How Long-Term Investors Should React to Market Sell-Offs

- UK Pensions

- 4 mins

After a historic six-month rally, the stock market has fallen almost 10% from its all-time high at the beginning of September. Although not as severe as the bear market crash earlier this year, it's understandable that some investors may be concerned by a possible market correction. This pullback may be the result of many factors including the on-going pandemic, economic uncertainty, tech stocks, the upcoming presidential election, fight over the Supreme Court and more. However, it's important to remember that markets are subject to periods of uncertainty. In the long run, despite endless causes for concern, investors are usually rewarded for having the fortitude to stay invested.

The recovery leading up to the recent market pullback was the fastest in history. Although the S&P 500 fell 34% from mid-February to late March, it first recovered its year-to-date losses in June and then all of its losses in August. The speed of this recovery, which occurred for many reasons including the reopening of the U.S. economy, was a surprise for many investors. Historically, recovering from a bear market decline requires 2 years or more.

This episode serves to highlight that stock market recoveries can happen quickly and unexpectedly - even as investors are still focused on the past. Perhaps the best example was the market bottom in March 2009. Few investors believed that stocks would ever recover. At best, many believed that there might be a "double-dip recession." At worst, it would take a decade to rebuild the global financial system. With the benefit of hindsight, those with the discipline to stay invested not only benefited from the early stages of the recovery but from steady returns over the next decade despite a variety of crises.

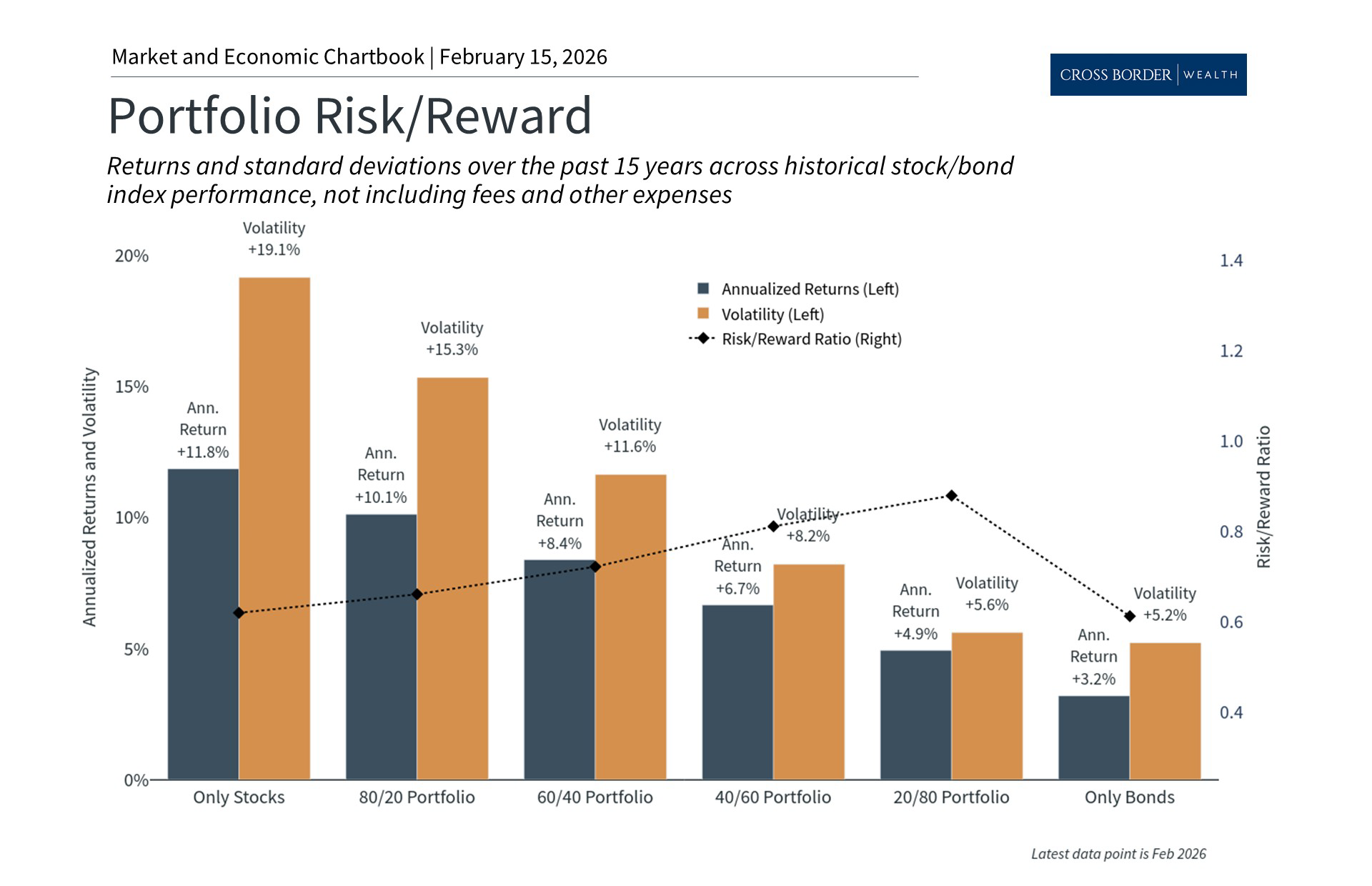

This is not to say that the stock market always recovers quickly after every pullback. Instead, the point is that investors with a long time horizon can afford to look past short-term uncertainty. Investors who focus only on one-year rolling periods will find that the stock market is quite often negative. Extending that horizon out to five years improves the odds immensely. Over ten-year horizons, there are only a handful of times since the Great Depression when the stock market was underwater. Over twenty-year horizons, there are exactly two periods: the Great Depression and the Global Financial Crisis. Holding a properly diversified portfolio of stocks and bonds improves the odds further.

Under the hood, this year in particular has been driven by one important factor: momentum. Although the term "momentum" can take on different meanings, it's usually the idea that stocks or groups of stocks that are rising might continue to rise. It's clearly been the case that certain stocks performed well throughout the COVID-19-induced economic lockdown and then continued to do so. The momentum factor has risen almost 15% this year, compared to the value factor which has fallen by the same amount.

However, just like the overall market, factor performance can turn on a dime. Another benefit of long-term investing is not having to go all-in on a single factor, sector, style, or other subset of the market. Over time, diversified portfolios with tilts toward attractive areas can benefit from the ebbs and flows of many parts of the market. Trying to time the market due to short-term events or periods of turbulence can just as often backfire.

Thus, investors ought to remain disciplined and focus on the long-term recovery in markets and the economy. Below are three charts that highlight the importance of staying invested amid today's uncertainty.

1. Stocks have fallen from their recent all-time highs

The stock market recovered quickly from its bear-market decline earlier this year. In fact, the S&P 500 accelerated as momentum and growth stocks outperformed. The market has since pulled back but this is neither unexpected nor unwelcome for long-term investors.

2. Historically, longer perspectives improve the odds of success

Investors who focus on longer time horizons often have better chances of success. Over one-year timeframes, the stock market is in the red quite often. However, this improves dramatically over five-year horizons. Those who can look even further - to ten or twenty years - without worrying about day-to-day or week-to-week volatility have historically done much better.

3. Momentum has driven the markets this year

The stock market has been driven by momentum stocks this year, a fact evident to anyone who has followed tech stocks and other industries that have done well in the wake of the COVID-19 pandemic. However, factor performance can change over time. It's more important that investors stay focused on their financial plans rather than chase returns or overreact to short-term pullbacks.

The bottom line? Investors should continue to stay disciplined rather than overreact to recent market events.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.

.jpg)