Tax Deductions for State, Local, and Real Estate Taxes

- Global Wealth Management

- 6 mins

You may deduct on Schedule A certain state and local taxes. These taxes include state and local income taxes, real estate taxes, and personal property taxes. These taxes are deductible in the year you paid them. You may also deduct most foreign taxes. For 2018 to 2025, the deduction is generally limited to $10,000 ($5,000 for married individuals filing a separate return) in total for such taxes. The $10,000/$5,000 limit does not apply to taxes paid or incurred in carrying on a trade or business or an activity for the production of income. The limit also does not apply to foreign income tax.

State and local income taxes

You can deduct both state income taxes and local income taxes, such as city wage taxes. It doesn't matter whether you paid these taxes through withholding, estimated payments, or payments for prior-year returns. However, you may not deduct any interest and penalties paid on state and local income taxes.

Tip: Alternatively, a taxpayer can elect to take as an itemized deduction state and local general sales taxes in lieu of the itemized deduction provided for state and local income taxes. Taxpayers can deduct the total amount of state and local sales taxes paid by accumulating receipts showing general sales taxes paid, or taxpayers can use tables created by the Secretary of the Treasury. Taxpayers who use the tables can, in addition to the table amounts, deduct eligible general sales taxes paid on cars, boats, and other items specified by the Secretary. This deduction is available for tax years beginning after December 31, 2003.

Tip: The optional general sales tax tables described above are available in IRS Publication 600, State and Local General Sales Taxes. A sales tax deduction calculator is also available on the IRS website (www.irs.gov) to help you determine the amount that you can claim.

Caution: The IRS may disallow deductions for large estimated state income tax payments made solely to increase itemized deductions. You should base prepayment of estimated state income tax on tax liability.

Real estate taxes

The property owner gets the deduction

If you own real estate, you may claim a deduction for the real estate taxes you pay. If you are married, and you and your spouse file separate returns, only one of you (the spouse who actually pays the taxes) may claim the deduction.

Prepaid real estate taxes

You can generally deduct prepaid real estate taxes in the year of the prepayment if: (1) you are a cash basis taxpayer, and (2) you don't live in a jurisdiction where the taxing authority considers prepayment a "deposit." Jurisdictions vary regarding how they treat prepaid tax.

Caution: Be aware that taxes placed in escrow aren't deductible.

Tenant shareholders in cooperative housing

A tenant stockholder in a cooperative housing corporation (co-op) can deduct the portion of real estate taxes allocated to that individual if all of these conditions are met:

- The corporation has only one class of stock outstanding

- Each stockholder has the right (but isn't required) to occupy a dwelling unit based solely on his or her stock ownership

- No stockholder can receive any capital distribution unless the corporation liquidates

- The corporation must receive at least 80 percent of its gross income from the tenant stockholders

If you are a tenant stockholder in a co-op, your allocated amount of taxes paid by the corporation is based on your percentage ownership of the total shares outstanding. The co-op will likely issue a year-end statement showing the allocated amounts.

Real estate tax refunds and rebates

Refunds and rebates of your real estate taxes can affect the amount of your real estate deduction on Schedule A. If you receive a refund or rebate in the same year in which you are filing your federal income tax return, you will need to reduce your real estate deduction on Schedule A by the amount of the refund or rebate. If, however, you receive a refund or rebate this year for a past year's real estate taxes, you don't reduce your real estate deduction. Instead, you report the refund or rebate on the "Other Income" line of Form 1040, to the extent that you used those taxes as a deduction to reduce that past year's tax.

Form 1099-S for real estate sales

When real estate is sold, the person responsible for reporting real estate transactions (the attorney, for example) files Form 1099-S. Box 5 shows the amount of real estate tax charged to the buyer at settlement. It should equal the part of the tax from the closing date through the end of the year.

If the seller already paid the real estate tax for the entire year, the deductible amount to claim on Schedule A can be calculated by subtracting the amount shown in box 5 from the total real estate taxes paid.

Tip: If the seller already deducted the real estate tax in a prior year, the amount in box 5 should be reported on the line for "Other Income" on Form 1040.

Principal/interest on special assessments

Principal and interest paid on special assessments are generally deductible as real estate taxes rather than interest. The table below outlines the circumstances in which you may claim a deduction for "special assessments."

Other things to note

You may deduct real estate taxes for all property that you own. You may not, however, deduct these taxes if you, as a property buyer, pay off your seller's delinquent real estate taxes.

Personal property taxes

You may deduct state and local personal property taxes that are based solely on the personal property's value and charged on an annual basis. A common type of personal property tax is a motor vehicle registration fee excise tax. Although these fees are for the privilege of registering and operating motor vehicles, they are a type of personal property tax. When these fees are based on a vehicle's value, they are deductible if they meet these three tests:

- The fee corresponds to a percentage of the property's value

- The fee is imposed on an annual basis, even if it is actually collected more or less frequently

- The fee is imposed on personal property

Caution: If the registration fee is based on weight, model, year, or horsepower rather than value, it is not a deductible personal property tax. If it is based partly on value and partly on another factor, you may deduct only the tax attributed to value.

