Why Cash May Be Comfortable But Counterproductive

- Market Insights

- 4 mins

With all of the market-moving events of the past few years - from the global pandemic to trade wars and more - it's understandable that some investors may prefer the safety of cash. After all, a great deal of investing is behavioral and requires being comfortable with a certain level of risk. Portfolios returns are important but so is being able to sleep well at night.

However, for those saving and investing to achieve financial goals, shifting a portfolio to cash may provide short-term comfort but will most likely jeopardize long-term gains. In other words, it simply doesn't strike the right balance. Finding this balance, while resisting the urge to react to short-term market developments, is the biggest challenge all investors face. There are three reasons why this is more important than ever.

First, cash still generates little to no income and hinders portfolio growth. This has been true since the 2008 financial crisis when interest rates fell to historic lows. Nearly 12 years later, rates are still at these levels with the federal funds rate back to zero. While this is good for borrowers - the average 30-year mortgage rate is around 3% - it hurts savers and those who rely on their savings for income.

Second, not only are interest rates low, but inflation slowly erodes the value of cash. This means that, left unchecked, the purchasing power of investors' hard-earned cash might actually decline each year. This has been true even though inflation, at least the way it's measured by economists, has been quite low by historical standards. But even minimal inflation can have a corrosive effect when cash generates limited income, acting as a drag on overall portfolios.

Another way to describe this effect is that investors often seek safety in all the wrong places. The cash balance on a bank statement may feel safe since it is stable. However, what matters isn't the dollar amount of cash but what it can purchase. Inflation means that the same number of dollars can purchase fewer goods and services each year. Thus, it takes actual portfolio growth to keep an investor's purchasing power at par, let alone to create real wealth.

Finally, and most importantly, there are better ways to manage portfolio risk and increase investor comfort. After all, this is usually the reason investors seek a shift to cash in the first place: as a market-timing tool in response to short-term events.

Unfortunately, this often backfires. Not only do markets have a history of recovering when investors least expect it (the current market environment is a prime example), but diversification provides a better way to lower risk while maintaining growth. While there is simplicity in holding cash, having the right mix of stocks, bonds and other assets can achieve a better ratio of risk and reward over long periods of time.

Ultimately, cash is an important part of any portfolio in moderation. Having the discipline to save enough in the first place is a laudable achievement. Staying invested with the right portfolio to grow this wealth also requires discipline. This is often why investors benefit from having a trusted advisor who can not just help to construct these portfolios, but act as a coach when times are difficult. Below are three charts that put the value of cash in perspective.

1. Cash still generates little to no income

Historical Interest Rates

Find this chart under "Interest Rates"

Twelve years after the global financial crisis, interest rates are still near historic lows. In fact, the federal funds rate is back to the zero-lower-bound due to the COVID-19 crisis. Investors who rely on income from their cash savings may continue to find it difficult to do so without other assets.

2. To make matters worse, inflation erodes the value of cash

Interest Income on Cash

Find this chart under "Interest Rates"

Inflation - even at very low levels - chips away at the purchasing power of cash savings. For most of the past decade, inflation has meant that the "real" value of cash has declined each year. Although cash may feel safe, it has been anything but in this low-rate environment.

