Why Bonds Present Opportunities in a Volatile Market

- Market Insights

- 5 mins

Get investing insights for US-connected global citizens.

Book a free consultation with our cross-border advisors.

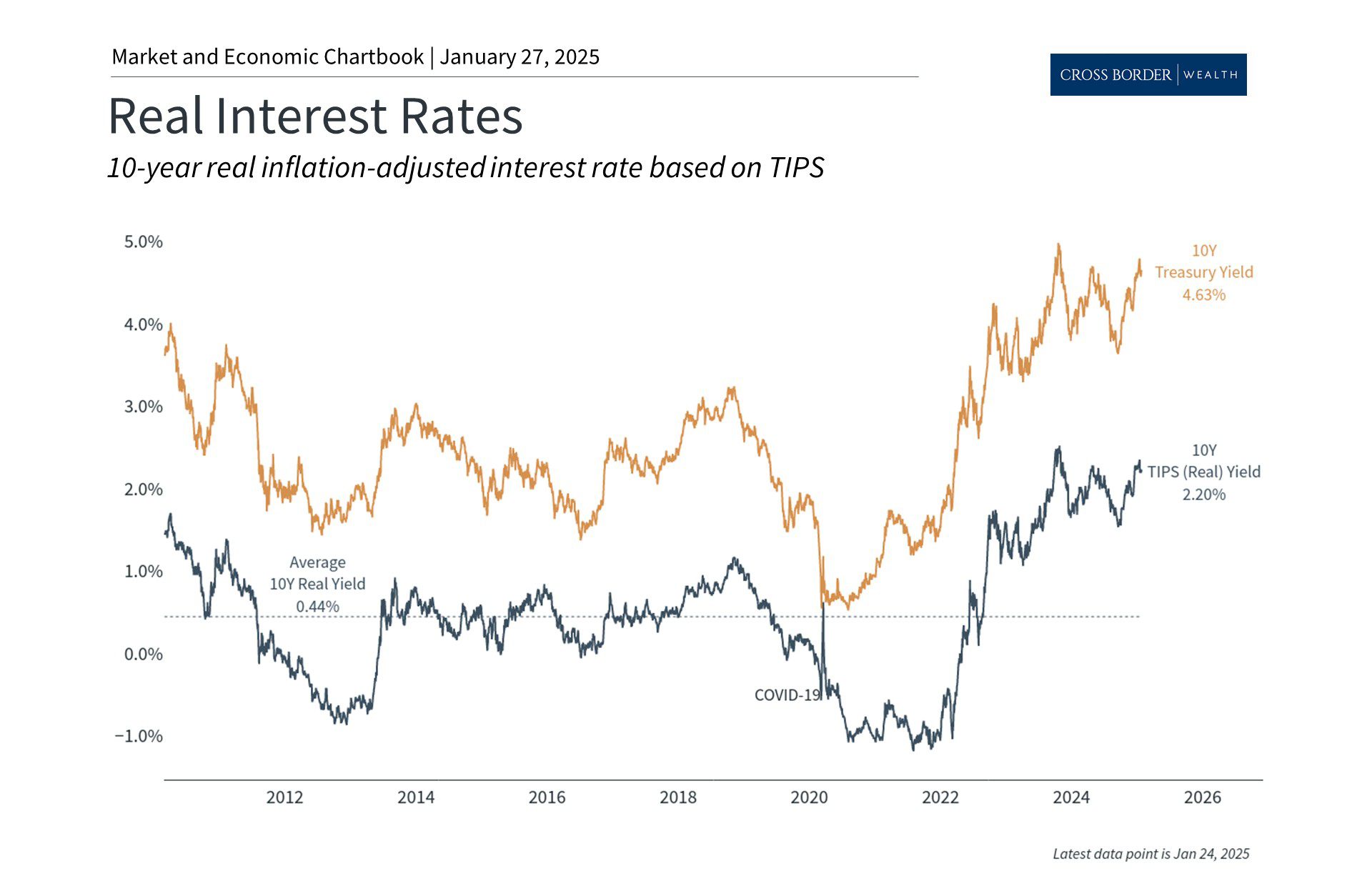

Interest rates are fluctuating as investors adjust their expectations around economic growth, Federal Reserve rate moves, and the Trump administration’s policies. The 10-year Treasury yield had risen as high as 4.8% in recent weeks before settling below 4.6%. The 2-year Treasury yield is also elevated, now around 4.2%, and the 30-year mortgage rate remains above 7%.

