Monthly Market Update for February 2025: Inflation and Growth Concerns

- Market Insights

- 6 mins

Get investing insights for US-connected global citizens.

Book a free consultation with our cross-border advisors.

February was a volatile month for stocks. Tech continued the selloff that started in late December, with the Magnificent 7 falling 8.1% in the month. Tariffs and inflation fueled worries about growth as the new Trump administration began implementing policy changes. Fourth quarter earnings reports were solid, though mixed economic data and policy uncertainty prompted investors to favor defensive sectors. Bonds, especially longer-dated Treasurys, helped stabilize portfolios during the market volatility.

The Magnificent 7 continues to weigh on the market

In February, a flurry of policy headlines and inflation concerns rattled markets and consumer sentiment. While major market indices ended weaker, the S&P 500 also reached new all-time highs during the month. These back-and-forth swings in the stock market may be uncomfortable, but they are a normal part of investing. In addition, the stock market pullback was partially offset by bond market gains, demonstrating the importance of portfolio balance. For long-term investors, it’s more important than ever to stay focused on financial goals.

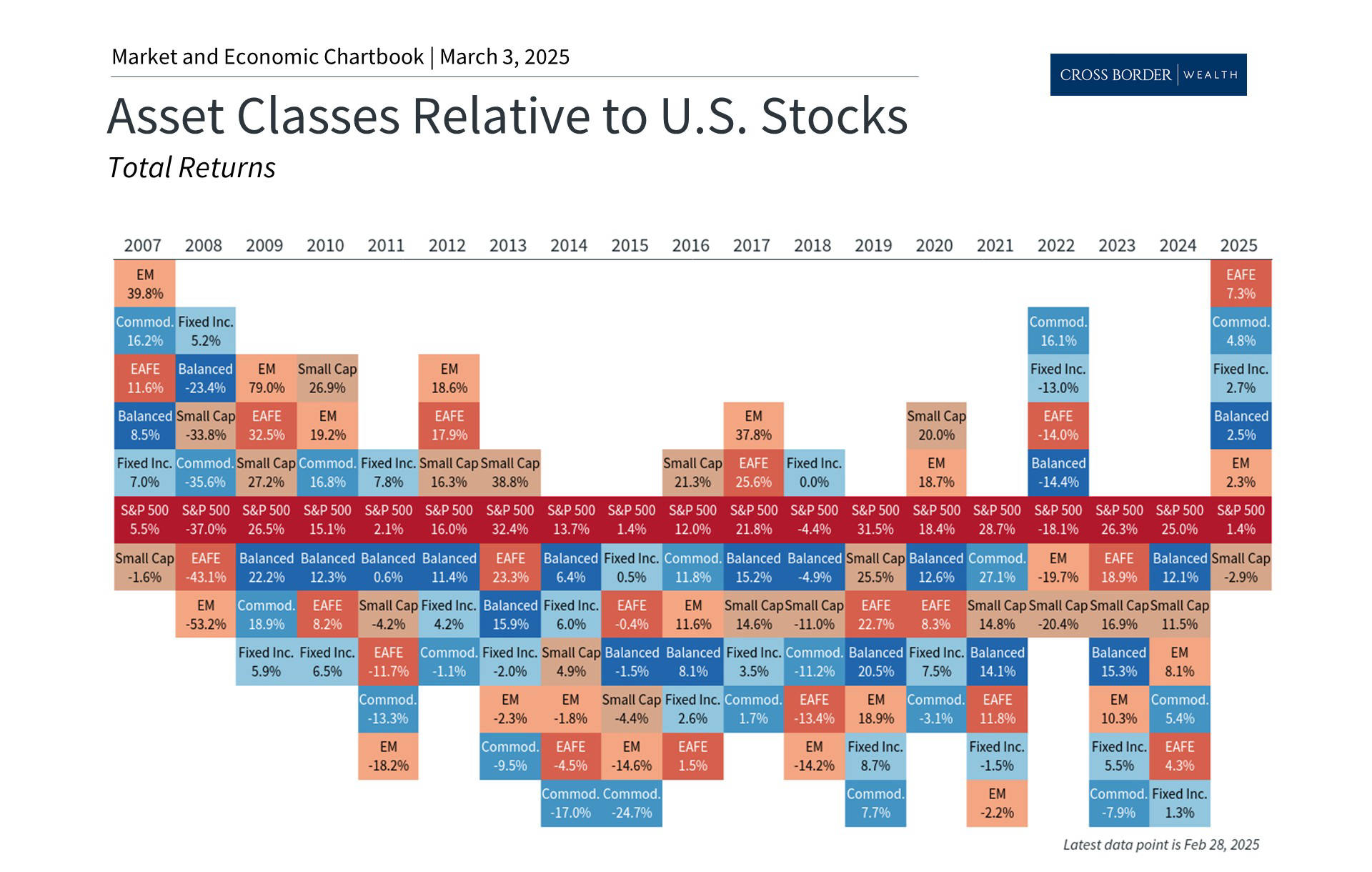

Chart: Many asset classes beyond U.S. stocks are positive this year

Past performance is not indicative of future results

Perhaps the biggest market moves that captured investor attention had to do with the largest technology stocks. The group of stocks known as the Magnificent 7 struggled to find its footing, even as plans for significant artificial intelligence spending were confirmed by several large technology companies and Nvidia reported solid earnings results. Investors continue to worry about the growth potential for some of the largest beneficiaries of the AI trade, especially if tariffs worsen production constraints.

While the recent selloff has improved valuations for many parts of the market, the Information Technology and Communication Services sectors remain priced at premiums compared to their historical averages. In fact, all but two S&P 500 sectors still have positive year-to-date returns. The top sectors, including Healthcare, Financials, and Consumer Staples, have tended to be more defensive.

Bonds have also played a positive role in this environment. The 10-year yield ended the month at 4.2%, more than one-third of a percentage point below where it began the month. When interest rates fall, the prices on existing bonds rise since their higher yields become more attractive. Thus, when interest rates decline alongside the stock market, bonds can help provide balance to portfolios.

