What Dynamics Are Driving the Stock Market?

- Market Insights

- 4 mins

Once again, the stock market is back to where it started the year. At the moment, the S&P 500 is flat year-to-date and less than 5% below its all-time high in February. However, the strong performance of the overall market hides differences between investment styles and sectors. The NASDAQ, which is comprised of technology stocks, has risen over 18% since the start of the year and has made new record highs. Small cap stocks, on the other hand, are still down 12%. These dynamics have not only affected returns but are a reminder to investors that properly diversifying across the market is the best way to achieve long-term goals.

The market is often said to operate in "regimes" - periods when certain types of investment factors outperform. These regimes can last months, years, or even decades and are studied by industry professionals and academic researchers. For instance, value stocks outperformed for many decades until growth stocks took over during the dot-com boom and bust. Value stocks then outperformed again until the last several years when growth stocks once again began to lead. While it's difficult to know exactly when and how regimes will switch, history makes it clear that no market dynamic lasts forever.

To make the current environment more complex, one of the defining characteristics of the first half of the year was the steep drawdown in the market which was followed by a similarly sharp recovery. As a result, many of the "riskier" investments which were hit the hardest also saw the largest recoveries once the situation stabilized. What's more, many areas of the stock market, especially those related to tech, experienced only small declines. In fact, many technology-driven companies have seen their stock prices benefit from the shift to remote work and online retail.

This is one reason that NASDAQ and "FAANG" stocks have made new highs even as the COVID-19 crisis continues. Many of these stocks tend to be classified as growth stocks and are large cap companies, which has allowed those investment styles to outperform their value and small-cap counterparts. It's important to note that what most investors consider to be technology stocks are not confined to the Information Technology sector. Many large household tech names are within the Consumer Discretionary and Communication Services Sectors as well.

As is always the case, an important principle when investing for the long run is to be aware of but not overreact to short-term trends. After such large market moves, this is more relevant than ever. At the moment, the Information Technology, Healthcare, Consumer Discretionary and Communication Services sectors are estimated to have the highest earnings growth over the next year. At a time when the economy and corporate earnings are uncertain, this has been highly valued.

However, these sectors also have the highest level of valuations. One reason that market dynamics often flip is that seemingly attractive investments become overpriced, which then lowers their expected returns. This paves the way for other stocks, sectors and styles to generate higher returns. While growth stocks have done extremely well, their valuations have greatly surpassed value stocks and the broader market.