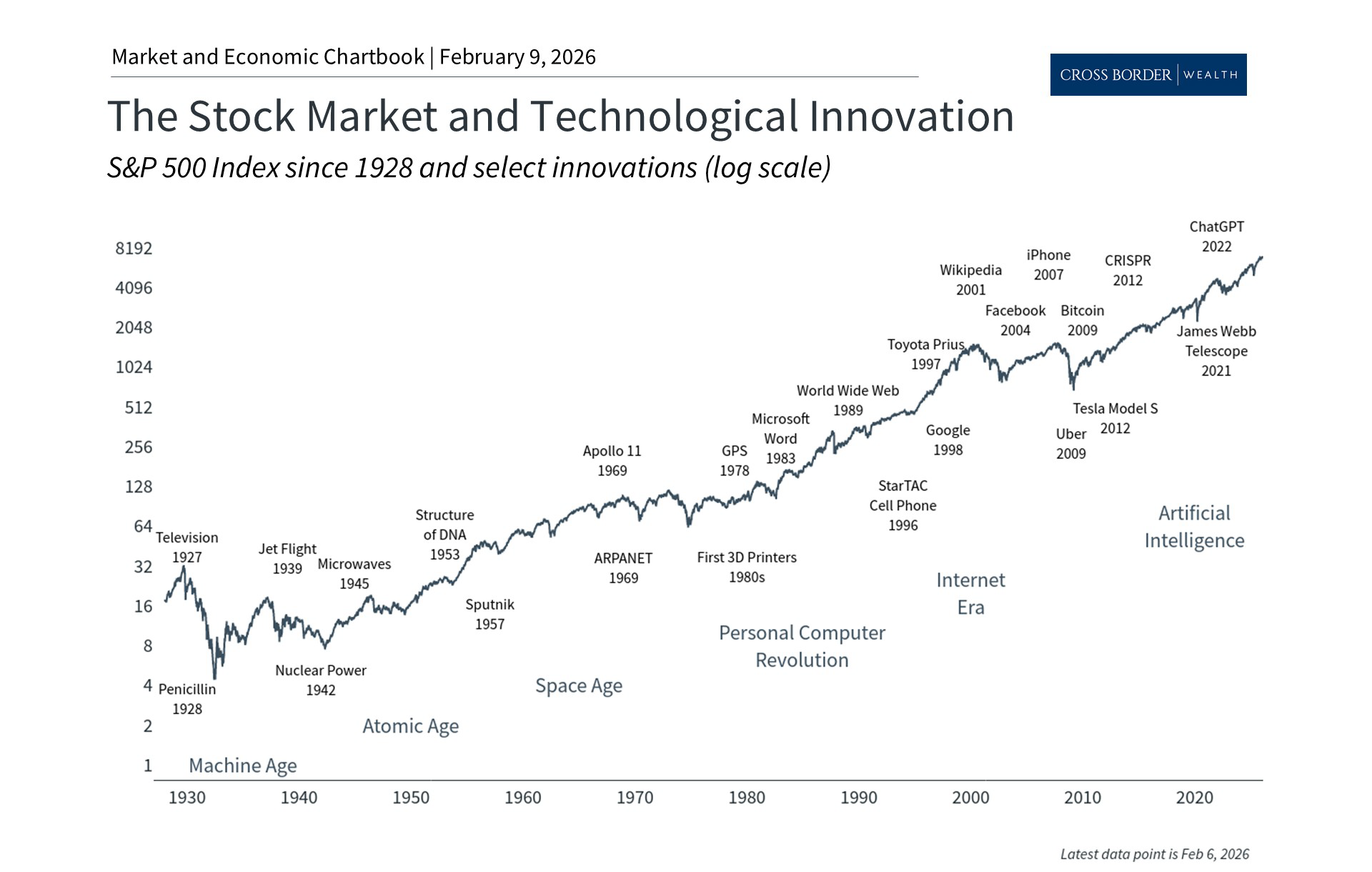

Concerns around artificial intelligence stocks have also led to market swings, affecting interest rates as well. For example, the recent decline in Nvidia’s share price and questions around AI chips have impacted the broader stock and bond markets. While interest rates are just one of many factors that influence portfolios, understanding these dynamics can help provide context for long-term financial planning.

Interest rates remain high, even after inflation

Past performance is not indicative of future results

Interest rates are important because they affect the balance between stocks and bonds. When interest rates are higher, investors can earn more from relatively safe investments like government bonds. This also influences what's known as the “equity risk premium” - the additional return that investors demand for taking on the risk of investing in stocks rather than lower-risk assets. As rates change, this premium adjusts accordingly, impacting how investors allocate their portfolios between stocks, bonds and other assets.

In periods when inflation is a concern, what matters to investors are “real yields,” or the return investors earn on bonds after accounting for inflation. Real yields are now around their highest level in over a decade. Yields on bonds jumped sharply after last November’s presidential election as investors anticipated pro-growth policies and lower taxes, even though higher tariffs and other factors could result in higher inflation.

Bond prices and yields have an inverse relationship – when yields rise, the prices on existing bonds fall, and vice versa. For those who are buying and selling bonds regularly, these price changes can impact portfolio returns.