As seen in the chart above, both fixed income and international markets have outperformed the S&P 500 year-to-date. While the stock market, and technology stocks in particular, have performed well over the past few years, February underscores the importance of being balanced across different parts of the market to help manage risk across different market conditions.

Investors and consumers continue to be focused on inflation

It’s not surprising that one of the main drivers of market volatility in February was inflation. According to the Consumer Price Index, inflation is back at 3% for the first time since last summer. Other inflation readings also showed that prices across many categories are stickier than many economists had anticipated.

Chart: Consumers are worried about higher inflation

Past performance is not indicative of future results

Consumer expectations of future inflation have also risen. The combination of still-rising food and shelter prices and the anticipated impact of tariffs is driving consumers to prepare for even higher prices. As seen in the accompanying chart, inflation expectations for the next 12 months jumped to 4.3% from 3.3% in January. Over the next five years, these same consumers expect average inflation as high as 3.5%.

The fear of a resurgence in inflation has rattled some investors. In addition to their economic and financial market impacts, higher prices increase uncertainty around Fed policy. If inflation remains stubborn, the Fed may need to keep rates higher for longer.

Corporate earnings are a bright spot

Amid these market and economic concerns, corporate earnings continue to be strong. Earnings-per-share growth of 18.2% year-over-year is the highest since 2021, according to FactSet. This earnings season was characterized by broad participation in growth across sectors and growing profit margins, which are indicators of a healthy economy. Notably, 75% of companies have exceeded consensus earnings estimates, in-line with the 10-year average. However, the size of the earnings beats was greater than the 10-year average.

Chart: The stock market follows earnings in the long run

Past performance is not indicative of future results

In the long run, growing corporate earnings are what drive financial markets higher, in spite of day-to-day headlines and investor fears. Current Wall Street estimates suggest that the S&P 500 earnings-per-share could reach $266 this year, representing a 12% growth rate. While much could change in the coming months, focusing on fundamental drivers such as earnings is far more important than reacting to daily headlines.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.