Example(s): Rocky lives in a state that assesses an auto registration fee based entirely on value. He can consider the entire fee a deductible personal property tax. Bill, on the other hand, lives in a state that assesses a registration fee based on 1 percent of value, plus $0.50 per hundredweight. He will be able to deduct only that portion of the tax equal to 1 percent of his car's value.

Foreign taxes

Most taxes paid to a foreign country or U.S. possession are allowable either as an itemized deduction on Schedule A or as a credit against tax on Form 1040. Taking the credit is usually more advantageous. For 2018 to 2025, a deduction is not available for foreign real property taxes.

Nondeductible taxes

You may not deduct the following taxes on Schedule A:

- Federal income and excise taxes

- Social Security, Medicare, and Railroad Retirement taxes

- Custom duties

- Federal estate and gift taxes

- License fees (marriage, driver's, dog, trailer, boat)

- Parking tickets, speeding tickets, or other fines for violating the law

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

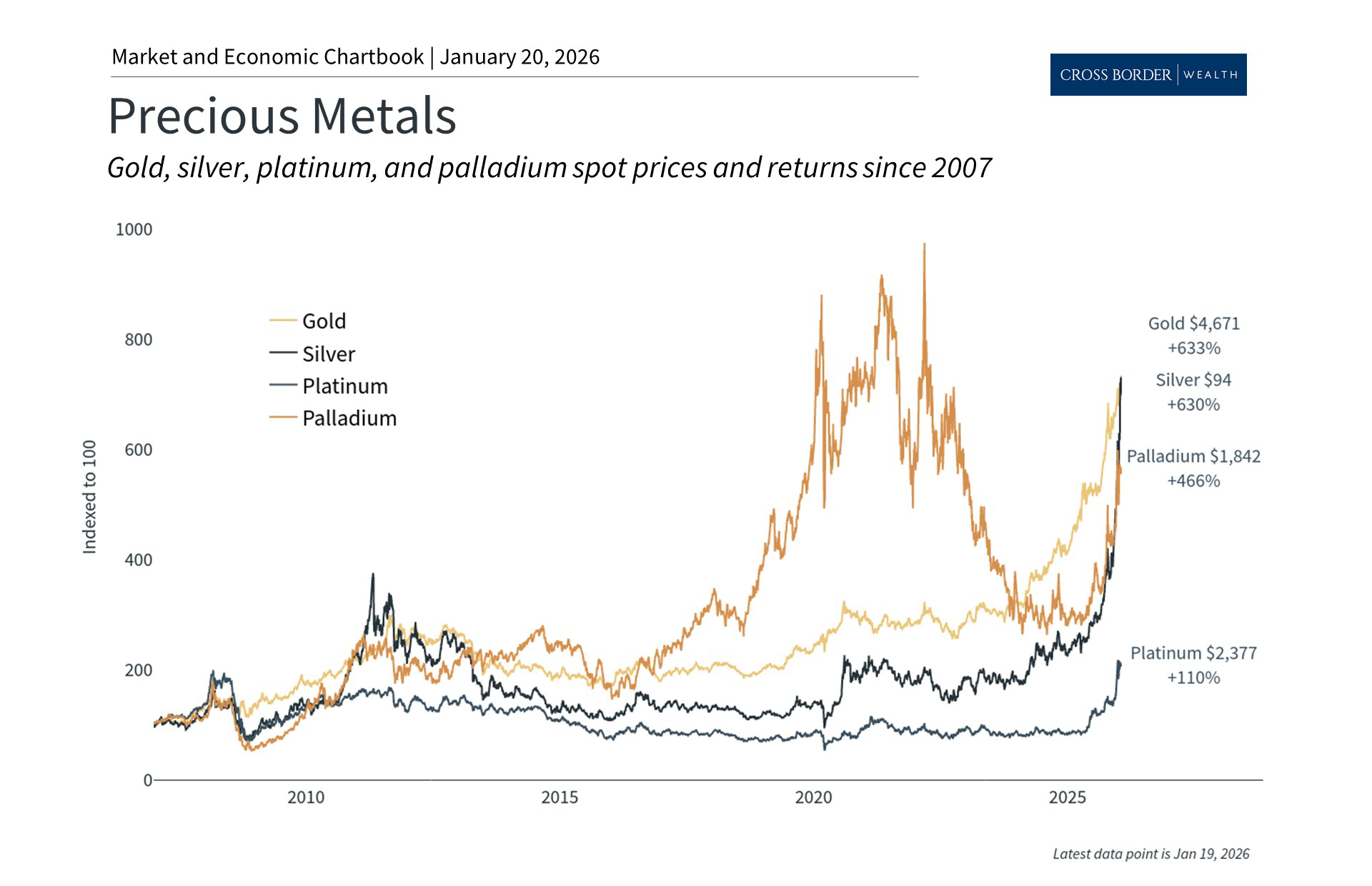

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.