Importantly, for long-term investors who are buying and holding bonds, including those in retirement, higher yields provide greater levels of portfolio income. This can help support retirement spending goals and potentially reduce the need to sell assets to cover everyday expenses. Additionally, higher yields may offer better opportunities for portfolio diversification, as bonds become more competitive with other asset classes. Of course, this depends on each retiree’s specific circumstances and should be discussed with a trusted advisor.

The stock market earnings yield is less attractive

Past performance is not indicative of future results

One way to measure the stock market’s “equity risk premium,” or how attractive stocks are compared to bonds, is via its earnings yield. This represents how much a company earns relative to its stock price, calculated by dividing earnings per share by the share price. It is useful because like bond yields, it measures how much an investor receives relative to its price.

The accompanying chart shows that the S&P 500 earnings yield has been on a declining trend for the past 15 years. Today, it is about the same as the 10-year Treasury yield, suggesting that the overall stock market is now less attractive than in the past. This situation reflects both the higher interest rate environment, as well as the strong bull market in stocks. Typically, investors demand a higher premium for holding stocks versus bonds since they are riskier.

A low equity risk premium does not forecast an immediate market decline. There have been many periods when earnings yields have been quite low during bull markets, particularly during times of low interest rates. It simply means that the stock market has grown more expensive compared to other asset classes.

One reason broad market valuations are expensive today is because of the strong rally in technology stocks over the past several years. Other sectors are still more attractively valued, highlighting the importance of diversification. What matters is balance between asset classes, as well as maintaining appropriate risk levels based on individual investment objectives and time horizons.