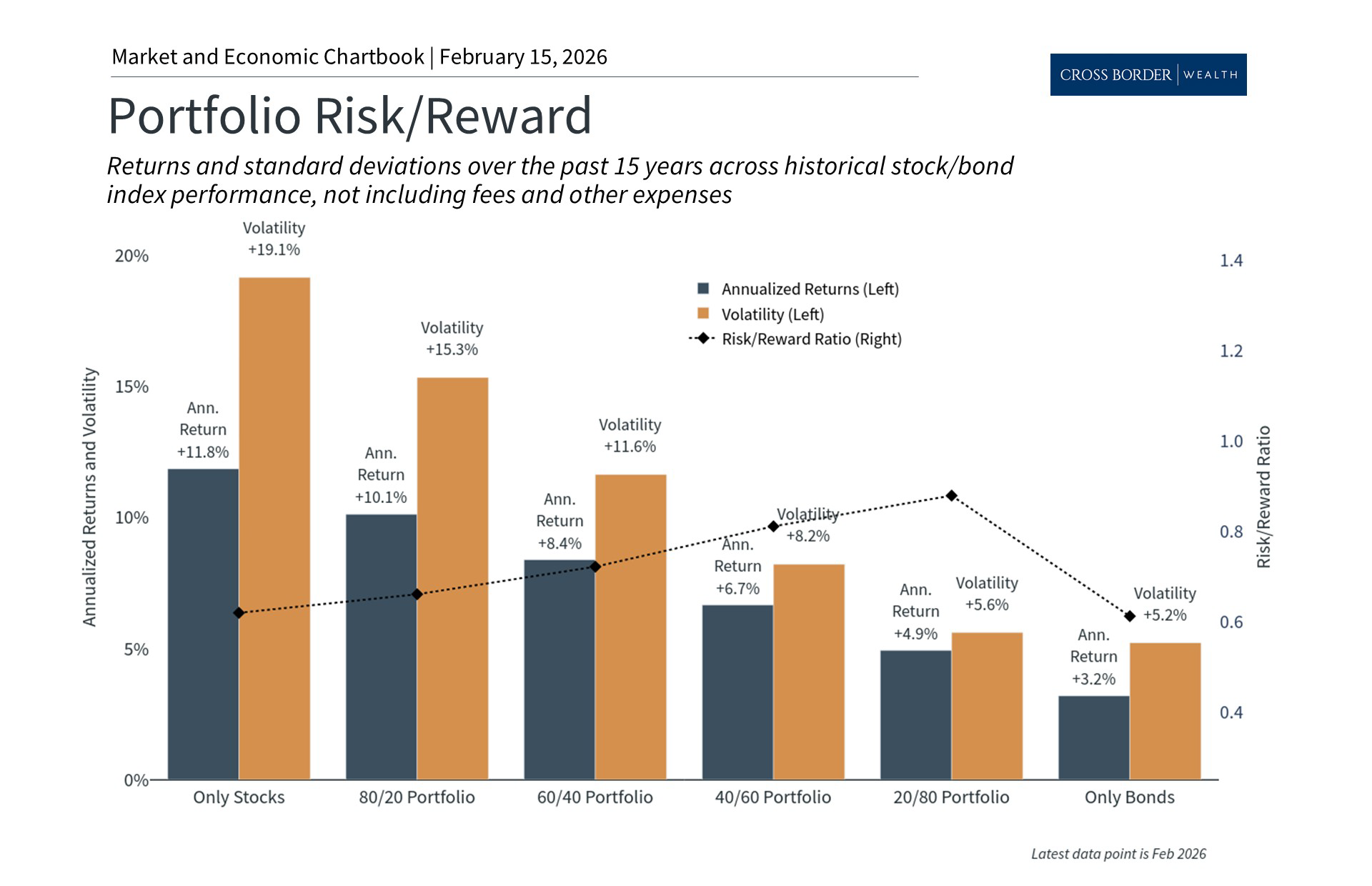

3. A portfolio approach to income and risk management is often superior

Portfolio Risk/Reward

Find this chart under "Asset Allocation"

Rather than simply relying on cash, holding an appropriately-constructed portfolio can often achieve a better risk/reward ratio while maintaining growth. The key ingredient is time: investors seeking to achieve their financial goals over the long run have historically done well by staying disciplined and holding a mix of assets.

The bottom line? While cash is tempting, it does little to help investors when interest rates are low, inflation eats away at its value, and there are better options. As always, staying diversified and not reacting to short-term market events is the best way to achieve financial goals.

Cross Border Wealth is a SEC-registered investment adviser which may only transact business in those jurisdictions in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Cross Border Wealth may discuss and display charts, graphs, formulas, stock, and sector picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. This specific information is limited and should not be used on their own to make investment decisions.

All information provided in this article is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investment, or investment strategies. Please ensure to first consult with a qualified financial adviser and or tax professional. Further, please note that while said information has been obtained from known sources which are believed to be reliable, none of these are guaranteed.