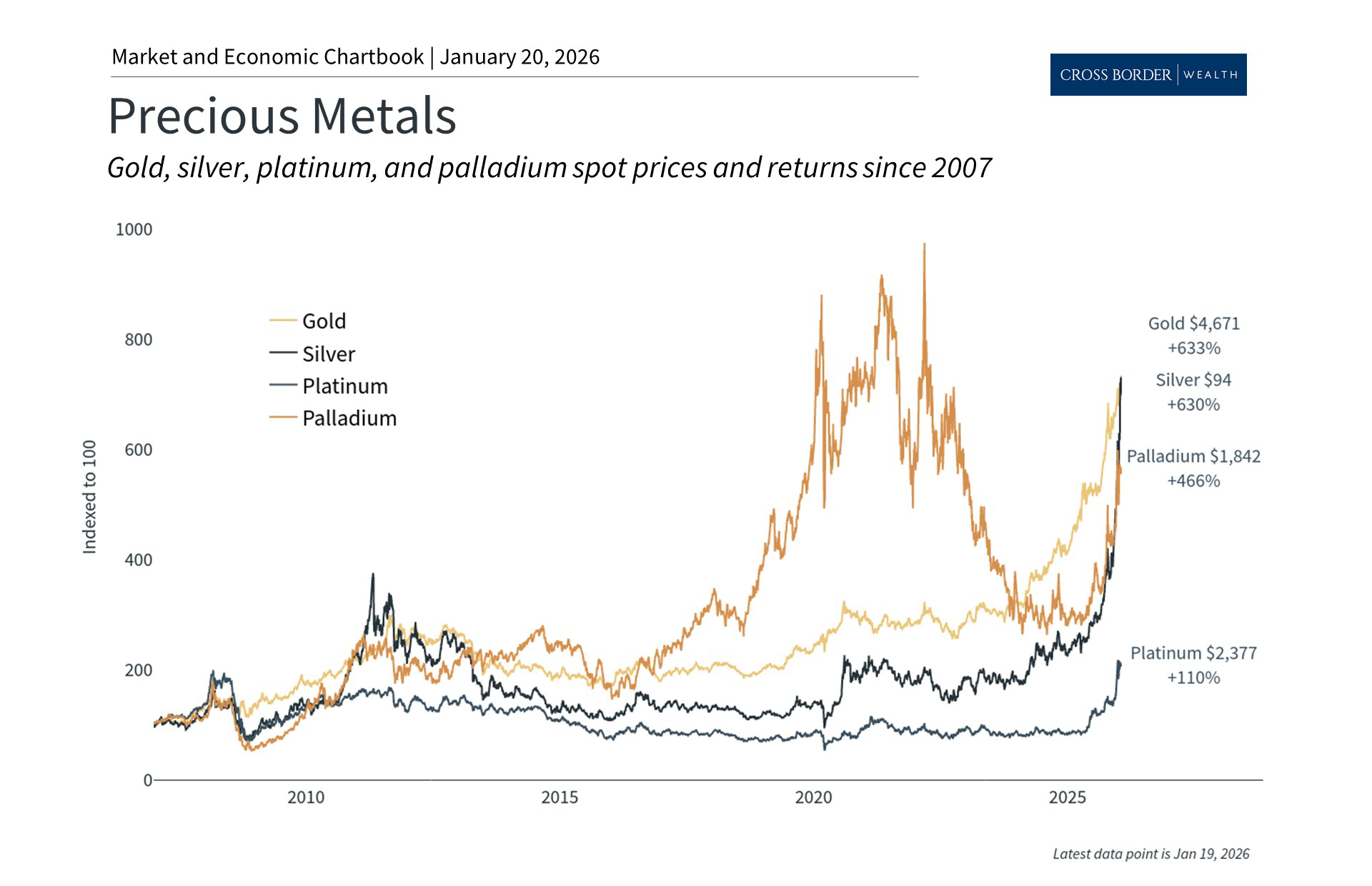

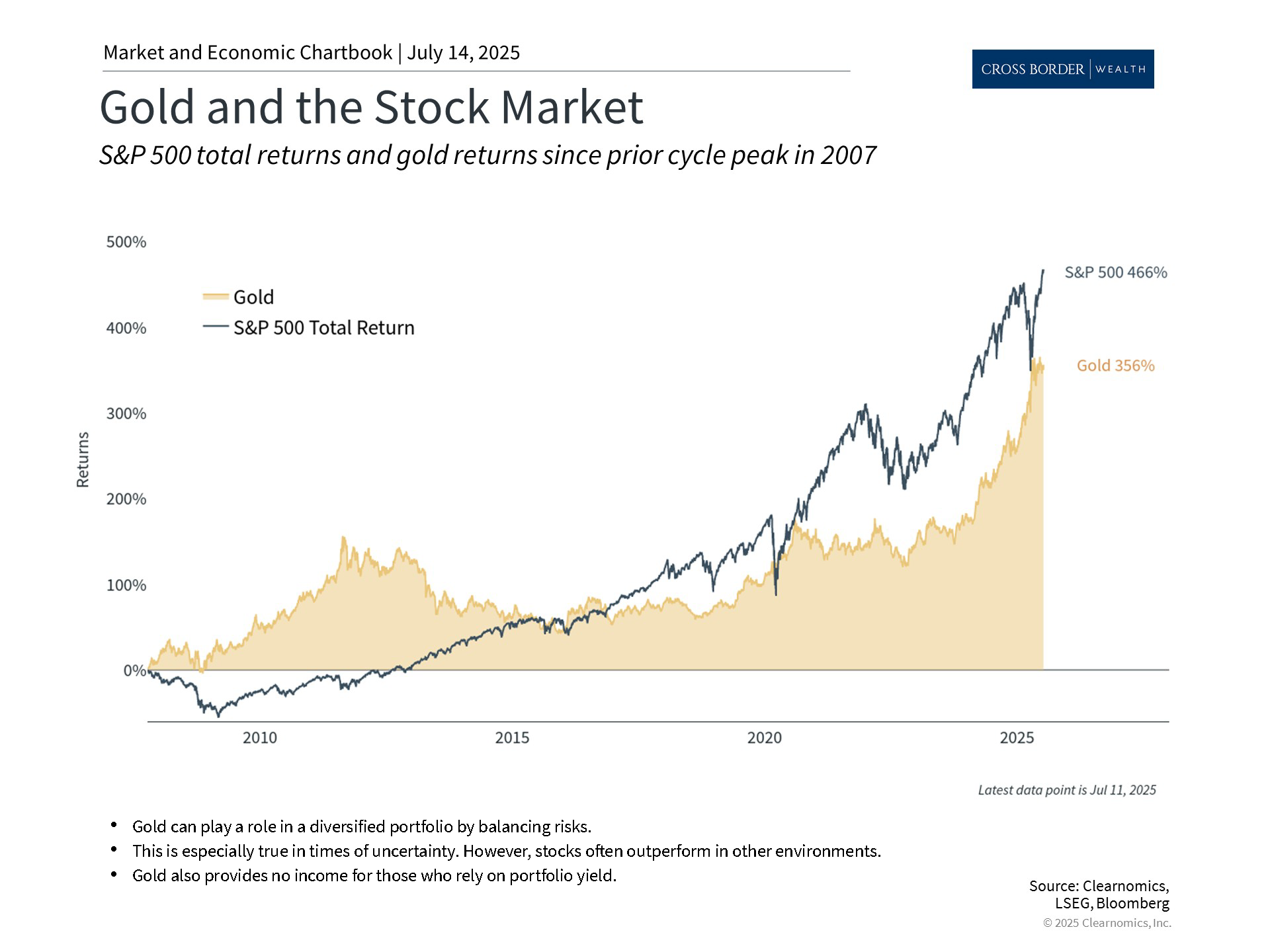

Precious metals like gold and silver have important considerations

Past performance is not indicative of future results

Gold and silver have also rallied recently, benefiting from their traditional roles as potential hedges against currency fluctuations, inflation concerns, geopolitical risk, central bank purchases, and more. In theory, gold and silver can also serve as a store of value during economic uncertainty although they face other challenges such as the fact that they do not generate income.

As the chart above shows, gold rose in value during periods such as the global financial crisis. However, over a longer period, the stock market has outpaced gold, even after its recent rally. During the 2010s, many expected gold to continue rising as the Fed kept interest rates low. The fact that this did not occur demonstrates how difficult and counterintuitive it can be to predict where gold will go next.

So, once again, what should matter to a long-term investor is their overall portfolio and whether it aligns with long-term financial goals. Assets like Bitcoin, copper, gold, and silver underscore both their potential benefits and the importance of thoughtful allocation decisions. At the very least, these assets should complement, not replace, diversified holdings in stocks, bonds, and other core asset classes.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.