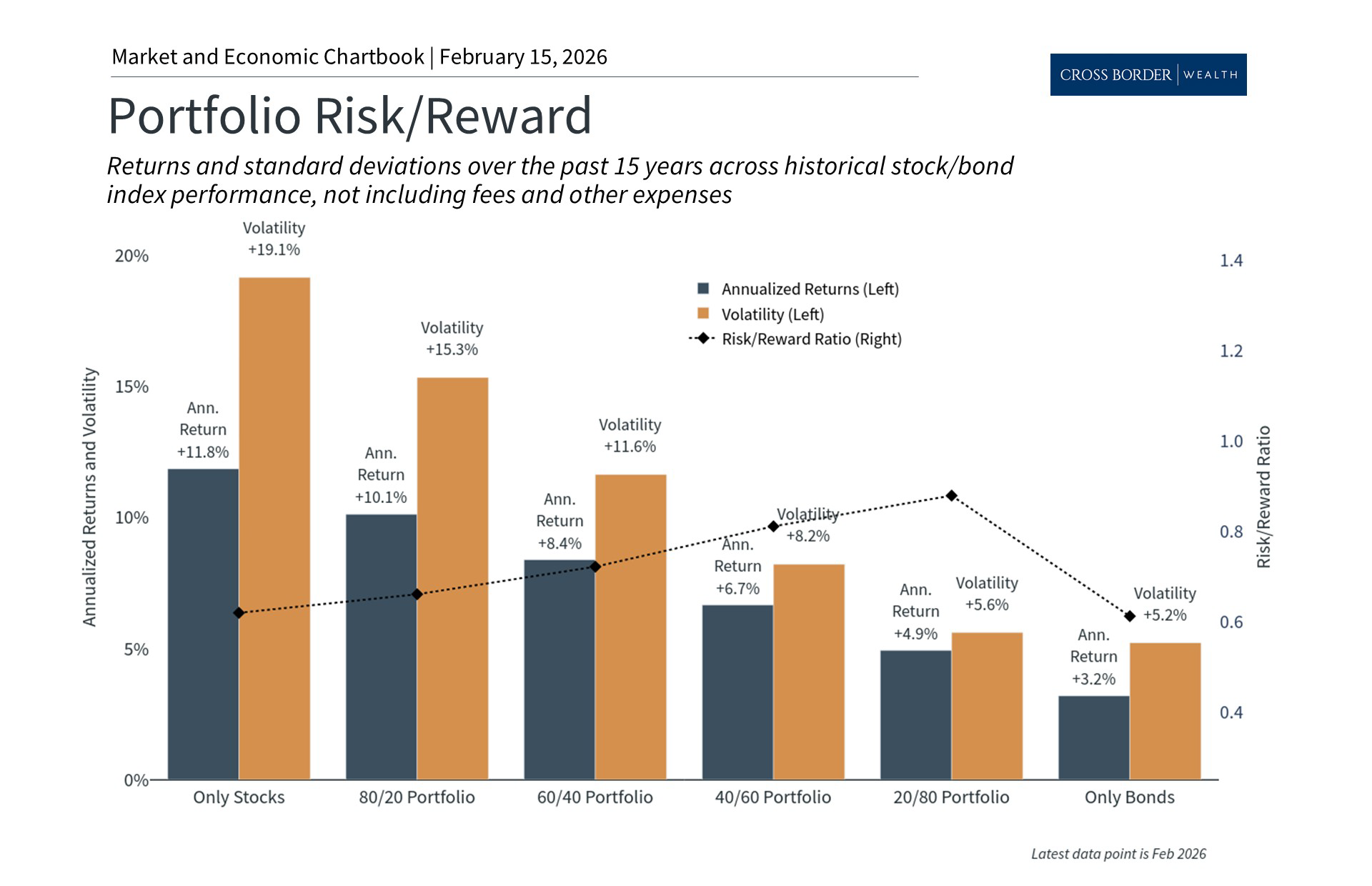

Bonds are an important part of a diversified portfolio

Past performance is not indicative of future results

With current interest rates, bonds are offering some of their most attractive yields in over a decade. This is especially important with short-term cash yields expected to decline further due to Fed rate cuts, affecting CDs, savings accounts, money market funds, etc. During periods of market uncertainty that cause interest rates to fall, bond prices tend to rise which helps to offset stock market swings.

Regardless of where interest rates go from here, fixed income is important for portfolio diversification. Not only have bonds been historically less volatile than stocks, but they also tend to help balance swings in stock prices. In fact, bonds often move in the opposite direction of stocks, helping to keep portfolios on track when market conditions change. This reduces overall portfolio risk and helps to keep investors on track.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.