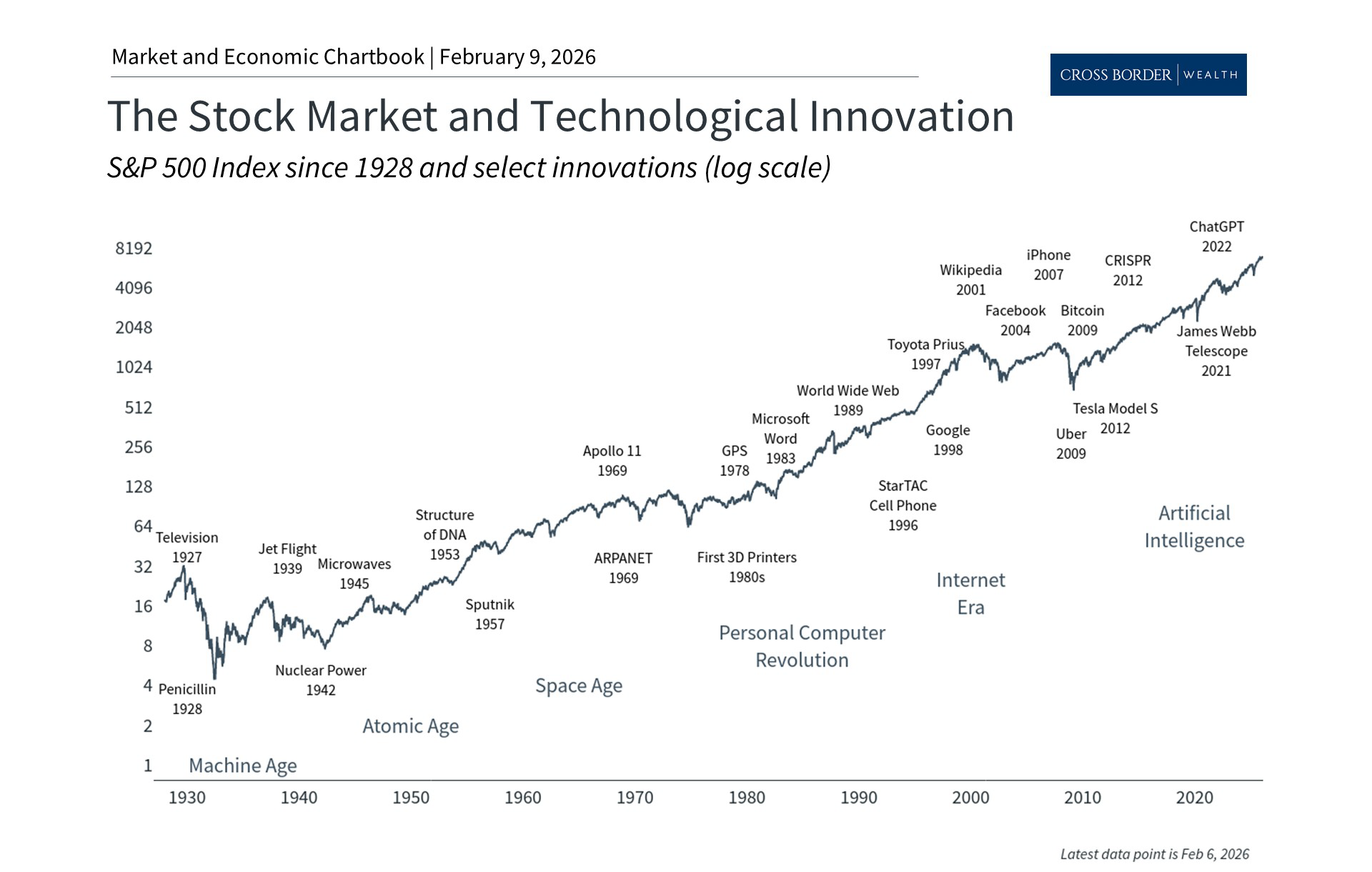

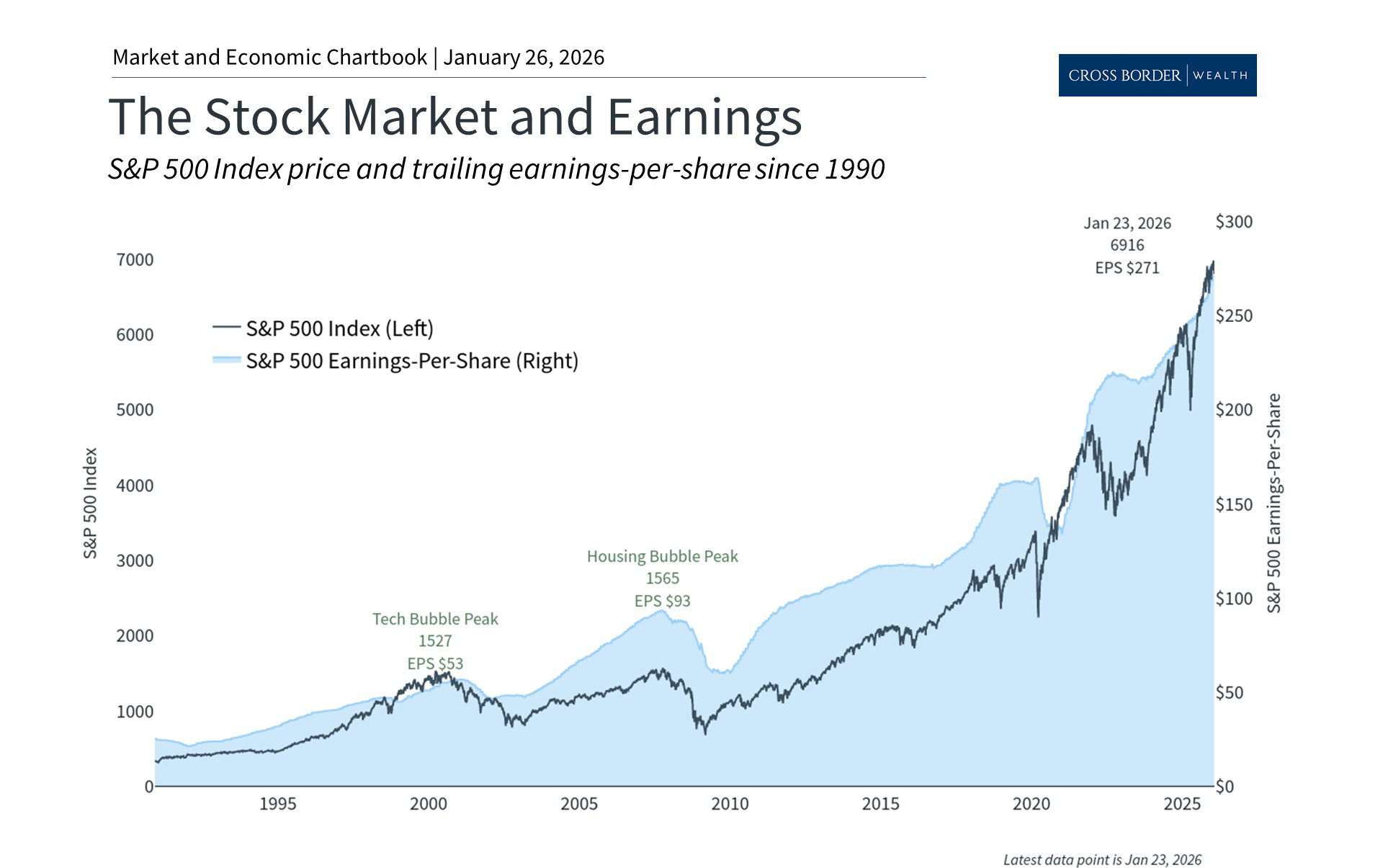

It's difficult to determine with certainty whether growth stocks will continue to outperform value ones indefinitely, and which sectors will do well over the years to come. But that's the point - ultimately, this is not a matter of market timing but of holding the appropriate balance of each. This is more important today with different long-term trends driving each investment style. Below are three charts that put these underlying stock market dynamics in perspective:

1. Certain styles have outperformed following the bear market crash

Size and Style Returns - Year over Year

Find this chart under "Stock Market Sectors and Styles"

In general, large caps and growth stocks have outperformed since the market bottom just a few months ago. This is partly due to on-going uncertainty around the economy and corporate earnings, but also due to large tech companies performing well during this period.

2. However, valuations have become very expensive as well

U.S. Growth vs Value Valuations

Find this chart under "Stock Market Sectors and Styles"

Although growth stocks have outperformed significantly, they also have much higher valuations. The chart above highlights the difference between growth and value price-to-book ratios. This spread has skyrocketed in recent weeks as a result of this dynamic.

3. Tech and health-related sectors have led the way but are also the most expensive

Sector Earnings and Valuations

Find this chart under "Stock Market Sectors"

While many of these market trends could continue for some time, it's important to remain diversified across styles and sectors. Tech and health-related sectors have done well and are expected to generate sizable earnings, but other sectors are much cheaper. In fact, all but 3 sectors are expected to have positive earnings growth in the next twelve months - not just those in tech.

The bottom line? Although the overall stock market is flat again for the year, not all parts of the market have behaved the same. This highlights the importance of staying diversified across styles and sectors to achieve long-term investment and financial goals.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.